Jillian Inc. manufactures and installs customized equipment. On January 1, 2021, Jillian entered into a contract to sell equipment to a client for $800,000. This amount included installation. The company normally charges an additional fee for its installation services, but in this case, the installation was "bundled" with the equipment. The standalone value of the machinery was $750,000 while the cost of the installation was estimated at $100,000. Jillian had the equipment in its inventory on January 1, 2021. The equipment, which had a cost of $600,000, was customized (at no cos Jillan), and delivered to the client and installed on that date. Payment terms are as follows: January 1. 2021: $80,000 upon contract signing and delivery and installation. December 31, 2021; Balance due. Jillian Inc. follows IFRS and estimates that the interest rate for a similar financing arrangement would be 6%.

Jillian Inc. manufactures and installs customized equipment. On January 1, 2021, Jillian entered into a contract to sell equipment to a client for $800,000. This amount included installation. The company normally charges an additional fee for its installation services, but in this case, the installation was "bundled" with the equipment. The standalone value of the machinery was $750,000 while the cost of the installation was estimated at $100,000. Jillian had the equipment in its inventory on January 1, 2021. The equipment, which had a cost of $600,000, was customized (at no cos Jillan), and delivered to the client and installed on that date. Payment terms are as follows: January 1. 2021: $80,000 upon contract signing and delivery and installation. December 31, 2021; Balance due. Jillian Inc. follows IFRS and estimates that the interest rate for a similar financing arrangement would be 6%.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 19E: Rix Company sells home appliances and provides installation and service for its customers. On April...

Related questions

Question

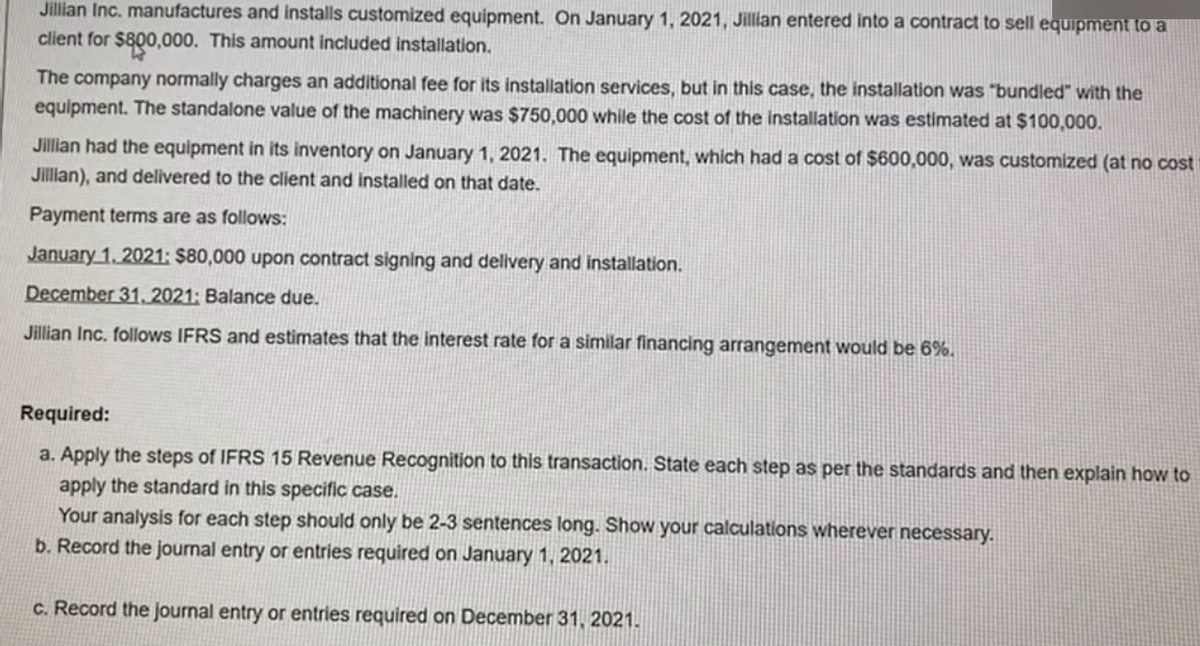

Transcribed Image Text:Jillian Inc. manufactures and installs customized equipment. On January 1, 2021, Jillian entered into a contract to sell equipment to a

client for $800,000. This amount included installation.

The company normally charges an additional fee for its installation services, but in this case, the installation was "bundled" with the

equipment. The standalone value of the machinery was $750,000 while the cost of the installation was estimated at $100,000.

Jillian had the equipment in its inventory on January 1, 2021. The equipment, which had a cost of $600,000, was customized (at no cost

Jillan), and delivered to the client and installed on that date.

Payment terms are as follows:

January 1, 2021: $80,000 upon contract signing and delivery and installation.

December 31, 2021; Balance due.

Jillian Inc. follows IFRS and estimates that the interest rate for a similar financing arrangement would be 6%.

Required:

a. Apply the steps of IFRS 15 Revenue Recognition to this transaction. State each step as per the standards and then explain how to

apply the standard in this specific case.

Your analysis for each step should only be 2-3 sentences long. Show your calculations wherever necessary.

b. Record the journal entry or entries required on January 1, 2021.

c. Record the journal entry or entries required on December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT