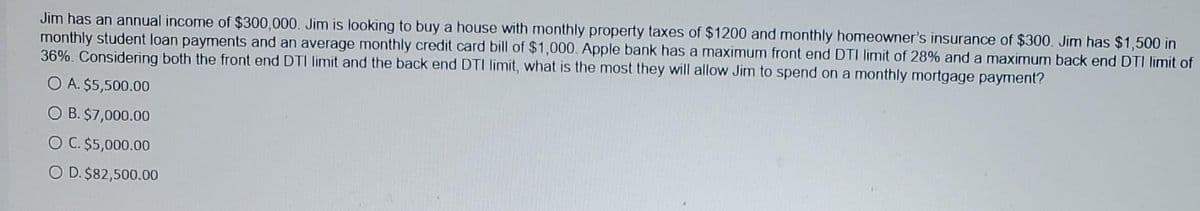

Jim has an annual income of $300,000. Jim is looking to buy a house with monthly property taxes of $1200 and monthly homeowner's insurance of $300. Jim has $1,500 in monthly student loan payments and an average monthly credit card bill of $1,000. Apple bank has a maximum front end DTI limit of 28% and a maximum back end DTI limit of 36%. Considering both the front end DTI limit and the back end DTI limit, what is the most they will allow Jim to spend on a monthly mortgage payment? O A. $5,500.00 O B. $7,000.00 OC. $5,000.00 O D. $82,500.00

Jim has an annual income of $300,000. Jim is looking to buy a house with monthly property taxes of $1200 and monthly homeowner's insurance of $300. Jim has $1,500 in monthly student loan payments and an average monthly credit card bill of $1,000. Apple bank has a maximum front end DTI limit of 28% and a maximum back end DTI limit of 36%. Considering both the front end DTI limit and the back end DTI limit, what is the most they will allow Jim to spend on a monthly mortgage payment? O A. $5,500.00 O B. $7,000.00 OC. $5,000.00 O D. $82,500.00

Chapter6: Building And Maintaining Good Credit

Section: Chapter Questions

Problem 1DTM

Related questions

Question

Need correct answer.

Transcribed Image Text:Jim has an annual income of $300,000. Jim is looking to buy a house with monthly property taxes of $1200 and monthly homeowner's insurance of $300. Jim has $1,500 in

monthly student loan payments and an average monthly credit card bill of $1,000. Apple bank has a maximum front end DTI limit of 28% and a maximum back end DTI limit of

36%. Considering both the front end DTI limit and the back end DTI limit, what is the most they will allow Jim to spend on a monthly mortgage payment?

O A. $5,500.00

O B. $7,000.00

O C. $5,000.00

O D. $82,500.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning