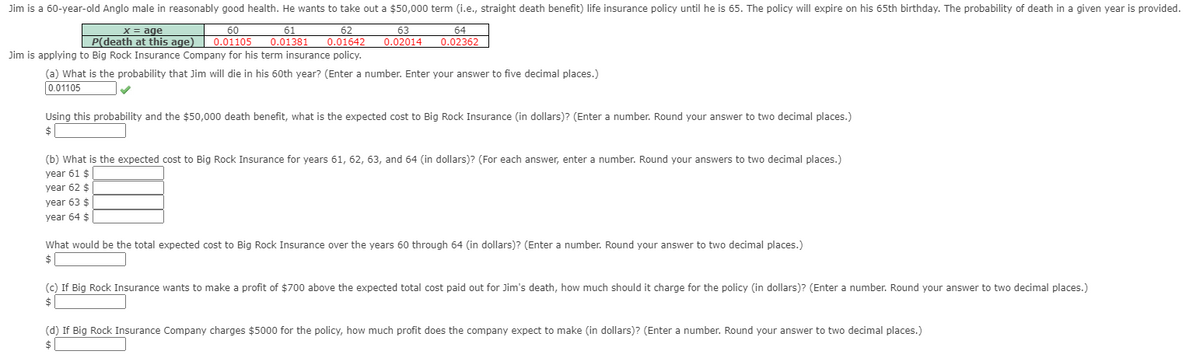

Jim is a 60-year-old Anglo male in reasonably good health. He wants to take out a $50,000 term (i.e., straight death benefit) life insurance policy until he is 65. The policy will expire on his 65th birthday. The probability of death in a given year 60 62 0.01642 Jim is applying to Big Rock Insurance Company for his term insurance policy. X = age P(death at this age) 0.01105 61 0.01381 63 0.02014 64 0.02362 (a) What is the probability that Jim will die in his 60th year? (Enter a number. Enter your answer to five decimal places.) 0.01105 Using this probability and the $50,000 death benefit, what is the expected cost to Big Rock Insurance (in dollars)? (Enter a number. Round your answer to two decimal places.) $ (b) What is the expected cost to Big Rock Insurance for years 61, 62, 63, and 64 (in dollars)? (For each answer, enter a number. Round your answers to two decimal places.) year 61 $ year 62 $ year 63 $ year 64 $ number. Round your answer to two decimal places.) What would be the total expected cost to Big Rock Insurance over the years 60 through 64 (in dollars)? (Enter 24 (c) If Big Rock Insurance wants to make a profit of $700 above the expected total cost paid out for Jim's death, how much should it charge for the policy (in dollars)? (Enter a number. Round your answer to two decimal places.) (d) If Big Rock Insurance Company charges $5000 for the policy, how much profit does the company expect to make (in dollars)? (Enter a number. Round your answer to two decimal places.)

Permutations and Combinations

If there are 5 dishes, they can be relished in any order at a time. In permutation, it should be in a particular order. In combination, the order does not matter. Take 3 letters a, b, and c. The possible ways of pairing any two letters are ab, bc, ac, ba, cb and ca. It is in a particular order. So, this can be called the permutation of a, b, and c. But if the order does not matter then ab is the same as ba. Similarly, bc is the same as cb and ac is the same as ca. Here the list has ab, bc, and ac alone. This can be called the combination of a, b, and c.

Counting Theory

The fundamental counting principle is a rule that is used to count the total number of possible outcomes in a given situation.

Please answer all parts. If not possible please answer b, c and d. thank you.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images