Joanna is playing blackjack for real money. She has reference-dependent preferences over money: if her earnings are m and her reference point is r, then her utility is v(m − r), where the value function v satisfies v(x) = √x for x ≥ 0, and v(x) = −2√−x for x ≤ 0 a) Graph Joanna’s utility function as a function of m − r b) Does Joanna’s utility function satisfy loss aversion? Does it satisfy diminishing sensitivity? Suppose that Joanna has linear probability weights (that is, she does NOT have prospect theory’s non-linear probability weighting function). Hence, if she has a fifty-fifty chance of getting amounts m and m′, and her reference point is r, her expected utility is 1/2v(m − r) + 1/2v(m′− r) (2) For parts (c), (d), and (e), assume that Joanna’s reference point is $0 (that is, no wins or losses) and answer the following questions for each part: (i) What is the g for which Joanna would be indifferent between not gambling and taking fifty-fifty win $g or lose $4 gamble? (ii) Does this reflect risk-loving or risk-averse behavior? (iii) What features of Joanna’s reference-dependent preferences are driving this choice. c) This is the first round and Joanna has not won or lost any money yet. d)Joanna is $9 down. e) Joanna is $9 ahead. f) Referring to parts c, d, and e, when is Joanna most risk-averse? Explain the

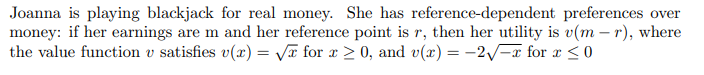

Joanna is playing blackjack for real money. She has reference-dependent preferences over

money: if her earnings are m and her reference point is r, then her utility is v(m − r), where

the value function v satisfies v(x) = √x for x ≥ 0, and v(x) = −2√−x for x ≤ 0

a) Graph Joanna’s utility function as a function of m − r

b) Does Joanna’s utility function satisfy loss aversion? Does it satisfy diminishing

sensitivity?

Suppose that Joanna has linear probability weights (that is, she does NOT have prospect

theory’s non-linear probability weighting function). Hence, if she has a fifty-fifty chance of

getting amounts m and m′, and her reference point is r, her expected utility is

1/2v(m − r) + 1/2v(m′− r) (2)

For parts (c), (d), and (e), assume that Joanna’s reference point is $0 (that is, no wins

or losses) and answer the following questions for each part: (i) What is the g for which

Joanna would be indifferent between not gambling and taking fifty-fifty win $g or lose

$4 gamble? (ii) Does this reflect risk-loving or risk-averse behavior? (iii) What features of

Joanna’s reference-dependent preferences are driving this choice.

c) This is the first round and Joanna has not won or lost any money yet.

d)Joanna is $9 down.

e) Joanna is $9 ahead.

f) Referring to parts c, d, and e, when is Joanna most risk-averse? Explain the

intuition.

Step by step

Solved in 4 steps with 1 images