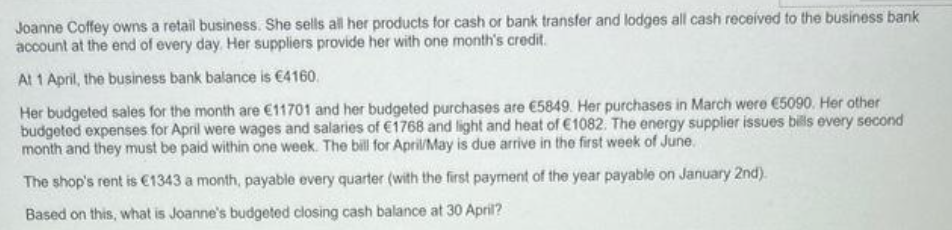

Joanne Coffey owns a retail business. She sells all her products for cash or bank transfer and lodges all cash received to the business bank account at the end of every day. Her suppliers provide her with one month's credit. At 1 April, the business bank balance is €4160. Her budgeted sales for the month are €11701 and her budgeted purchases are €5849. Her purchases in March were €5090. Her other budgeted expenses for April were wages and salaries of €1768 and light and heat of €1082. The energy supplier issues bills every second month and they must be paid within one week. The bill for April/May is due arrive in the first week of June. The shop's rent is €1343 a month, payable every quarter (with the first payment of the year payable on January 2nd). Based on this, what is Joanne's budgeted closing cash balance at 30 April?

Joanne Coffey owns a retail business. She sells all her products for cash or bank transfer and lodges all cash received to the business bank account at the end of every day. Her suppliers provide her with one month's credit. At 1 April, the business bank balance is €4160. Her budgeted sales for the month are €11701 and her budgeted purchases are €5849. Her purchases in March were €5090. Her other budgeted expenses for April were wages and salaries of €1768 and light and heat of €1082. The energy supplier issues bills every second month and they must be paid within one week. The bill for April/May is due arrive in the first week of June. The shop's rent is €1343 a month, payable every quarter (with the first payment of the year payable on January 2nd). Based on this, what is Joanne's budgeted closing cash balance at 30 April?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter17: Activity Resource Usage Model And Tactical Decision Making

Section: Chapter Questions

Problem 6E: Elliott, Inc., has four salaried clerks to process purchase orders. Each clerk is paid a salary of...

Related questions

Question

Ef 618.

Transcribed Image Text:Joanne Coffey owns a retail business. She sells all her products for cash or bank transfer and lodges all cash received to the business bank

account at the end of every day. Her suppliers provide her with one month's credit.

At 1 April, the business bank balance is €4160.

Her budgeted sales for the month are €11701 and her budgeted purchases are €5849. Her purchases in March were €5090. Her other

budgeted expenses for April were wages and salaries of €1768 and light and heat of €1082. The energy supplier issues bills every second

month and they must be paid within one week. The bill for April/May is due arrive in the first week of June.

The shop's rent is €1343 a month, payable every quarter (with the first payment of the year payable on January 2nd).

Based on this, what is Joanne's budgeted closing cash balance at 30 April?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT