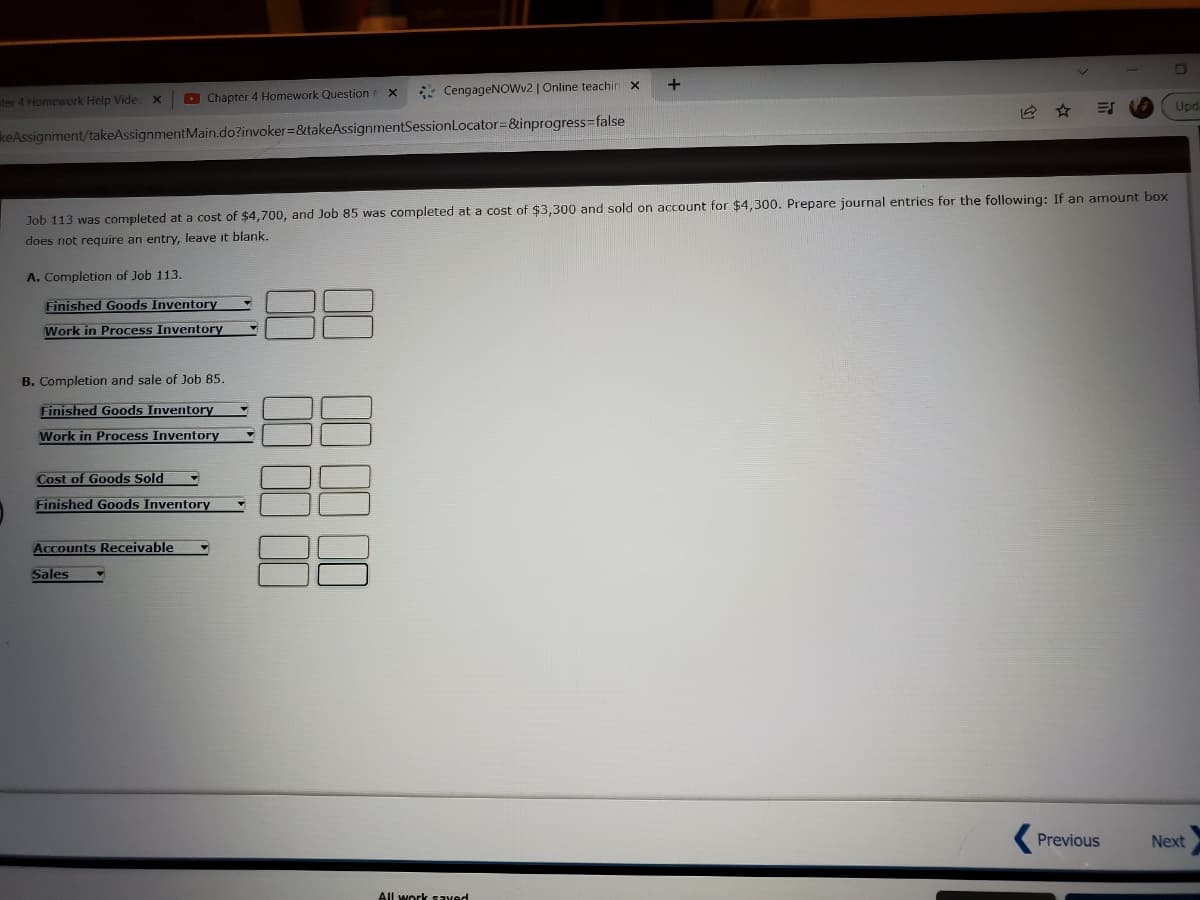

Job 113 was completed at a cost of $4,700, and Job 85 was completed at a cost of $3,300 and sold on account for $4,300. Prepare journal entries for the following: If an amount box does not require an entry, leave it blank. A. Completion of Job 113. Finished Goods Inventory Work in Process Inventory B. Completion and sale of Job 85. Finished Goods Inventory Work in Process Inventory Cost of Goods Sold Finished Goods Inventory Accounts Receivable Sales 00

Job 113 was completed at a cost of $4,700, and Job 85 was completed at a cost of $3,300 and sold on account for $4,300. Prepare journal entries for the following: If an amount box does not require an entry, leave it blank. A. Completion of Job 113. Finished Goods Inventory Work in Process Inventory B. Completion and sale of Job 85. Finished Goods Inventory Work in Process Inventory Cost of Goods Sold Finished Goods Inventory Accounts Receivable Sales 00

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 1RP

Related questions

Question

100%

How to you solve this?

Transcribed Image Text:* CengageNOwv2 | Online teachin x

ter 4 Homework Help Vide

D Chapter 4 Homework Question

Iun

Upd

keAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress3false

Job 113 was completed at a cost of $4,700, and Job 85 was completed at a cost of $3,300 and sold on account for $4,300. Prepare journal entries for the following: If an amount box

does not require an entry, leave it blank.

A. Completion of Job 113.

Finished Goods Inventory

Work in Process Inventory

B. Completion and sale of Job 85.

Finished Goods Inventory

Work in Process Inventory

Cost of Goods Sold

Finished Goods Inventory

ACcounts Receivable

Sales

Previous

Next

All work saved

Expert Solution

Step 1

Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal. An accounting journal shows a company's debit and credit balances.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you