Using Carrot Corp. What is the Average collection period for year 2? a. 20 days b. 22.50 days c. 24 days d. 24.50 days

Using Carrot Corp. What is the Average collection period for year 2? a. 20 days b. 22.50 days c. 24 days d. 24.50 days

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4PB

Related questions

Question

100%

May I ask for a solution and explanation to the problem for a better understanding. Thank you!

6. Using Carrot Corp. What is the Average collection period for year 2?

a. 20 days

b. 22.50 days

c. 24 days

d. 24.50 days

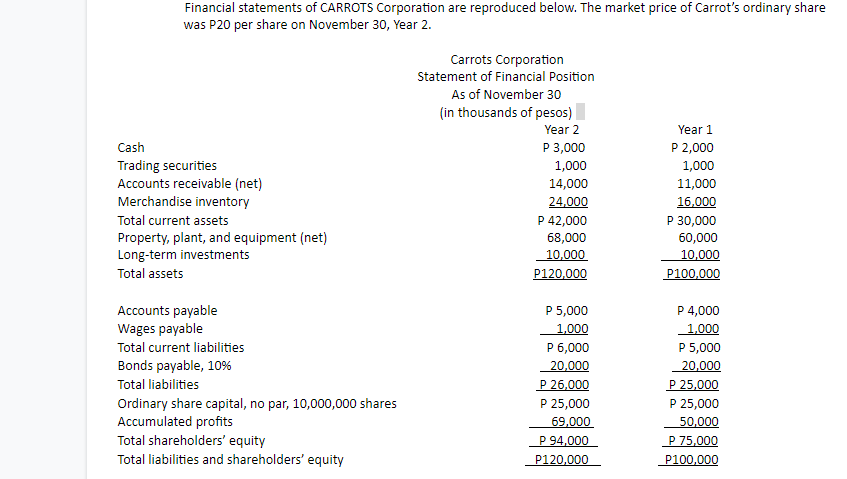

Transcribed Image Text:Financial statements of CARROTS Corporation are reproduced below. The market price of Carrot's ordinary share

was P20 per share on November 30, Year 2.

Carrots Corporation

Statement of Financial Position

As of November 30

(in thousands of pesos)

Year 2

Year 1

Cash

P 3,000

P 2,000

Trading securities

Accounts receivable (net)

Merchandise inventory

1,000

1,000

14,000

11,000

24,000

16,000

Total current assets

P 42,000

P 30,000

Property, plant, and equipment (net)

Long-term investments

68,000

60,000

10,000

10,000

Total assets

P120,000

P100,000

P 5,000

P 4,000

Accounts payable

Wages payable

1,000

1,000

Total current liabilities

P 6,000

P 5,000

Bonds payable, 10%

20,000

20,000

P 25,000

P 26,000

P 25,000

Total liabilities

Ordinary share capital, no par, 10,000,000 shares

Accumulated profits

Total shareholders' equity

Total liabilities and shareholders' equity

P 25,000

69.000

50,000

P 94,000

P 75,000

P120.000

P100,000

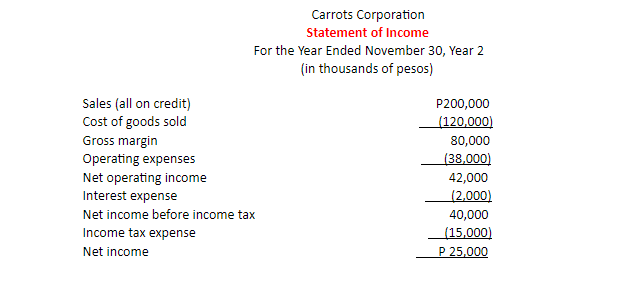

Transcribed Image Text:Carrots Corporation

Statement of Income

For the Year Ended November 30, Year 2

(in thousands of pesos)

Sales (all on credit)

Cost of goods sold

Gross margin

Operating expenses

P200,000

(120,000)

80,000

(38,000)

Net operating income

Interest expense

42,000

(2,000)

Net income before income tax

40,000

Income tax expense

(15,000)

P 25,000

Net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning