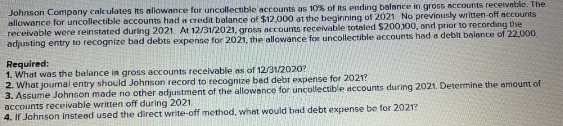

Johnson Company caleulates its allowance for uncollectible'accounts as 10% of its ending balance in gross accounts recelvable. The allowance for uncollectible accounts had a credit balance of $12.000 at the beginning of 2021 No previously written-off accounts receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totnled $200,100, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 22,000. Required: 1. What was the balance in gross accounts receivable as of 12/31/2020? 2. What journal entry should Johnson record to recognize bed debt expense for 2021? 3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021. 4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021?

Johnson Company caleulates its allowance for uncollectible'accounts as 10% of its ending balance in gross accounts recelvable. The allowance for uncollectible accounts had a credit balance of $12.000 at the beginning of 2021 No previously written-off accounts receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totnled $200,100, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 22,000. Required: 1. What was the balance in gross accounts receivable as of 12/31/2020? 2. What journal entry should Johnson record to recognize bed debt expense for 2021? 3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021. 4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021?

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter14: Accounting For Uncollectible Accounts Receivable

Section: Chapter Questions

Problem 1CP

Related questions

Question

Transcribed Image Text:Johnson Company caleulates its allowance for uncollectible'accounts as 10% of its ending balance in gross accounts recelvable. The

allowance for uncollectible accounts had a credit balance of $12.000 at the beginning of 2021 No previously written-off accounts

receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totnled $200,100, and prior to recording the

adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 22,000.

Required:

1. What was the balance in gross accounts receivable as of 12/31/2020?

2. What journal entry should Johnson record to recognize bed debt expense for 2021?

3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of

accounts receivable written off during 2021.

4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,