Johnson Industries purchased metal-working lathe for $38,000. This item will be used for business 90% of the time. Accountants elected to take a $17,000 section 179 deduction and utilize the special depreciation allowance of 50%. Prepare a depreciation schedule using MACRS. Round all dollar amounts to the nearest cent. Johnson Industries MACRS Depreciation Schedule-Metal-working Lathe End of Year Basis for Depreciation Recovery Percent MACRS Depreciation Deduction Accumulated Depreciation Book Value 1 x 33.33% 2 44.45% 3 x 14.81% 7.41% Step 1 The modified accelerated cost recovery system (MACRS) is the name given to tax rules for getting back, or recovering, through depreciation deductions the cost of property that is used in a trade or business. We must calculate the basis for depreciation, which is the cost of the lathe that will be used for depreciation purposes. This is based on the original cost of the lathe, the percentage of time it will be used for business purposes, the section 179 deduction, and any special depreciation allowance that may be used. This lathe will only be used for business purposes 90% of the time. Therefore, the business-use basis amount will be found by multiplying the original cost of the lathe, $38,000, by the percentage of time it will be used for business purposes. business-use basis original cost x business-use percentage = 38,000 x 90% = $ Now the section 179 deduction of $17,000 can be applied by finding the tentative basis, which is the difference of the business-use basis and the section 179 deduction. tentative basis business-use basis-section 179 deduction = $ The final value of the basis for depreciation can now be found. A special depreciation allowance of 50% will be used. Find the basis for depreciation. basis for depreciation tentative basis(100% - special depreciation allowance percent) = tentative basis(100% - 50%) = $

Johnson Industries purchased metal-working lathe for $38,000. This item will be used for business 90% of the time. Accountants elected to take a $17,000 section 179 deduction and utilize the special depreciation allowance of 50%. Prepare a depreciation schedule using MACRS. Round all dollar amounts to the nearest cent. Johnson Industries MACRS Depreciation Schedule-Metal-working Lathe End of Year Basis for Depreciation Recovery Percent MACRS Depreciation Deduction Accumulated Depreciation Book Value 1 x 33.33% 2 44.45% 3 x 14.81% 7.41% Step 1 The modified accelerated cost recovery system (MACRS) is the name given to tax rules for getting back, or recovering, through depreciation deductions the cost of property that is used in a trade or business. We must calculate the basis for depreciation, which is the cost of the lathe that will be used for depreciation purposes. This is based on the original cost of the lathe, the percentage of time it will be used for business purposes, the section 179 deduction, and any special depreciation allowance that may be used. This lathe will only be used for business purposes 90% of the time. Therefore, the business-use basis amount will be found by multiplying the original cost of the lathe, $38,000, by the percentage of time it will be used for business purposes. business-use basis original cost x business-use percentage = 38,000 x 90% = $ Now the section 179 deduction of $17,000 can be applied by finding the tentative basis, which is the difference of the business-use basis and the section 179 deduction. tentative basis business-use basis-section 179 deduction = $ The final value of the basis for depreciation can now be found. A special depreciation allowance of 50% will be used. Find the basis for depreciation. basis for depreciation tentative basis(100% - special depreciation allowance percent) = tentative basis(100% - 50%) = $

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 15PB: Urquhart Global purchases a building to house its administrative offices for $500,000. The best...

Related questions

Question

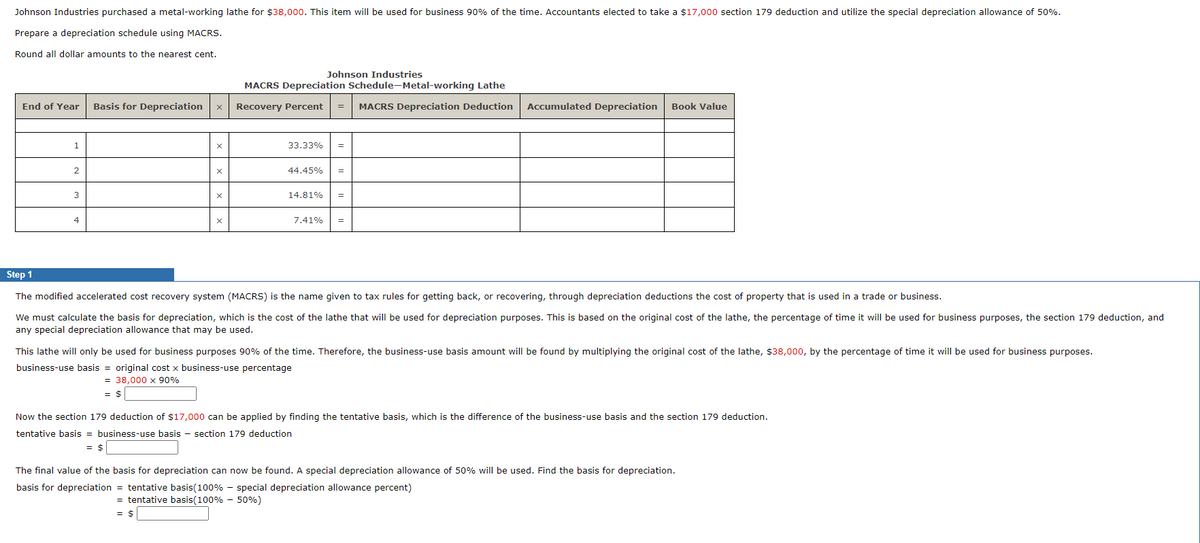

Transcribed Image Text:Johnson Industries purchased a metal-working lathe for $38,000. This item will be used for business 90% of the time. Accountants elected to take a $17,000 section 179 deduction and utilize the special depreciation allowance of 50%.

Prepare a depreciation schedule using MACRS.

Round all dollar amounts to the nearest cent.

Johnson Industries

MACRS Depreciation Schedule-Metal-working Lathe

End of Year Basis for Depreciation

X

Recovery Percent = MACRS Depreciation Deduction Accumulated Depreciation Book Value

1

X

33.33% =

2

X

44.45% =

3

X

14.81% =

4

X

7.41% =

Step 1

The modified accelerated cost recovery system (MACRS) is the name given to tax rules for getting back, or recovering, through depreciation deductions the cost of property that is used in a trade or business.

We must calculate the basis for depreciation, which is the cost of the lathe that will be used for depreciation purposes. This is based on the original cost of the lathe, the percentage of time it will be used for business purposes, the section 179 deduction, and

any special depreciation allowance that may be used.

This lathe will only be used for business purposes 90% of the time. Therefore, the business-use basis amount will be found by multiplying the original cost of the lathe, $38,000, by the percentage of time it will be used for business purposes.

business-use basis = original cost x business-use percentage

= 38,000 x 90%

= $

Now the section 179 deduction of $17,000 can be applied by finding the tentative basis, which is the difference of the business-use basis and the section 179 deduction.

tentative basis = business-use basis section 179 deduction

= $

The final value of the basis for depreciation can now be found. A special depreciation allowance of 50% will be used. Find the basis for depreciation.

basis for depreciation = tentative basis(100% - special depreciation allowance percent)

= tentative basis(100% - 50%)

= $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning