48. Assuming Perry Company acquired 80% of the outstanding ordinary share of Sassy Company for P273,600 excluding control premium of P36,000. Non-controlling interest is measured at fair value, how much is the total consolidated assets on the date of acquisition?

48. Assuming Perry Company acquired 80% of the outstanding ordinary share of Sassy Company for P273,600 excluding control premium of P36,000. Non-controlling interest is measured at fair value, how much is the total consolidated assets on the date of acquisition?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 18E

Related questions

Question

please answer this thank you

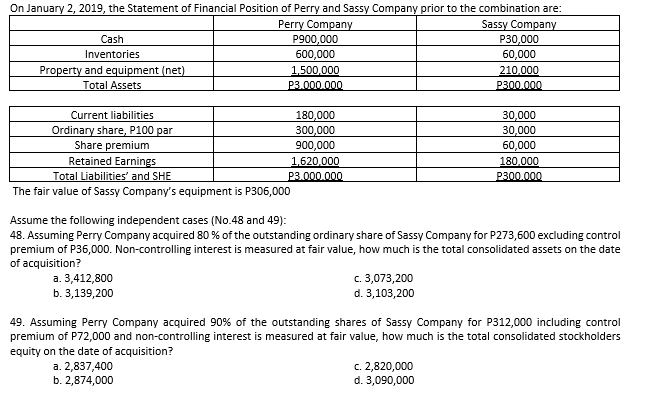

Transcribed Image Text:On January 2, 2019, the Statement of Financial Position of Perry and Sassy Company prior to the combination are:

Perry Company

Sassy Company

P900,000

P30,000

Cash

Inventories

600,000

60,000

Property and equipment (net)

1,500,000

210,000

Total Assets

P3.000.000

P300.000

Current liabilities

180,000

30,000

Ordinary share, P100 par

300,000

30,000

Share premium

900,000

60,000

Retained Earnings

1,620,000

180,000

Total Liabilities and SHE

P3.000.000

P300.000

The fair value of Sassy Company's equipment is P306,000

Assume the following independent cases (No.48 and 49):

48. Assuming Perry Company acquired 80% of the outstanding ordinary share of Sassy Company for P273,600 excluding control

premium of P36,000. Non-controlling interest is measured at fair value, how much is the total consolidated assets on the date

of acquisition?

a.

3,412,800

c. 3,073,200

d. 3,103,200

b. 3,139,200

49. Assuming Perry Company acquired 90% of the outstanding shares of Sassy Company for P312,000 including control

premium of P72,000 and non-controlling interest is measured at fair value, how much is the total consolidated stockholders

equity on the date of acquisition?

a. 2,837,400

c. 2,820,000

d. 3,090,000

b. 2,874,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning