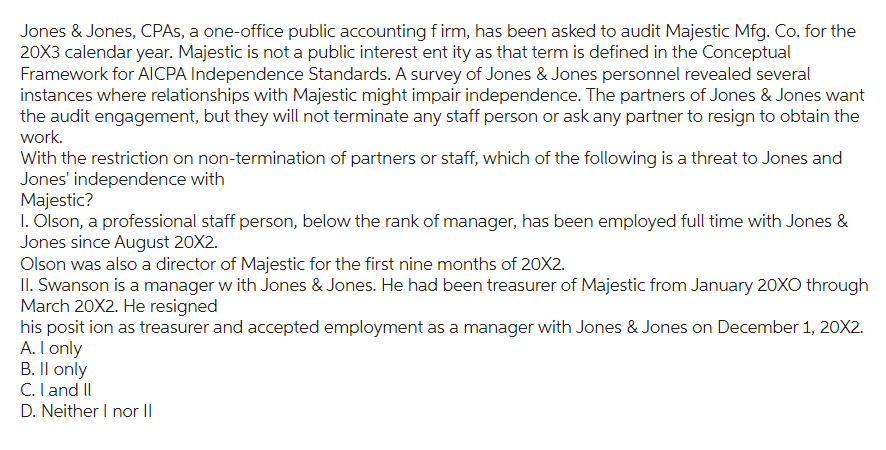

Jones & Jones, CPAS, a one-office public accounting firm, has been asked to audit Majestic Mfg. Co. for the 20X3 calendar year. Majestic is not a public interest entity as that term is defined in the Conceptual Framework for AICPA Independence Standards. A survey of Jones & Jones personnel revealed several instances where relationships with Majestic might impair independence. The partners of Jones & Jones want the audit engagement, but they will not terminate any staff person or ask any partner to resign to obtain the work. With the restriction on non-termination of partners or staff, which of the following is a threat to Jones and Jones' independence with Majestic? 1. Olson, a professional staff person, below the rank of manager, has been employed full time with Jones & Jones since August 20X2. Olson was also a director of Majestic for the first nine months of 20X2. II. Swanson is a manager with Jones & Jones. He had been treasurer of Majestic from January 20XO through March 20X2. He resigned his position as treasurer and accepted employment as a manager with Jones & Jones on December 1, 20X2. A. I only B. II only C. I and II D. Neither I nor II

Jones & Jones, CPAS, a one-office public accounting firm, has been asked to audit Majestic Mfg. Co. for the 20X3 calendar year. Majestic is not a public interest entity as that term is defined in the Conceptual Framework for AICPA Independence Standards. A survey of Jones & Jones personnel revealed several instances where relationships with Majestic might impair independence. The partners of Jones & Jones want the audit engagement, but they will not terminate any staff person or ask any partner to resign to obtain the work. With the restriction on non-termination of partners or staff, which of the following is a threat to Jones and Jones' independence with Majestic? 1. Olson, a professional staff person, below the rank of manager, has been employed full time with Jones & Jones since August 20X2. Olson was also a director of Majestic for the first nine months of 20X2. II. Swanson is a manager with Jones & Jones. He had been treasurer of Majestic from January 20XO through March 20X2. He resigned his position as treasurer and accepted employment as a manager with Jones & Jones on December 1, 20X2. A. I only B. II only C. I and II D. Neither I nor II

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter2: The Auditor’s Responsibilities Regarding Fraud And Mechanisms To Address Fraud: Regulation And Corporate Governance

Section: Chapter Questions

Problem 23RQSC

Related questions

Question

Transcribed Image Text:Jones & Jones, CPAs, a one-office public accounting firm, has been asked to audit Majestic Mfg. Co. for the

20X3 calendar year. Majestic is not a public interest ent ity as that term is defined in the Conceptual

Framework for AICPA Independence Standards. A survey of Jones & Jones personnel revealed several

instances where relationships with Majestic might impair independence. The partners of Jones & Jones want

the audit engagement, but they will not terminate any staff person or ask any partner to resign to obtain the

work.

With the restriction on non-termination of partners or staff, which of the following is a threat to Jones and

Jones' independence with

Majestic?

1. Olson, a professional staff person, below the rank of manager, has been employed full time with Jones &

Jones since August 20X2.

Olson was also a director of Majestic for the first nine months of 20X2.

II. Swanson is a manager with Jones & Jones. He had been treasurer of Majestic from January 20XO through

March 20X2. He resigned

his position as treasurer and accepted employment as a manager with Jones & Jones on December 1, 20X2.

A. I only

B. II only

C. I and II

D. Neither I nor II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College