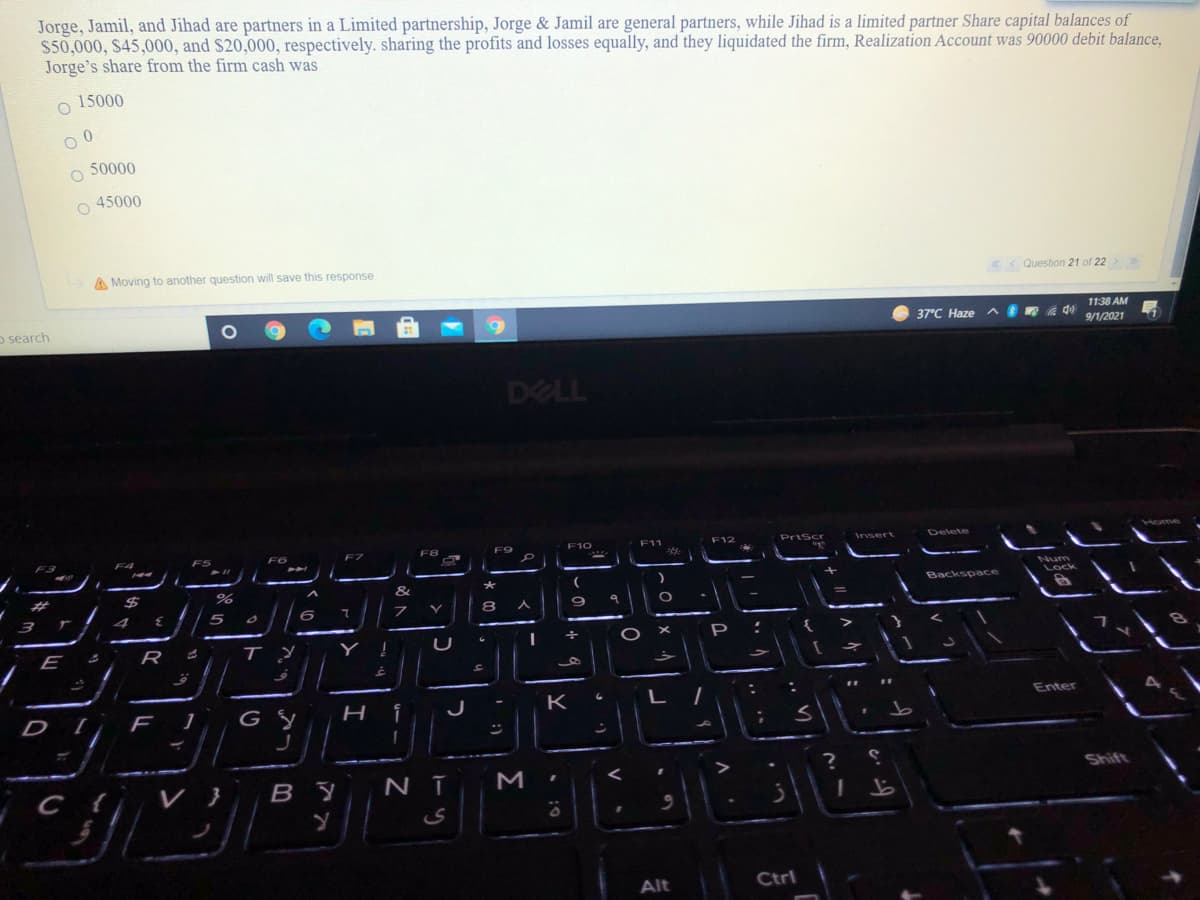

Jorge, Jamil, and Jihad are partners in a Limited partnership, Jorge & Jamil are general partners, while Jihad is a limited partner Share capital balances of S50,000, S45,000, and $20,000, respectively. sharing the profits and losses equally, and they liquidated the firm, Realization Account was 90000 debit balance, Jorge's share from the firm cash was o 15000 50000 45000

Jorge, Jamil, and Jihad are partners in a Limited partnership, Jorge & Jamil are general partners, while Jihad is a limited partner Share capital balances of S50,000, S45,000, and $20,000, respectively. sharing the profits and losses equally, and they liquidated the firm, Realization Account was 90000 debit balance, Jorge's share from the firm cash was o 15000 50000 45000

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 42P

Related questions

Question

100%

Transcribed Image Text:Jorge, Jamil, and Jihad are partners in a Limited partnership, Jorge & Jamil are general partners, while Jihad is a limited partner Share capital balances of

S50,000, $45,000, and $20,000, respectively. sharing the profits and losses equally, and they liquidated the firm, Realization Account was 90000 debit balance,

Jorge's share from the firm cash was

o 15000

O 50000

45000

A Moving to another question will save this response

«< Question 21 of 22

O search

37°C Haze

11:38 AM

9/1/2021

DELL

PrtScr

Insert

Delete

Home

%24

&

Num

Lock

Backspace

E

R

{

D

K

L /

Enter

C

V }

В У

N T

?

Shift

ی

Alt

Ctrl

Σ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College