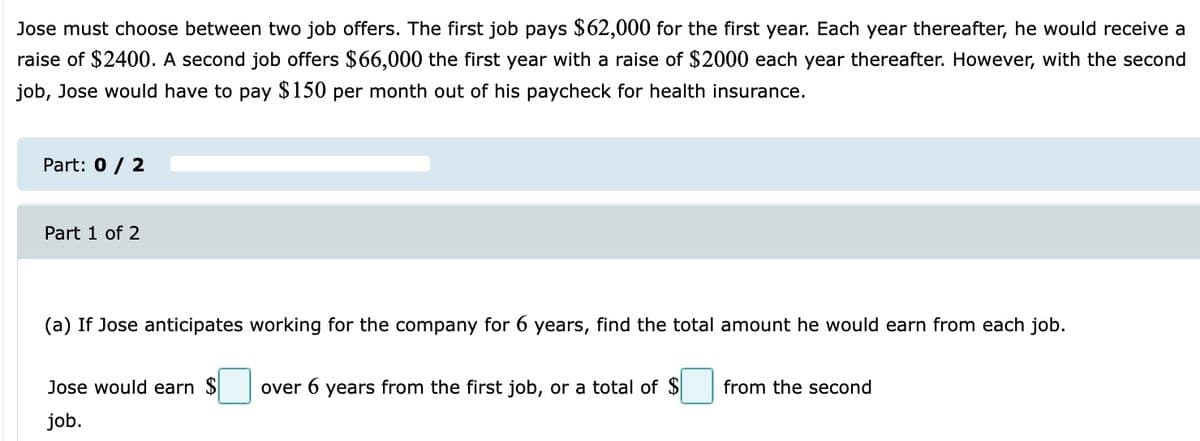

Jose must choose between two job offers. The first job pays $62,000 for the first year. Each year thereafter, he would receive a raise of $2400. A second job offers $66,000 the first year with a raise of $2000 each year thereafter. However, with the second job, Jose would have to pay $150 per month out of his paycheck for health insurance. Part: 0/ 2 Part 1 of 2 (a) If Jose anticipates working for the company for 6 years, find the total amount he would earn from each job. Jose would earn $ over 6 years from the first job, or a total of $ from the second job.

Jose must choose between two job offers. The first job pays $62,000 for the first year. Each year thereafter, he would receive a raise of $2400. A second job offers $66,000 the first year with a raise of $2000 each year thereafter. However, with the second job, Jose would have to pay $150 per month out of his paycheck for health insurance. Part: 0/ 2 Part 1 of 2 (a) If Jose anticipates working for the company for 6 years, find the total amount he would earn from each job. Jose would earn $ over 6 years from the first job, or a total of $ from the second job.

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 12DQ

Related questions

Question

Transcribed Image Text:Jose must choose between two job offers. The first job pays $62,000 for the first year. Each year thereafter, he would receive a

raise of $2400. A second job offers $66,000 the first year with a raise of $2000 each year thereafter. However, with the second

job, Jose would have to pay $150 per month out of his paycheck for health insurance.

Part: 0 / 2

Part 1 of 2

(a) If Jose anticipates working for the company for 6 years, find the total amount he would earn from each job.

Jose would earn $

over 6 years from the first job, or a total of $

from the second

job.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning