Cost NRV January 1, 2019 December 31, 2019 December 31, 2020 December 31, 2021 $50,000 64,000 71,000 75,000 $50,000 60,000 70,000 78,000 Required: 1. Assume the inventory that existed at the end of cach year was sold in the subscquent year. Prepare journal entries to record the lower of cost or net realizable value for each of the following alternatives: a. allowance method, perpetual inventory system b. direct method, perpetual inventory system 2. Next Level Explain any differences in inventory valuation and income between the two methods.

Cost NRV January 1, 2019 December 31, 2019 December 31, 2020 December 31, 2021 $50,000 64,000 71,000 75,000 $50,000 60,000 70,000 78,000 Required: 1. Assume the inventory that existed at the end of cach year was sold in the subscquent year. Prepare journal entries to record the lower of cost or net realizable value for each of the following alternatives: a. allowance method, perpetual inventory system b. direct method, perpetual inventory system 2. Next Level Explain any differences in inventory valuation and income between the two methods.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 15P: (Appendix 8.1) Inventory Write-Down The following are the inventories for the years 2019, 2020, and...

Related questions

Question

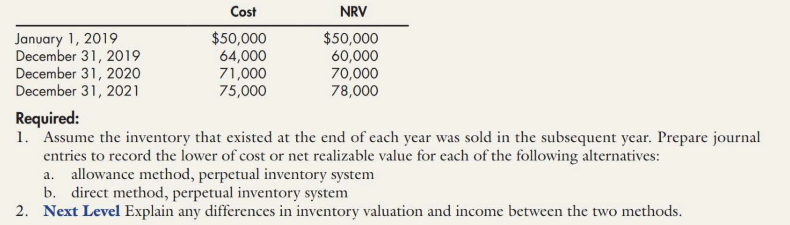

The following are the inventories for the years 2019, 2020, and 2021 for Parry Company:

Transcribed Image Text:Cost

NRV

January 1, 2019

December 31, 2019

December 31, 2020

December 31, 2021

$50,000

64,000

71,000

75,000

$50,000

60,000

70,000

78,000

Required:

1. Assume the inventory that existed at the end of cach year was sold in the subscquent year. Prepare journal

entries to record the lower of cost or net realizable value for each of the following alternatives:

a. allowance method, perpetual inventory system

b. direct method, perpetual inventory system

2. Next Level Explain any differences in inventory valuation and income between the two methods.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning