Joseph Farmer earned $126,400 in 2018 for a company in Kentucky. He is single with one withholding allowance and is paid annually. The FUTA rate in Kentucky for 2018 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent with a wage base of $10,200. Use the percentage method withholding tables in Appendix C and the state information in Appendix D. Use Figure 5.3. Required: Compute the following employee share of the taxes. (Round your answers to 2 decimal places.)

Joseph Farmer earned $126,400 in 2018 for a company in Kentucky. He is single with one withholding allowance and is paid annually. The FUTA rate in Kentucky for 2018 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent with a wage base of $10,200. Use the percentage method withholding tables in Appendix C and the state information in Appendix D. Use Figure 5.3. Required: Compute the following employee share of the taxes. (Round your answers to 2 decimal places.)

Chapter5: Unemployment Compensation Taxes

Section: Chapter Questions

Problem 11PA

Related questions

Question

Please do not give image format

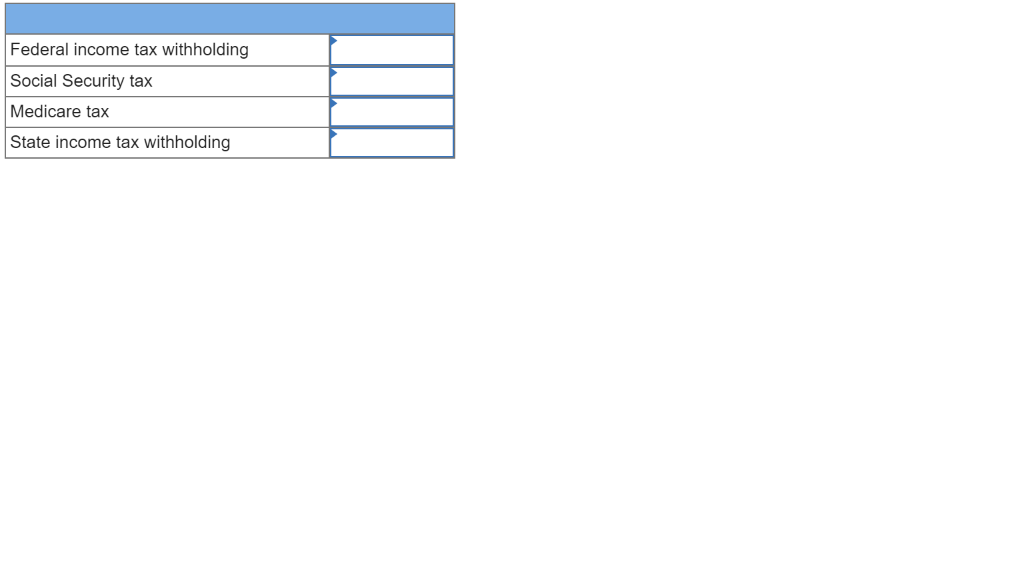

Transcribed Image Text:Federal income tax withholding

Social Security tax

Medicare tax

State income tax withholding

Transcribed Image Text:Joseph Farmer earned $126,400 in

2018 for a company in Kentucky. He is

single with one withholding allowance

and is paid annually. The FUTA rate in

Kentucky for 2018 is 0.6 percent on the

first $7,000 of employee wages, and

the SUTA rate is 5.4 percent with a

wage base of $10,200. Use the

percentage method withholding tables

in Appendix C and the state

information in Appendix D. Use Figure

5.3.

Required:

Compute the following employee

share of the taxes. (Round your

answers to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,