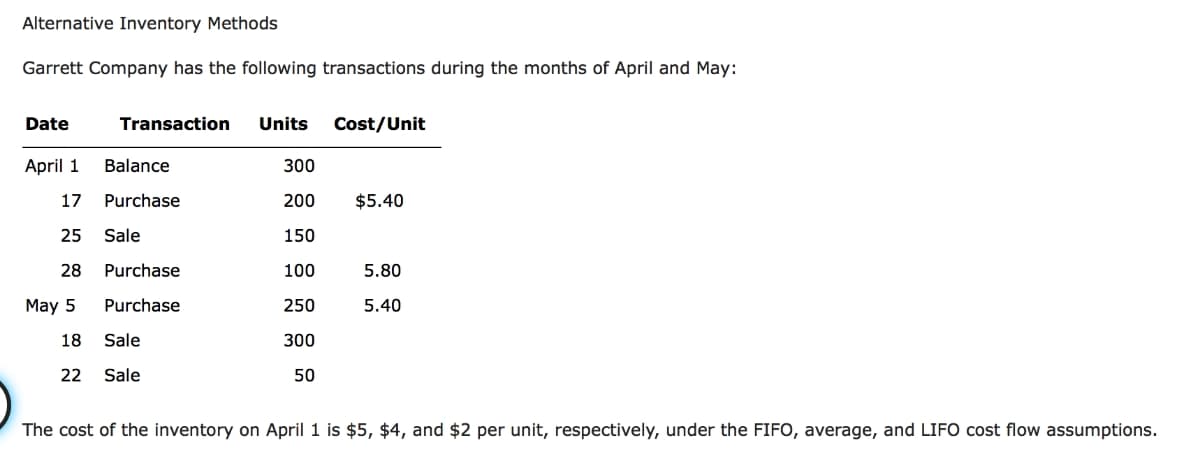

Alternative Inventory Methods Garrett Company has the following transactions during the months of April and May: Date April 1 17 25 28 May 5 Transaction Units Balance Purchase Sale Purchase Purchase 18 Sale 22 Sale 300 200 150 100 250 300 50 Cost/Unit $5.40 5.80 5.40 The cost of the inventory on April 1 is $5, $4, and $2 per unit, respectively, under the FIFO, average, and LIFO cost flow assumptions.

Alternative Inventory Methods Garrett Company has the following transactions during the months of April and May: Date April 1 17 25 28 May 5 Transaction Units Balance Purchase Sale Purchase Purchase 18 Sale 22 Sale 300 200 150 100 250 300 50 Cost/Unit $5.40 5.80 5.40 The cost of the inventory on April 1 is $5, $4, and $2 per unit, respectively, under the FIFO, average, and LIFO cost flow assumptions.

Chapter10: Inventory

Section: Chapter Questions

Problem 4PA: Calculate the cost of goods sold dollar value for A74 Company for the sale on March 11, considering...

Related questions

Question

Please do not give image format

Transcribed Image Text:Alternative Inventory Methods

Garrett Company has the following transactions during the months of April and May:

Date

April 1

17

25 Sale

28

May 5

Transaction Units Cost/Unit

18

22

Balance

Purchase

Purchase

Purchase

Sale

Sale

300

200

150

100

250

300

50

$5.40

5.80

5.40

The cost of the inventory on April 1 is $5, $4, and $2 per unit, respectively, under the FIFO, average, and LIFO cost flow assumptions.

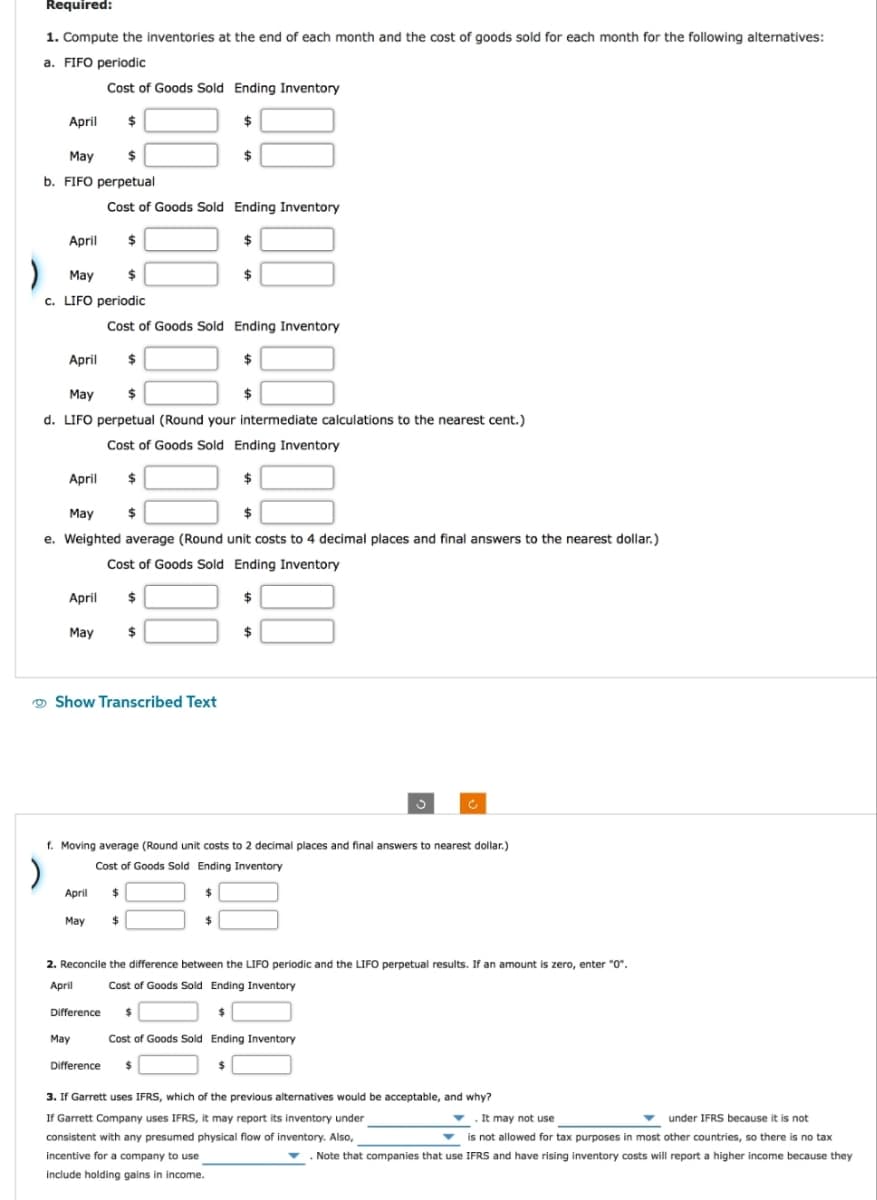

Transcribed Image Text:Required:

1. Compute the inventories at the end of each month and the cost of goods sold for each month for the following alternatives:

a. FIFO periodic

Cost of Goods Sold Ending Inventory

$

$

April

May

$

b. FIFO perpetual

April

May

$

c. LIFO periodic

April

April

May

April

May

$

d. LIFO perpetual (Round your intermediate calculations to the nearest cent.)

Cost of Goods Sold Ending Inventory

$

May

$

$

e. Weighted average (Round unit costs to 4 decimal places and final answers to the nearest dollar.)

Cost of Goods Sold Ending Inventory

$

April

Cost of Goods Sold Ending Inventory

May

$

Difference

Show Transcribed Text

May

Cost of Goods Sold Ending Inventory

$

$

$

$

$

$

$

f. Moving average (Round unit costs to 2 decimal places and final answers to nearest dollar.)

Cost of Goods Sold Ending Inventory

$

$

$

$

Difference $

$

2. Reconcile the difference between the LIFO periodic and the LIFO perpetual results. If an amount is zero, enter "0".

Cost of Goods Sold Ending Inventory

April

$

Cost of Goods Sold Ending Inventory

$

$

3. If Garrett uses IFRS, which of the previous alternatives would be acceptable, and why?

If Garrett Company uses IFRS, it may report its inventory under

consistent with any presumed physical flow of inventory. Also,

incentive for a company to use

include holding gains in income.

. It may not use

under IFRS because it is not

is not allowed for tax purposes in most other countries, so there is no tax

▼ Note that companies that use IFRS and have rising inventory costs will report a higher income because they

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 24 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,