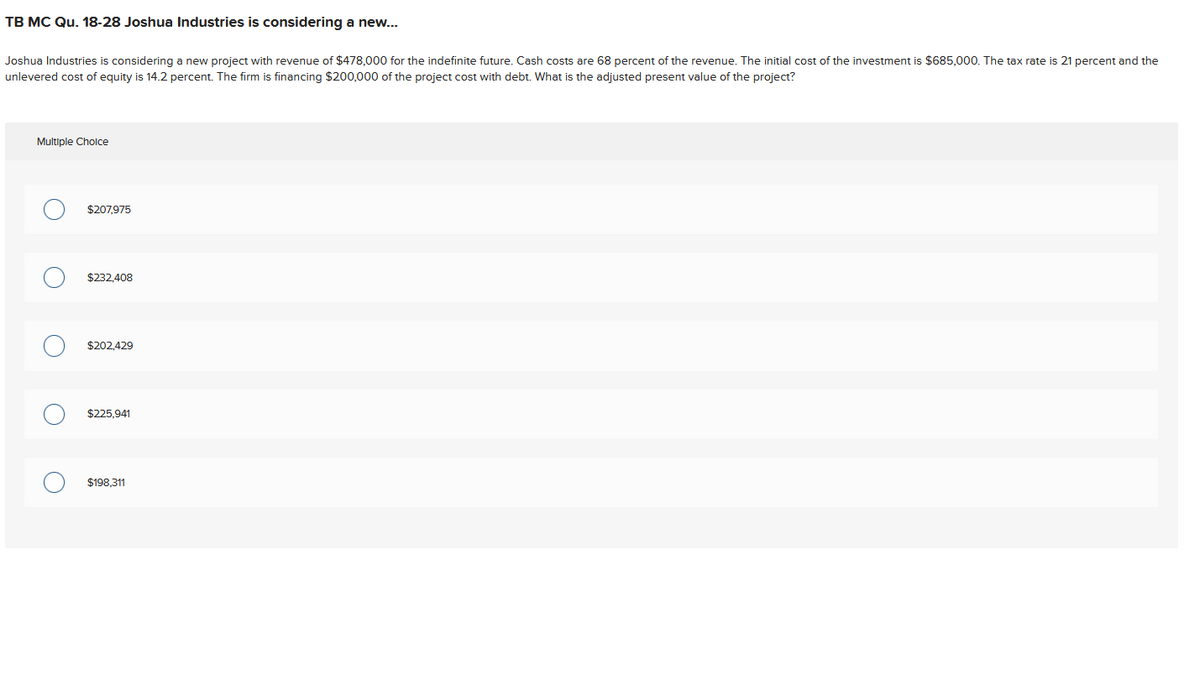

Joshua Industries is considering a new project with revenue of $478,000 for the indefinite future. Cash costs are 68 percent of the revenue. The initial cost of the investment is $685,000. The tax rate is 21 percen unlevered cost of equity is 14.2 percent. The firm is financing $200,000 of the project cost with debt. What is the adjusted present value of the project?

Joshua Industries is considering a new project with revenue of $478,000 for the indefinite future. Cash costs are 68 percent of the revenue. The initial cost of the investment is $685,000. The tax rate is 21 percen unlevered cost of equity is 14.2 percent. The firm is financing $200,000 of the project cost with debt. What is the adjusted present value of the project?

Chapter11: The Cost Of Capital

Section: Chapter Questions

Problem 20PROB

Related questions

Question

100%

Transcribed Image Text:TB MC Qu. 18-28 Joshua Industries is considering a new...

Joshua Industries is considering a new project with revenue of $478,000 for the indefinite future. Cash costs are 68 percent of the revenue. The initial cost of the investment is $685,000. The tax rate is 21 percent and the

unlevered cost of equity is 14.2 percent. The firm is financing $200,000 of the project cost with debt. What is the adjusted present value of the project?

Multiple Choice

O

O

O

$207,975

$232,408

$202,429

$225,941

$198,311

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you