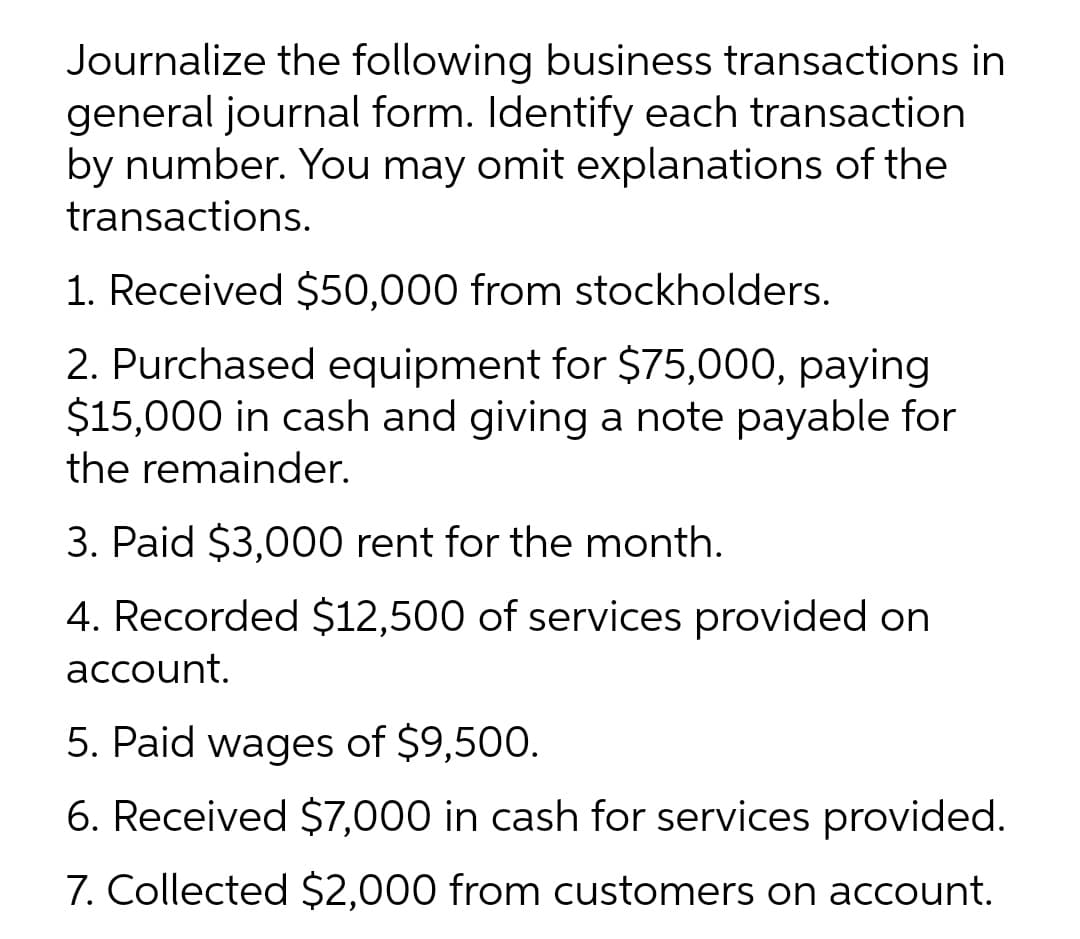

Journalize the following business transactions in general journal form. Identify each transaction by number. You may omit explanations of the transactions. 1. Received $50,000 from stockholders. 2. Purchased equipment for $75,000, paying $15,000 in cash and giving a note payable for the remainder. 3. Paid $3,000 rent for the month. 4. Recorded $12,500 of services provided on account. 5. Paid wages of $9,500. 6. Received $7,000 in cash for services provided. 7. Collected $2,000 from customers on account.

Q: Record the following selected transactions for January in a two-column journal. Recorded $12,000…

A: Accounting records begin from recording of financial transactions in the form of journal entries.…

Q: Liu Zhang operates Lawson Consulting, which began operations on June 1. The Retained Earnings…

A: Net income = Service revenue - Rent expense - Wages expense Net income = $16,200 - $3,400 - $8,000…

Q: If an amount box does not require an entry, leave it blank. a. In the T accounts, record the…

A: a. Prepare T-accounts for Potter pool services for the transactions as shown below:

Q: for the A. On first day of the month, issued common stock for cash, $24,000. B. On third day of…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: Following are the transactions for Valdez Services. a. The company paid $2,000 cash for payment on a…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: At the beginning of April, Owl Corporation has a balance of $13,000 in the Retained Earnings…

A: Retained Earnings means earnings retained in the business after distributing dividend for equity…

Q: Lawson Consulting, which began operations on December 1, had the following accounts and amounts on…

A: Statement of owner's equity indicates the investment balance of the owner. The ending balance of…

Q: Show the effects of each transaction on the accounting equation by indicating under the proper…

A: As per the Accounting Equation,Assets =Liabilities +Shareholder's Equity

Q: The following are the transactions of Spotlighter, Incorporated, for the month of January. Borrowed…

A: Journal entries are used by the business entity to record the financial transections in the books of…

Q: The following table contains several business transactions for the current month. Required:…

A: Account which is affected and element of financial statement has been answered.

Q: Show the effects of each transaction on the accounting equation by indicating under the proper…

A: The accounting equation is written as: Assets = Liabilities + owner's equity

Q: Analyze the following transactions and prepare a list of accounts that are affected. Organize them…

A: The chart of accounts gives the list of all the Accounts of the company.

Q: Lawson Consulting, which began operations on December 1, had the following accounts and amounts on…

A: The balance sheet represents the financial position of the business with assets and liabilities on a…

Q: Hart, Attorney at Law, experienced the following transactions in Year 1, the first year of…

A: The financial transactions of the business effects different financial statements of the business.…

Q: A business has the following transactions:• The business is started by receiving cash from an…

A: Net income is computed by collecting revenues and deducting company expenditures such as production…

Q: Journalize the following selected transactions for January in good form. Jan. 1 Received cash…

A: Journal Entries are recorded chronologically following the rules of debit and credit.

Q: Transactions, financial statementsOn August 1, 2089, Brooke Kline established Western Realty.…

A: The transaction effect in accounting is usually shown as per the double-entry system with the help…

Q: Record the following selected transactions for December in a two-column journal, identifying each…

A: Journal entries are accounting entries that record business transactions. In journal entries, each…

Q: Liu Zhang operates Lawson Consulting, which began operations on June 1. The Retained Earnings…

A: Formula: Net Income = Revenues - expenses Deduction of expenses from revenues derives the Net…

Q: Prepare balance sheet for this transaction. Don Pedro’s Accounting Firm has the following account…

A: Balance sheet is the financial statements of the organization prepared at the end of the year. It…

Q: Journalize the following business transactions in general journal form. Identify each transaction by…

A: Journal entry: It can be defined as the recording of financial events and transactions that have…

Q: Record the following transactions directly into the appropriate T accounts and determine the balance…

A: The business transactions are recorded in the books of accounts through journal entries, which will…

Q: effected the value of increase or decrease for each accounting element

A: Every accounting transaction has an effect on the accounting equation. The accounting equation is…

Q: Carmen Camry operates a consulting firm called Help Today, which began operations on December 1. On…

A: Balance sheet is a component of financial statements that shows the exact position of assets and…

Q: The company issued shares of common stock in exchange for $ 100,000 in cash. The company purchased…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: A business has the following transactions: The business is started by receiving cash from an…

A: Net Income can be calculated by substracting all the expenses from the service revenue earned by the…

Q: The Haper Center company presents a statement of initial situation with cash of $ 26,000, accounts…

A:

Q: Below are the account balances for Cowboy Law Firm at the end of December.Accounts…

A: Income statement: Income statement is the financial statement of a company which shows all the…

Q: Prepare journal entries to record the following transactions: A. December 1, collected balance due…

A: Journal entry: A journal entry is used to record day-to-day transactions of the business by debiting…

Q: On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $83,660…

A: Balance sheet is the financial statement which is prepared to check the financial health of the…

Q: John Sullivan started a business. During the first month, the following transactions occured. Show…

A:

Q: The following are the transactions of Spotlighter, Inc., for the month of January. Borrowed…

A: Each transaction has an impact on the ledger and its balance. That will impact the balances in the…

Q: Show the effects of each transaction on the accounting equation by indicating under the proper…

A: 1. Purchase of supplies on account and amount payable for equipment in six months both are credited…

Q: The following transactions for the month of March have been journalized and posted to the proper O…

A: Accounting equation is one of the important concept in accounting. It has three important elements,…

Q: A business has the following transactions: The business is started by receiving cash from an…

A: Total income for the month is calculated by deducting total expenses from the total revenues of the…

Q: service revenue $15,600 accounts receivable $5,700 equipment $7,700…

A: The company has provided details for the month of June. Required Prepare a June statement of…

Q: Using the Transaction Analysis table provided, analyze the effect of the transactions listed below…

A: Accounting equation states that assets is equal to sum of liabilities and Owner's equity. Assets =…

Q: Below are several transactions for Scarlet Knight Corporation. A junior accountant, recently…

A: ExpectedTransaction 1. Incorrect 2. Correct 3. Incorrect 4. Incorrect 5. Incorrect

Q: Record the following selected transactions for April in a two-column journal, identifying each entry…

A: Journal entry means the entry in prime book with chronological order. Journal entry should have…

Q: Journalize the following transactions for the month of July: July 1 K. Elliot deposited $10,000 in…

A: Supplies on account=1000-500=$500

Q: Make a General Ledger for the following selected transactions completed by the SPC Laundry Shop…

A: T accounts are the general ledger accounts that are being prepared for the purpose of posting of…

Q: Identify the explanation from a through j below that best describes each transaction 1 through 5…

A: The accounting equation is considered to be the foundation of the double-entry accounting system.…

Q: The following transactions for the month of March have been journalized and posted to the proper…

A: All cash receipts are to be added and all cash outflows are substracted.

Q: The following seven transactions produced the account balances shown above. a. Y. Min invested…

A: If you have a cash account with such a brokerage firm, all securities transactions must be paid in…

Q: Journalize the transactions

A: Journal entry is the act of keeping or making records of transactions in the business

Q: Using the business transactions below, complete T-accounts for the Smith Company. I have provided a…

A: The T-accounts are prepared to record the transactions to their specific accounts and final prepared…

Q: During the year, the Flight Company experienced the following accounting transactions: 1. Issued…

A: The accounting equation is an equation that works on the principle of double entry system. There are…

Q: Liu Zhang operates Lawson Consulting, which began operations on June 1. The Retained Earnings…

A: Formula: Net income = Revenues - Expenses

Q: Show the effect of each transaction on the three basic accounting elements by Indicating the dollar…

A: The transactions and events of the company will be recorded in the books of accounts in an…

With Proper Format.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Journal entries and trial balance On October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following transactions during the month: a. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 40,000. b. Paid rent on office and equipment for the month, 4,800. c. Purchased supplies on account, 2,150. d. Paid creditor on account, 1,100. e. Earned sales commissions, receiving cash, 18,750. f. Paid automobile expenses (including rental charge) for month, 1,580, and miscellaneous expenses, 800. g. Paid office salaries, 3,500. h. Determined that the cost of supplies used was 1,300. i. Paid dividends, 1,500. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of October 31, 20Y6. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for October. 5. Determine the increase or decrease in retained earnings for October.Journal Entries Recorded Directly in T Accounts Record each of the following transactions directly in T accounts using the numbers preceding the transactions to identify them in the accounts. Each account needs a separate T account. Received contribution of $6,500 from each of the three principal owners of We-Go Delivery Service in exchange for shares of stock. Purchased office supplies for cash of $130. Purchased a van for $15,000 on an open account. The company has 25 days to pay for the van. Provided delivery services to residential customers for cash of $125. Billed a local business $200 for delivery services. The customer is to pay the bill within 15 days. Paid the amount due on the van. Received the amount due from the local business billed in (5).On July 1, K. Resser opened Ressers Business Services. Ressers accountant listed the following chart of accounts: The following transactions were completed during July: a. Resser deposited 25,000 in a bank account in the name of the business. b. Bought tables and chairs for cash, 725, Ck. No. 1200. c. Paid the rent for the current month, 1,750, Ck. No. 1201. d. Bought computers and copy machines from Ferber Equipment, 15,700, paying 4,000 in cash and placing the balance on account, Ck. No. 1202. e. Bought supplies on account from Wigginss Distributors, 535. f. Sold services for cash, 1,742. g. Bought insurance for one year, 1,375, Ck. No. 1203. h. Paid on account to Ferber Equipment, 700, Ck. No. 1204. i. Received and paid the electric bill, 438, Ck. No. 1205. j. Paid on account to Wigginss Distributors, 315, Ck. No. 1206. k. Sold services to customers for cash for the second half of the month, 820. l. Received and paid the bill for the business license, 75, Ck. No. 1207. m. Paid wages to an employee, 1,200, Ck. No. 1208. n. Resser withdrew cash for personal use, 700, Ck. No. 1209. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of July 31, 20--. 6. Prepare an income statement for July 31, 20--. 7. Prepare a statement of owners equity for July 31, 20--. 8. Prepare a balance sheet as of July 31, 20--. LO 1, 2, 3, 4, 5, 6

- Prepare journal entries to record the following transactions. Create a T-account for Cash, post any entries that affect the account, and calculate the ending balance for the account. Assume a Cash beginning balance of $16,333. A. February 2, issued stock to shareholders, for cash, $25,000 B. March 10, paid cash to purchase equipment, $16,000In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.Prepare journal entries to record the following transactions: A. December 1, collected balance due from customer account, $5,500 B. December 12, paid creditors for supplies purchased last month, $4,200 C. December 31, paid cash dividend to stockholders, $1,000

- EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first month (March 20--), the following transactions occurred. Show the effect of each transaction on the accounting equation: Assets= Liabilities + Owners Equity. After each transaction, show the new account totals. (a) Invested cash in the business, 30,000. (b) Bought office equipment on account, 4,500. (c) Bought office equipment for cash, 1,600. (d) Paid cash on account to supplier in transaction (b), 2,000. EFFECTS OF TRANSACTIONS (REVENUE, EXPENSE, WITHDRAWALS) This exercise is an extension of Exercise 2-3B. Lets assume Jon Wallace completed the following additional transactions during March. Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets = Liabilities + Owners Equity (Capital Drawing + Revenues Expenses). After transaction (k), report the totals for each element. Demonstrate that the accounting equation has remained in balance. (e) Performed services and received cash, 3,000. (f) Paid rent for March, 1,000. (g) Paid March phone bill, 68. (h) Jon Wallace withdrew cash for personal use, 800. (i) Performed services for clients on account, 900. (j) Paid wages to part-time employee, 500. (k) Received cash for services performed on account in transaction (i), 500.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.Prepare journal entries to record the following transactions. A. July 1, issued common stock for cash, $15,000 B. July 15, purchased supplies, on account, $1,800 C. July 25, billed customer for accounting services provided, $950A business has the following transactions: The business is started by receiving cash from an investor in exchange for common stock $20,000 The business purchases supplies on account $500 The business purchases furniture on account $2,000 The business renders services to various clients on account totaling $9,000 The business pays salaries $2,000 The business pays this months rent $3,000 The business pays for the supplies purchased on account. The business collects from one of its clients for services rendered earlier in the month $1,500. What is total income for the month?