College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 4PB

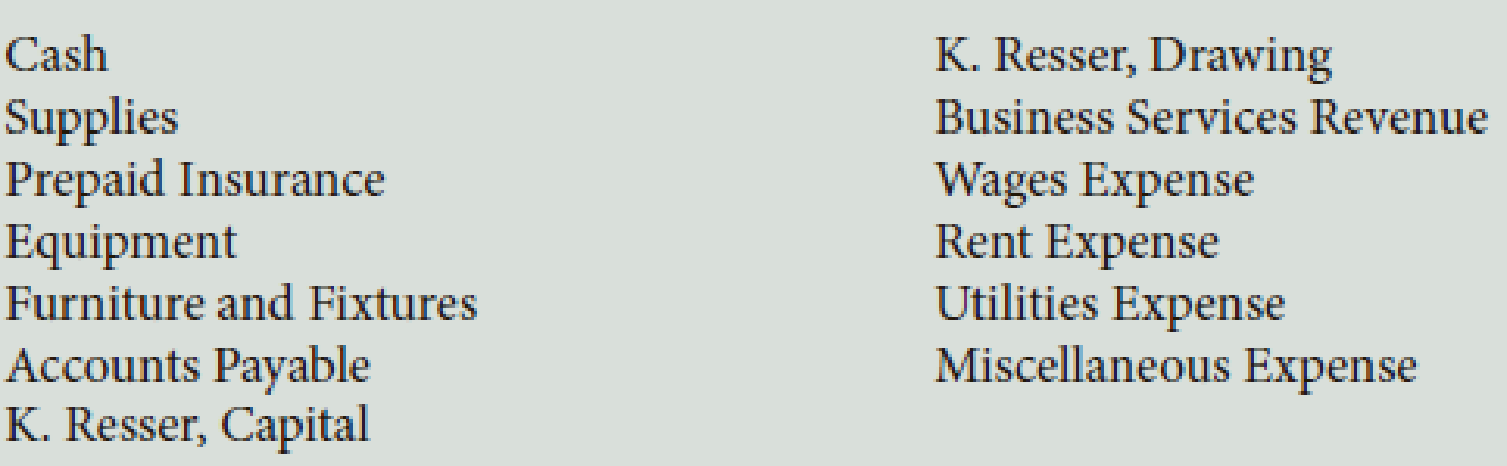

On July 1, K. Resser opened Resser’s Business Services. Resser’s accountant listed the following chart of accounts:

The following transactions were completed during July:

- a. Resser deposited $25,000 in a bank account in the name of the business.

- b. Bought tables and chairs for cash, $725, Ck. No. 1200.

- c. Paid the rent for the current month, $1,750, Ck. No. 1201.

- d. Bought computers and copy machines from Ferber Equipment, $15,700, paying $4,000 in cash and placing the balance on account, Ck. No. 1202.

- e. Bought supplies on account from Wiggins’s Distributors, $535.

- f. Sold services for cash, $1,742.

- g. Bought insurance for one year, $1,375, Ck. No. 1203.

- h. Paid on account to Ferber Equipment, $700, Ck. No. 1204.

- i. Received and paid the electric bill, $438, Ck. No. 1205.

- j. Paid on account to Wiggins’s Distributors, $315, Ck. No. 1206.

- k. Sold services to customers for cash for the second half of the month, $820.

- l. Received and paid the bill for the business license, $75, Ck. No. 1207.

- m. Paid wages to an employee, $1,200, Ck. No. 1208.

- n. Resser withdrew cash for personal use, $700, Ck. No. 1209.

Required

- 1. Record the owner’s name in the Capital and Drawing T accounts.

- 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts.

- 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction.

- 4. Foot the T accounts and show the balances.

- 5. Prepare a

trial balance as of July 31, 20--. - 6. Prepare an income statement for July 31, 20--.

- 7. Prepare a statement of owner’s equity for July 31, 20--.

- 8. Prepare a balance sheet as of July 31, 20--. LO 1, 2, 3, 4, 5, 6

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - On a sheet of paper, draw the fundamental...Ch. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - A fellow accounting student has difficulty...Ch. 2 - What Would You Do? A new bookkeeper cant find the...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The amount that should be recorded by Company R for building under historical cost principle.

Financial Accounting (11th Edition)

Calculating certain information using the direct method (Learning Objective 4) 20-25 min. Trudeaus Marine, Inc....

Financial Accounting, Student Value Edition (5th Edition)

Dave Nelson recently retired at age 48, courtesy of the numerous stock options he had been granted while presid...

Managerial Accounting: Creating Value in a Dynamic Business Environment

Using the information from Problem 1-2B and the inventory information for the Best Bikes below, complete the re...

Managerial Accounting

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (4th Edition)

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

Principles Of Taxation For Business And Investment Planning 2020 Edition

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardIn July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardOn March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

- In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardIn March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardIn April, J. Rodriguez established an apartment rental service. The account headings are presented below. Transactions completed during the month of April follow. a. Rodriguez deposited 70,000 in a bank account in the name of the business. b. Paid the rent for the month, 2,000, Ck. No. 101 (Rent Expense). c. Bought supplies on account, 150. d. Bought a truck for 23,500, paying 2,500 in cash and placing the remainder on account. e. Bought insurance for the truck for the year, 2,400, Ck. No. 102. f. Sold services on account, 4,700. g. Bought office equipment on account from Stern Office Supply, 1,250. h. Sold services for cash for the first half of the month, 8,250. i. Received and paid the bill for utilities, 280, Ck. No. 103. j. Received a bill for gas and oil for the truck, 130. k. Paid wages to the employees, 2,680, Ck. Nos. 104106. l. Sold services for cash for the remainder of the month, 3,500. m. Rodriguez withdrew cash for personal use, 4,000, Ck. No. 107. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

- Journal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.arrow_forwardP. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented below. Transactions completed during the month follow. a. Schwartz deposited 25,000 in a bank account in the name of the business. b. Bought office equipment on account from QuipCo, 9,670. c. Schwartz invested his personal law library, which cost 2,800. d. Paid the office rent for the month, 1,700, Ck. No. 2000. e. Bought office supplies for cash, 418, Ck. No. 2001. f. Bought insurance for two years, 944, Ck. No. 2002. g. Sold legal services for cash, 8,518. h. Paid the salary of the part-time receptionist, 1,820, Ck. No. 2003. i. Received and paid the telephone bill, 388, Ck. No. 2004. j. Received and paid the bill for utilities, 368, Ck. No. 2005. k. Sold legal services for cash, 9,260. l. Paid on account to QuipCo, 2,670, Ck. No. 2006. m. Schwartz withdrew cash for personal use, 2,500, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardOn June 1 of this year, J. Larkin, Optometrist, established the Larkin Eye Clinic. The clinics account names are presented below. Transactions completed during the month follow. a. Larkin deposited 25,000 in a bank account in the name of the business. b. Paid the office rent for the month, 950, Ck. No. 1001 (Rent Expense). c. Bought supplies for cash, 357, Ck. No. 1002. d. Bought office equipment on account from NYC Office Equipment Store, 8,956. e. Bought a computer from Wardens Office Outfitters, 1,636, paying 750 in cash and placing the balance on account, Ck. No. 1003. f. Sold professional services for cash, 3,482 (Professional Fees). g. Paid on account to Wardens Office Outfitters, 886, Ck. No. 1004. h. Received and paid the bill for utilities, 382, Ck. No. 1005 (Utilities Expense). i. Paid the salary of the assistant, 1,050, Ck. No. 1006 (Salary Expense). j. Sold professional services for cash, 3,295 (Professional Fees). k. Larkin withdrew cash for personal use, 1,250, Ck. No. 1007. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

- On May 1, B. Bangle opened Self-Wash Laundry. His accountant listed the following chart of accounts: The following transactions were completed during May: a. Bangle deposited 35,000 in a bank account in the name of the business. b. Bought chairs and tables, paying cash, 1,870, Ck. No. 1000. c. Bought supplies on account from Barnes Supply Company, 225. d. Paid the rent for the current month, 875, Ck. No. 1001. e. Bought washing machines and dryers from Lara Equipment Company, 12,500, paying 3,600 in cash and placing the balance on account, Ck. No. 1002. f. Sold services for cash for the first half of the month, 1,925. g. Bought insurance for one year, 1,560, Ck. No. 1003. h. Paid on account to Lara Equipment Company, 1,800, Ck. No. 1004. i. Received and paid electric bill, 285, Ck. No. 1005. j. Sold services for cash for the second half of the month, 1,835. k. Paid wages to an employee, 940, Ck. No. 1006. l. Bangle withdrew cash for his personal use, 800, Ck. No. 1007. m. Paid on account to Barnes Supply Company, 225, Ck. No. 1008. n. Received and paid bill from the county for sidewalk repair assessment, 280, Ck. No. 1009. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of May 31, 20--. 6. Prepare an income statement for May 31, 20--. 7. Prepare a statement of owners equity for May 31, 20--. 8. Prepare a balance sheet as of May 31, 20--.arrow_forwardOn June 1 of this year, J. Larkin, Optometrist, established the Larkin Eye Clinic. The clinics account names are presented below. Transactions completed during the month follow. a. Larkin deposited 25,000 in a bank account in the name of the business. b. Paid the office rent for the month, 950, Ck. No. 1001. c. Bought supplies for cash, 357, Ck. No. 1002. d. Bought office equipment on account from NYC Office Equipment Store, 8,956. e. Bought a computer from Wardens Office Outfitters, 1,636, paying 750 in cash and placing the balance on account, Ck. No. 1003. f. f. Sold professional services for cash, 3,482. g. Paid on account to Wardens Office Outfitters, 886, Ck. No. 1004. h. Received and paid the bill for utilities, 382, Ck. No. 1005. i. Paid the salary of the assistant, 1,050, Ck. No. 1006. j. Sold professional services for cash, 3,295. k. Larkin withdrew cash for personal use, 1,250, Ck. No. 1007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardIn April, J. Rodriguez established an apartment rental service. The account headings are presented below. Transactions completed during the month of April follow. a. Rodriguez deposited 70,000 in a bank account in the name of the business. b. Paid the rent for the month, 2,000, Ck. No. 101 (Rent Expense). c. Bought supplies on account, 150. d. Bought a truck for 23,500, paying 2,500 in cash and placing the remainder on account. e. Bought insurance for the truck for the year, 2,400, Ck. No. 102. f. Sold services on account, 4,700 (Service Income). g. Bought office equipment on account from Stern Office Supply, 1,250. h. Sold services for cash for the first half of the month, 8,250 (Service Income). i. Received and paid the bill for utilities, 280, Ck. No. 103 (Utilities Expense). j. Received a bill for gas and oil for the truck, 130 (Gas and Oil Expense). k. Paid wages to the employees, 2,680, Ck. Nos. 104106 (Wages Expense). l. Sold services for cash for the remainder of the month, 3,500 (Service Income). m. Rodriguez withdrew cash for personal use, 4,000, Ck. No. 107. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY