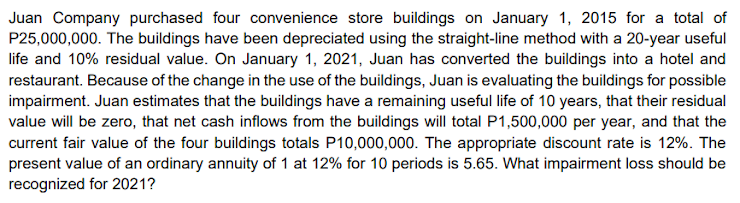

Juan Company purchased four convenience store buildings on January 1, 2015 for a total of P25,000,000. The buildings have been depreciated using the straight-line method with a 20-year useful life and 10% residual value. On January 1, 2021, Juan has converted the buildings into a hotel and restaurant. Because of the change in the use of the buildings, Juan is evaluating the buildings for possible impairment. Juan estimates that the buildings have a remaining useful life of 10 years, that their residual value will be zero, that net cash inflows from the buildings will total P1,500,000 per year, and that the current fair value of the four buildings totals P10,000,000. The appropriate discount rate is 12%. The present value of an ordinary annuity of 1 at 12% for 10 periods is 5.65. What impairment loss should be recognized for 2021?

Juan Company purchased four convenience store buildings on January 1, 2015 for a total of P25,000,000. The buildings have been depreciated using the straight-line method with a 20-year useful life and 10% residual value. On January 1, 2021, Juan has converted the buildings into a hotel and restaurant. Because of the change in the use of the buildings, Juan is evaluating the buildings for possible impairment. Juan estimates that the buildings have a remaining useful life of 10 years, that their residual value will be zero, that net cash inflows from the buildings will total P1,500,000 per year, and that the current fair value of the four buildings totals P10,000,000. The appropriate discount rate is 12%. The present value of an ordinary annuity of 1 at 12% for 10 periods is 5.65. What impairment loss should be recognized for 2021?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

5. Juan Company

Transcribed Image Text:Juan Company purchased four convenience store buildings on January 1, 2015 for a total of

P25,000,000. The buildings have been depreciated using the straight-line method with a 20-year useful

life and 10% residual value. On January 1, 2021, Juan has converted the buildings into a hotel and

restaurant. Because of the change in the use of the buildings, Juan is evaluating the buildings for possible

impairment. Juan estimates that the buildings have a remaining useful life of 10 years, that their residual

value will be zero, that net cash inflows from the buildings will total P1,500,000 per year, and that the

current fair value of the four buildings totals P10,000,000. The appropriate discount rate is 12%. The

present value of an ordinary annuity of 1 at 12% for 10 periods is 5.65. What impairment loss should be

recognized for 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning