Determine the following as a result of your audit: 1. How much is the correct carrying value of the note payable as of December 31, 2021? 2. How much is the correct interest expense that Latte recognized in the statement of comprehensive income for the period ending December 31, 2021? 3. How much of the note is reported in the current liability section in its December 31, 2021 statement of financial position? 4. How much of the note is reported in the non-current liability section in its December 31, 2021 statement of financial position? 5. What is your proposed adjusting journal entry (PAJE) as a result of your audit as of December 31, 2021?

Determine the following as a result of your audit: 1. How much is the correct carrying value of the note payable as of December 31, 2021? 2. How much is the correct interest expense that Latte recognized in the statement of comprehensive income for the period ending December 31, 2021? 3. How much of the note is reported in the current liability section in its December 31, 2021 statement of financial position? 4. How much of the note is reported in the non-current liability section in its December 31, 2021 statement of financial position? 5. What is your proposed adjusting journal entry (PAJE) as a result of your audit as of December 31, 2021?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 2P: Notes Payable and Effective Interest On November 1,2019, Edwin Inc. borrowed cash and signed a...

Related questions

Question

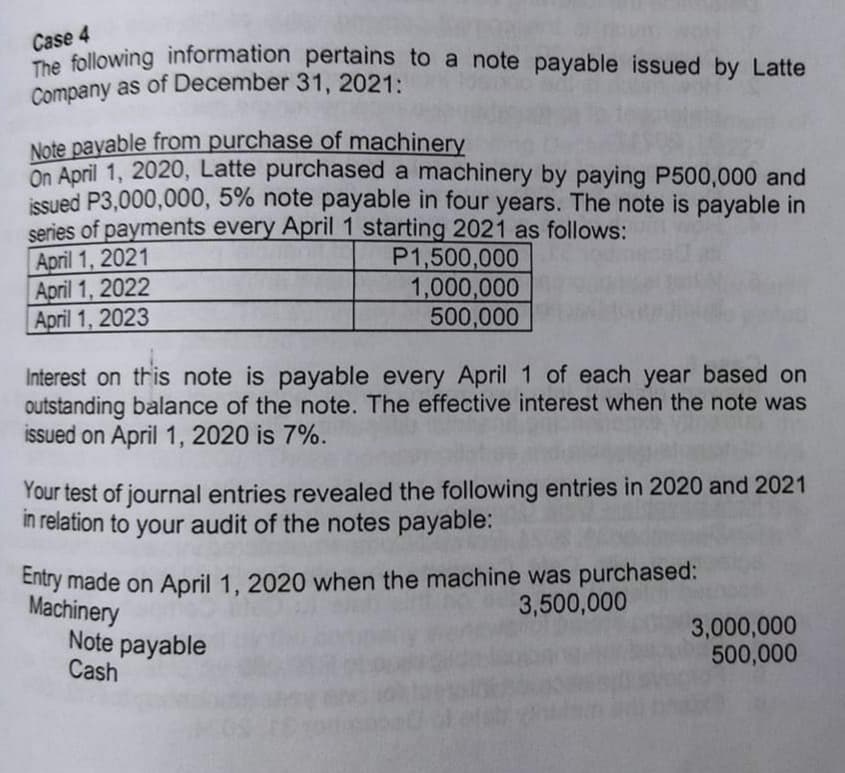

Transcribed Image Text:Company as of December 31, 2021:

Case 4

Cefollowing information pertains to a note payable issued by Latte

Note payable from purchase of machinery

On April 1, 2020, Latte purchased a machinery by paying P500,000 and

issued P3,000,000, 5% note payable in four years. The note is payable in

series of payments every April 1 starting 2021 as follows:

April 1, 2021

April 1, 2022

April 1, 2023

P1,500,000

1,000,000

500,000

Interest on this note is payable every April 1 of each year based on

outstanding balance of the note. The effective interest when the note was

issued on April 1, 2020 is 7%.

Your test of journal entries revealed the following entries in 2020 and 2021

in relation to your audit of the notes payable:

Entry made on April 1, 2020 when the machine was purchased:

Machinery

Note payable

Cash

3,500,000

3,000,000

500,000

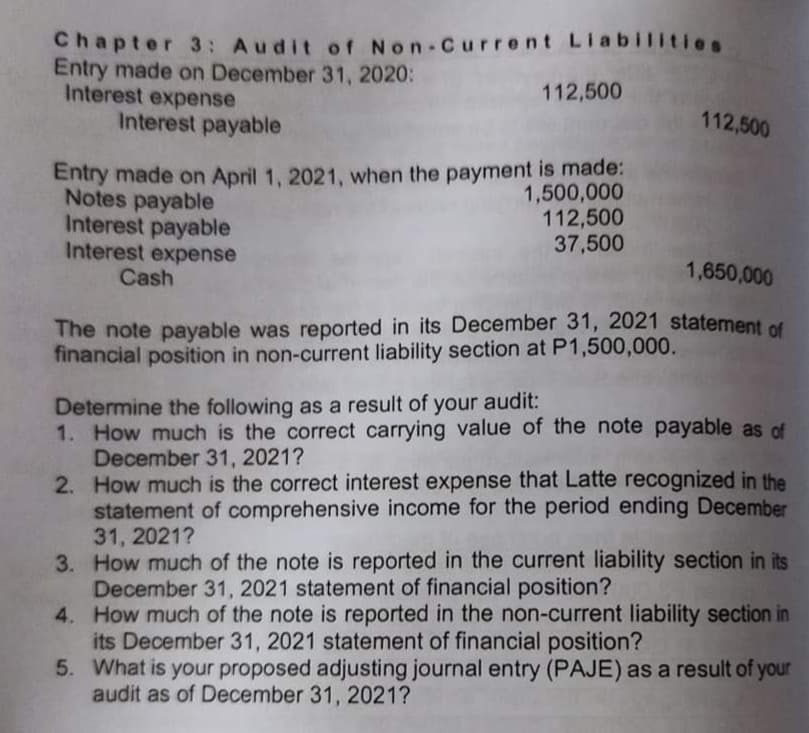

Transcribed Image Text:Chapter 3: Audit of Non-Current Liabilitiies

Entry made on December 31, 2020:

Interest expense

Interest payable

112,500

112,500

Entry made on April 1, 2021, when the payment is made:

Notes payable

Interest payable

Interest expense

Cash

1,500,000

112,500

37,500

1,650,000

The note payable was reported in its December 31, 2021 statement of

financial position in non-current liability section at P1,500,000.

Determine the following as a result of your audit:

1. How much is the correct carrying value of the note payable as of

December 31, 2021?

2. How much is the correct interest expense that Latte recognized in the

statement of comprehensive income for the period ending December

31, 2021?

3. How much of the note is reported in the current liability section in its

December 31, 2021 statement of financial position?

4. How much of the note is reported in the non-current liability section in

its December 31, 2021 statement of financial position?

5. What is your proposed adjusting journal entry (PAJE) as a result of your

audit as of December 31, 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning