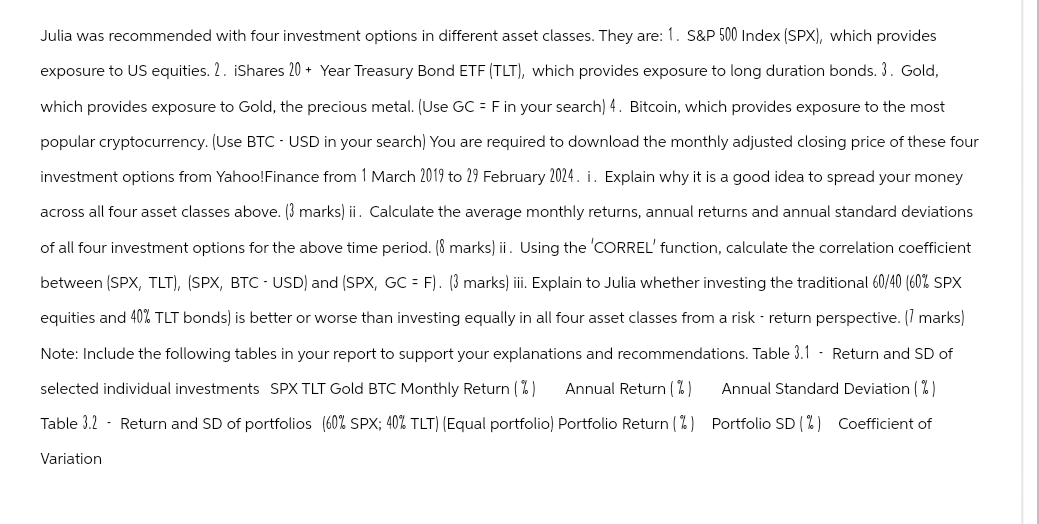

Julia was recommended with four investment options in different asset classes. They are: 1. S&P 500 Index (SPX), which provides exposure to US equities. 2. iShares 20+ Year Treasury Bond ETF (TLT), which provides exposure to long duration bonds. 3. Gold, which provides exposure to Gold, the precious metal. (Use GC = F in your search) 4. Bitcoin, which provides exposure to the most popular cryptocurrency. (Use BTC - USD in your search) You are required to download the monthly adjusted closing price of these four investment options from Yahoo!Finance from 1 March 2019 to 29 February 2024. i. Explain why it is a good idea to spread your money across all four asset classes above. (3 marks) ii. Calculate the average monthly returns, annual returns and annual standard deviations of all four investment options for the above time period. (8 marks) ii. Using the 'CORREL' function, calculate the correlation coefficient between (SPX, TLT), (SPX, BTC - USD) and (SPX, GC = F). (3 marks) iii. Explain to Julia whether investing the traditional 60/40 (60% SPX equities and 40% TLT bonds) is better or worse than investing equally in all four asset classes from a risk return perspective. [1 marks) Note: Include the following tables in your report to support your explanations and recommendations. Table 3.1 - Return and SD of selected individual investments SPX TLT Gold BTC Monthly Return (%) Annual Return (%) Annual Standard Deviation (%) Table 3.2 Return and SD of portfolios (60% SPX; 40% TLT) (Equal portfolio) Portfolio Return (%) Portfolio SD (%) Coefficient of Variation

Julia was recommended with four investment options in different asset classes. They are: 1. S&P 500 Index (SPX), which provides exposure to US equities. 2. iShares 20+ Year Treasury Bond ETF (TLT), which provides exposure to long duration bonds. 3. Gold, which provides exposure to Gold, the precious metal. (Use GC = F in your search) 4. Bitcoin, which provides exposure to the most popular cryptocurrency. (Use BTC - USD in your search) You are required to download the monthly adjusted closing price of these four investment options from Yahoo!Finance from 1 March 2019 to 29 February 2024. i. Explain why it is a good idea to spread your money across all four asset classes above. (3 marks) ii. Calculate the average monthly returns, annual returns and annual standard deviations of all four investment options for the above time period. (8 marks) ii. Using the 'CORREL' function, calculate the correlation coefficient between (SPX, TLT), (SPX, BTC - USD) and (SPX, GC = F). (3 marks) iii. Explain to Julia whether investing the traditional 60/40 (60% SPX equities and 40% TLT bonds) is better or worse than investing equally in all four asset classes from a risk return perspective. [1 marks) Note: Include the following tables in your report to support your explanations and recommendations. Table 3.1 - Return and SD of selected individual investments SPX TLT Gold BTC Monthly Return (%) Annual Return (%) Annual Standard Deviation (%) Table 3.2 Return and SD of portfolios (60% SPX; 40% TLT) (Equal portfolio) Portfolio Return (%) Portfolio SD (%) Coefficient of Variation

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Question

Transcribed Image Text:Julia was recommended with four investment options in different asset classes. They are: 1. S&P 500 Index (SPX), which provides

exposure to US equities. 2. iShares 20+ Year Treasury Bond ETF (TLT), which provides exposure to long duration bonds. 3. Gold,

which provides exposure to Gold, the precious metal. (Use GC = F in your search) 4. Bitcoin, which provides exposure to the most

popular cryptocurrency. (Use BTC - USD in your search) You are required to download the monthly adjusted closing price of these four

investment options from Yahoo!Finance from 1 March 2019 to 29 February 2024. i. Explain why it is a good idea to spread your money

across all four asset classes above. (3 marks) ii. Calculate the average monthly returns, annual returns and annual standard deviations

of all four investment options for the above time period. (8 marks) ii. Using the 'CORREL' function, calculate the correlation coefficient

between (SPX, TLT), (SPX, BTC - USD) and (SPX, GC = F). (3 marks) iii. Explain to Julia whether investing the traditional 60/40 (60% SPX

equities and 40% TLT bonds) is better or worse than investing equally in all four asset classes from a risk return perspective. [1 marks)

Note: Include the following tables in your report to support your explanations and recommendations. Table 3.1 - Return and SD of

selected individual investments SPX TLT Gold BTC Monthly Return (%) Annual Return (%) Annual Standard Deviation (%)

Table 3.2 Return and SD of portfolios (60% SPX; 40% TLT) (Equal portfolio) Portfolio Return (%) Portfolio SD (%) Coefficient of

Variation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education