JWing Is FALSE regarding the Efficient Market Hypothesis? ) In general, the Efficient Market Hypothesis says that stock prices very quickly reflect information that is available. If financial markets are weak form efficient, then technical analysts cannot make abnormally good returns, on average, by studying charts of past stock prices and trading volumes. If financial markets are strong form efficient, then insiders with private information about a company would not be able to make abnormally good returns by trading on that information. OThe Efficient Market Hypothesis implies that skilled fundamental analysts can make abnormally good returns by studying a firm's financial statements, suppliers, customers, and the economic conditions. O Evidence suggests that insiders who trade on private information can make abnormally good returns, but it's illegal to do so.

JWing Is FALSE regarding the Efficient Market Hypothesis? ) In general, the Efficient Market Hypothesis says that stock prices very quickly reflect information that is available. If financial markets are weak form efficient, then technical analysts cannot make abnormally good returns, on average, by studying charts of past stock prices and trading volumes. If financial markets are strong form efficient, then insiders with private information about a company would not be able to make abnormally good returns by trading on that information. OThe Efficient Market Hypothesis implies that skilled fundamental analysts can make abnormally good returns by studying a firm's financial statements, suppliers, customers, and the economic conditions. O Evidence suggests that insiders who trade on private information can make abnormally good returns, but it's illegal to do so.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter25: Portfolio Theory And Asset Pricing Models

Section: Chapter Questions

Problem 11MC

Related questions

Question

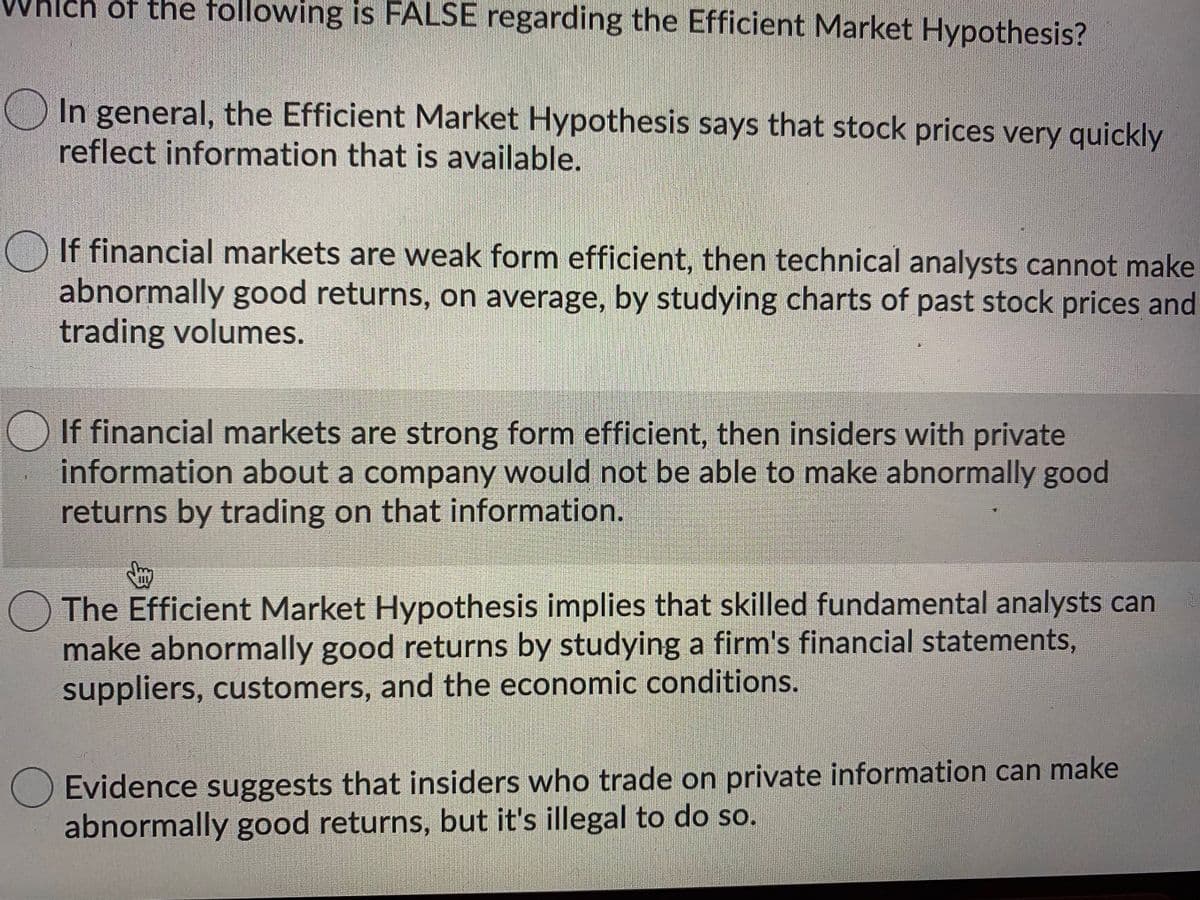

Transcribed Image Text:of the following is FALSE regarding the Efficient Market Hypothesis?

In general, the Efficient Market Hypothesis says that stock prices very quickly

reflect information that is available.

O If financial markets are weak form efficient, then technical analysts cannot make

abnormally good returns, on average, by studying charts of past stock prices and

trading volumes.

If financial markets are strong form efficient, then insiders with private

information about a company would not be able to make abnormally good

returns by trading on that information.

The Efficient Market Hypothesis implies that skilled fundamental analysts can

make abnormally good returns by studying a firm's financial statements,

suppliers, customers, and the economic conditions.

Evidence suggests that insiders who trade on private information can make

abnormally good returns, but it's illegal to do so.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you