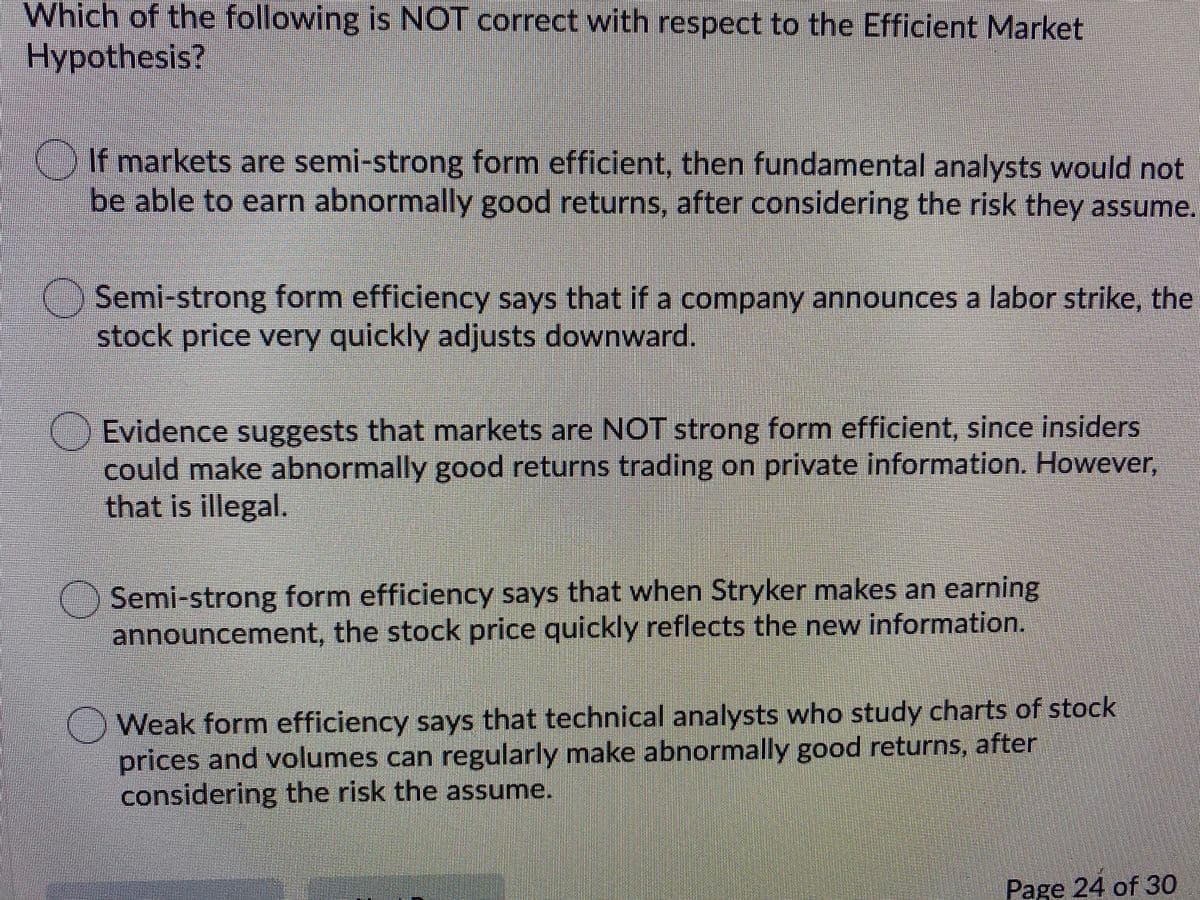

Which of the following is NOT correct with respect to the Efficient Market Hypothesis? O If markets are semi-strong form efficient, then fundamental analysts would not be able to earn abnormally good returns, after considering the risk they assume Semi-strong form efficiency says that if a company announces a labor strike, the stock price very quickly adjusts downward. Evidence suggests that markets are NOT strong form efficient, since insiders could make abnormally good returns trading on private information. However, that is illegal. Semi-strong form efficiency says that when Stryker makes an earning announcement, the stock price quickly reflects the new information. O Weak form efficiency says that technical analysts who study charts of stock prices and volumes can regularly make abnormally good returns, after considering the risk the assume.

Which of the following is NOT correct with respect to the Efficient Market Hypothesis? O If markets are semi-strong form efficient, then fundamental analysts would not be able to earn abnormally good returns, after considering the risk they assume Semi-strong form efficiency says that if a company announces a labor strike, the stock price very quickly adjusts downward. Evidence suggests that markets are NOT strong form efficient, since insiders could make abnormally good returns trading on private information. However, that is illegal. Semi-strong form efficiency says that when Stryker makes an earning announcement, the stock price quickly reflects the new information. O Weak form efficiency says that technical analysts who study charts of stock prices and volumes can regularly make abnormally good returns, after considering the risk the assume.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter25: Portfolio Theory And Asset Pricing Models

Section: Chapter Questions

Problem 8MC: You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand...

Related questions

Question

Transcribed Image Text:Which of the following is NOT correct with respect to the Efficient Market

Hypothesis?

If markets are semi-strong form efficient, then fundamental analysts would not

be able to earn abnormally good returns, after considering the risk they assume.

O Semi-strong form efficiency says that if a company announces a labor strike, the

stock price very quickly adjusts downward.

Evidence suggests that markets are NOT strong form efficient, since insiders

could make abnormally good returns trading on private information. However,

that is illegal.

() Semi-strong form efficiency says that when Stryker makes an earning

announcement, the stock price quickly reflects the new information.

)Weak form efficiency says that technical analysts who study charts of stock

prices and volumes can regularly make abnormally good returns, after

considering the risk the assume.

Page 24 of 30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage