K. Jackson Corporation Assets Cash Accounts receivable Inventory Net fixed assets Total assets Liabilities and owners' equity Accounts payable ST Notes payable Long-term debt Owners' Equity LUNG Balance Sheet $250,000 450,000 500,000 2,100,000 $3,300.000 $100.000 450.000 1,050,000 1,700,000 Income Statement Sales (all credit) Cost of goods sold Operating expense Interest expense Income taxes Net income $8,000,000 (4.000.000) (2.900,000) (150.000) (380,000) $570,000

K. Jackson Corporation Assets Cash Accounts receivable Inventory Net fixed assets Total assets Liabilities and owners' equity Accounts payable ST Notes payable Long-term debt Owners' Equity LUNG Balance Sheet $250,000 450,000 500,000 2,100,000 $3,300.000 $100.000 450.000 1,050,000 1,700,000 Income Statement Sales (all credit) Cost of goods sold Operating expense Interest expense Income taxes Net income $8,000,000 (4.000.000) (2.900,000) (150.000) (380,000) $570,000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

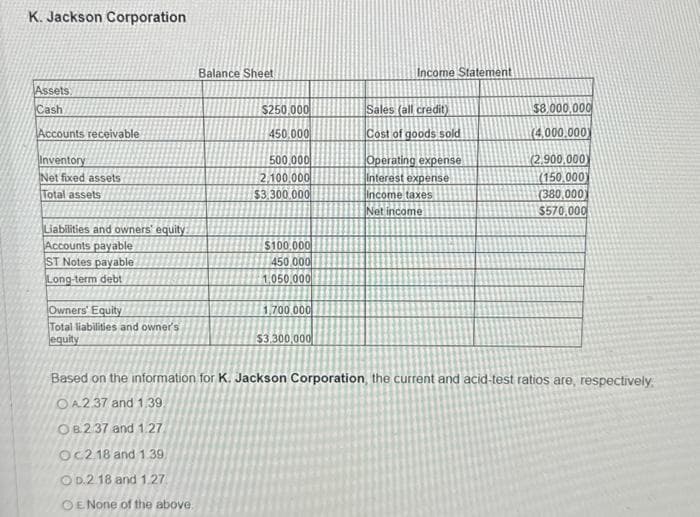

Transcribed Image Text:K. Jackson Corporation

Assets

Cash

Accounts receivable

Inventory

Net fixed assets

Total assets

Liabilities and owners' equity.

Accounts payable

ST Notes payable

Long-term debt

Owners' Equity

Total liabilities and owner's

equity

Balance Sheet

$250,000

450.000

500,000

2.100,000

$3,300.000

$100.000

450.000

1,050,000

1,700.000

$3,300,000

Income Statement

Sales (all credit)

Cost of goods sold

Operating expense

Interest expense

Income taxes

Net income

$8,000,000

(4.000.000)

(2,900,000)

(150,000)

(380,000)

$570,000

Based on the information for K. Jackson Corporation, the current and acid-test ratios are, respectively.

OA2.37 and 1.39.

OB2 37 and 1.27

OC2 18 and 1.39

OD.2 18 and 1.27

OE None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College