Kajala, a Malaysian resident, disposed of her properties as follows: In 2013 she sold a shop house for RM320,000 which she had bought for RM360,000. The shop house was sold within two years after the date of acquisition In 2016 she sold a bungalow lot for RM490,000 and incurred agent’s fees of RM6,800 on the disposal. She had bought the bungalow lot for RM480,000. The bungalow lot was sold in the fifth year after the date of acquisition. On 13 May 2017, she sold a townhouse for RM280,000. She had bought the townhouse for RM185,000 on 6 April 2014. RPGT rate are as follows: Disposal RPGT rates Companies Individuals Within 3 years 30% 30% In the 4th year 20% 20% In the 5th year 15% 15% In the 6th and subsequent year 10% 5% Required: Compute the real property gains tax payable in respect of each of the above disposals. Dear Tutor, please help me solve this question

Kajala, a Malaysian resident, disposed of her properties as follows: In 2013 she sold a shop house for RM320,000 which she had bought for RM360,000. The shop house was sold within two years after the date of acquisition In 2016 she sold a bungalow lot for RM490,000 and incurred agent’s fees of RM6,800 on the disposal. She had bought the bungalow lot for RM480,000. The bungalow lot was sold in the fifth year after the date of acquisition. On 13 May 2017, she sold a townhouse for RM280,000. She had bought the townhouse for RM185,000 on 6 April 2014. RPGT rate are as follows: Disposal RPGT rates Companies Individuals Within 3 years 30% 30% In the 4th year 20% 20% In the 5th year 15% 15% In the 6th and subsequent year 10% 5% Required: Compute the real property gains tax payable in respect of each of the above disposals. Dear Tutor, please help me solve this question

Chapter12: Nonrecognition Transactions

Section: Chapter Questions

Problem 39P

Related questions

Question

100%

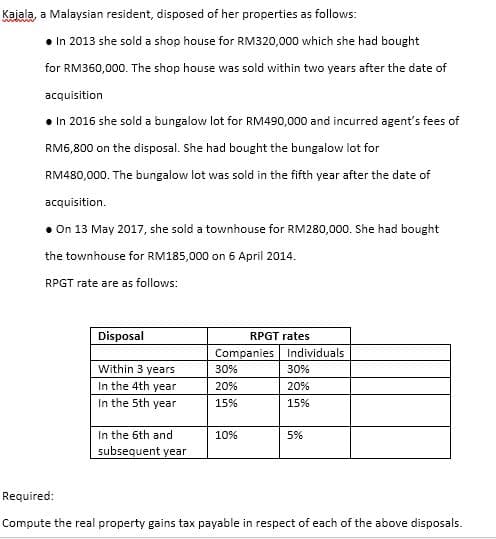

Kajala, a Malaysian resident, disposed of her properties as follows:

- In 2013 she sold a shop house for RM320,000 which she had bought

for RM360,000. The shop house was sold within two years after the date of

acquisition

- In 2016 she sold a bungalow lot for RM490,000 and incurred agent’s fees of

RM6,800 on the disposal. She had bought the bungalow lot for

RM480,000. The bungalow lot was sold in the fifth year after the date of

acquisition.

- On 13 May 2017, she sold a townhouse for RM280,000. She had bought

the townhouse for RM185,000 on 6 April 2014.

RPGT rate are as follows:

|

Disposal |

RPGT rates |

|

|

|

|

Companies |

Individuals |

|

|

Within 3 years |

30% |

30% |

|

|

In the 4th year |

20% |

20% |

|

|

In the 5th year |

15% |

15%

|

|

|

In the 6th and subsequent year |

10% |

5% |

|

Required:

Compute the real property gains tax payable in respect of each of the above disposals.

Dear Tutor, please help me solve this question

Transcribed Image Text:Kajala, a Malaysian resident, disposed of her properties as follows:

• In 2013 she sold a shop house for RM320,000 which she had bought

for RM360,000. The shop house was sold within two years after the date of

acquisition

In 2016 she sold a bungalow lot for RM490,000 and incurred agent's fees of

RM6,800 on the disposal. She had bought the bungalow lot for

RM480,000. The bungalow lot was sold in the fifth year after the date of

acquisition.

• On 13 May 2017, she sold a townhouse for RM280,000. She had bought

the townhouse for RM185,000 on 6 April 2014.

RPGT rate are as follows:

Disposal

RPGT rates

Companies Individuals

Within 3 years

30%

30%

In the 4th year

In the 5th year

20%

20%

15%

15%

In the 6th and

10%

5%

subsequent year

Required:

Compute the real property gains tax payable in respect of each of the above disposals.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Computation of real property gain tax on shop house

VIEWStep 2: Computation of real property gain tax on bungalow

VIEWStep 3: Computation of real property gain tax on townhouse

VIEWStep 4: Computation of total real property gain tax

VIEWStep 5: Computation of total real property gain tax payable (exemption on townhouse)

VIEWStep by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT