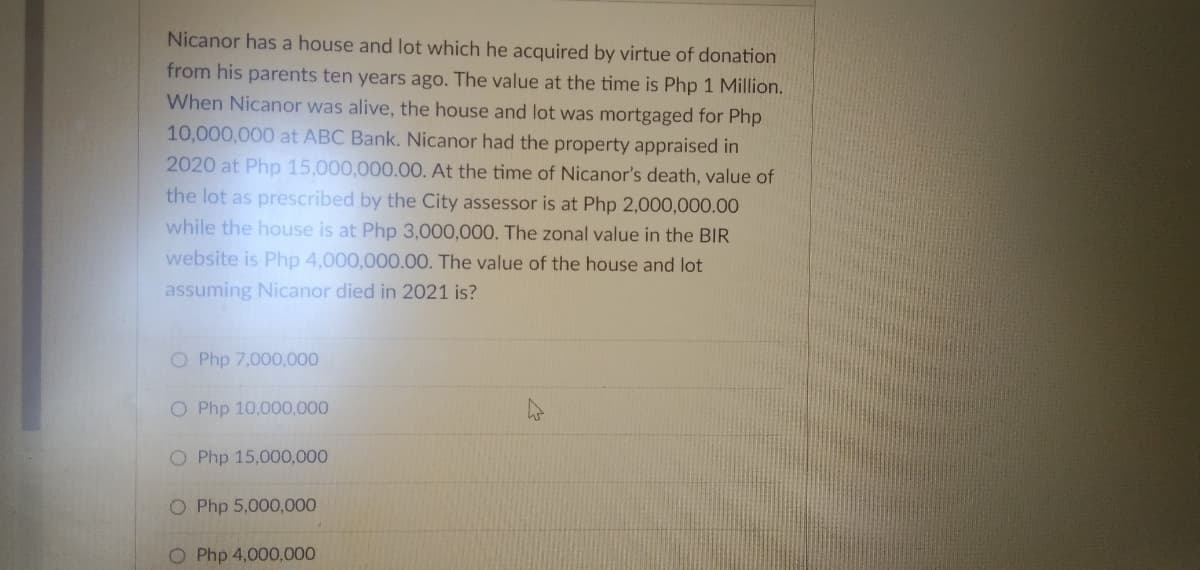

Nicanor has a house and lot which he acquired by virtue of donation from his parents ten years ago. The value at the time is Php 1 Million. When Nicanor was alive, the house and lot was mortgaged for Php 10,000,000 at ABC Bank. Nicanor had the property appraised in 2020 at Php 15,000,000.00. At the time of Nicanor's death, value of the lot as prescribed by the City assessor is at Php 2,000,000.00 while the house is at Php 3,000,000. The zonal value in the BIR website is Php 4,000,000.00. The value of the house and lot assuming Nicanor died in 2021 is? O Php 7,000,000 O Php 10,000,000 O Php 15,000,000 O Php 5,000,000 O Php 4,000,000

Nicanor has a house and lot which he acquired by virtue of donation from his parents ten years ago. The value at the time is Php 1 Million. When Nicanor was alive, the house and lot was mortgaged for Php 10,000,000 at ABC Bank. Nicanor had the property appraised in 2020 at Php 15,000,000.00. At the time of Nicanor's death, value of the lot as prescribed by the City assessor is at Php 2,000,000.00 while the house is at Php 3,000,000. The zonal value in the BIR website is Php 4,000,000.00. The value of the house and lot assuming Nicanor died in 2021 is? O Php 7,000,000 O Php 10,000,000 O Php 15,000,000 O Php 5,000,000 O Php 4,000,000

Chapter15: Property Transactions: Nontaxable Exchanges

Section: Chapter Questions

Problem 3CPA: Chad owned an office building that was destroyed in a tornado. The area was declared a Federal...

Related questions

Question

Q33

Transcribed Image Text:Nicanor has a house and lot which he acquired by virtue of donation

from his parents ten years ago. The value at the time is Php 1 Million.

When Nicanor was alive, the house and lot was mortgaged for Php

10,000,000 at ABC Bank. Nicanor had the property appraised in

2020 at Php 15,000,000.00. At the time of Nicanor's death, value of

the lot as prescribed by the City assessor is at Php 2,000,000.00

while the house is at Php 3,000,000. The zonal value in the BIR

website is Php 4,000,000.00. The value of the house and lot

assuming Nicanor died in 2021 is?

O Php 7,000,000

O Php 10,000,000

O Php 15,000,000

O Php 5,000,000

O Php 4,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT