Kari Downs, an auditor with Wheeler CPAs, is performing a review of Waterway Company’s inventory account. Waterway did not have a good year, and top management is under pressure to boost reported income. According to its records, the inventory balance at year-end was $747,000. However, the following information was not considered when determining that amount. Prepare a schedule to determine the correct inventory amount.

Kari Downs, an auditor with Wheeler CPAs, is performing a review of Waterway Company’s inventory account. Waterway did not have a good year, and top management is under pressure to boost reported income. According to its records, the inventory balance at year-end was $747,000. However, the following information was not considered when determining that amount. Prepare a schedule to determine the correct inventory amount.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 51E: Inventory Costing Methods On June 1, Welding Products Company had a beginning inventory of 210 cases...

Related questions

Question

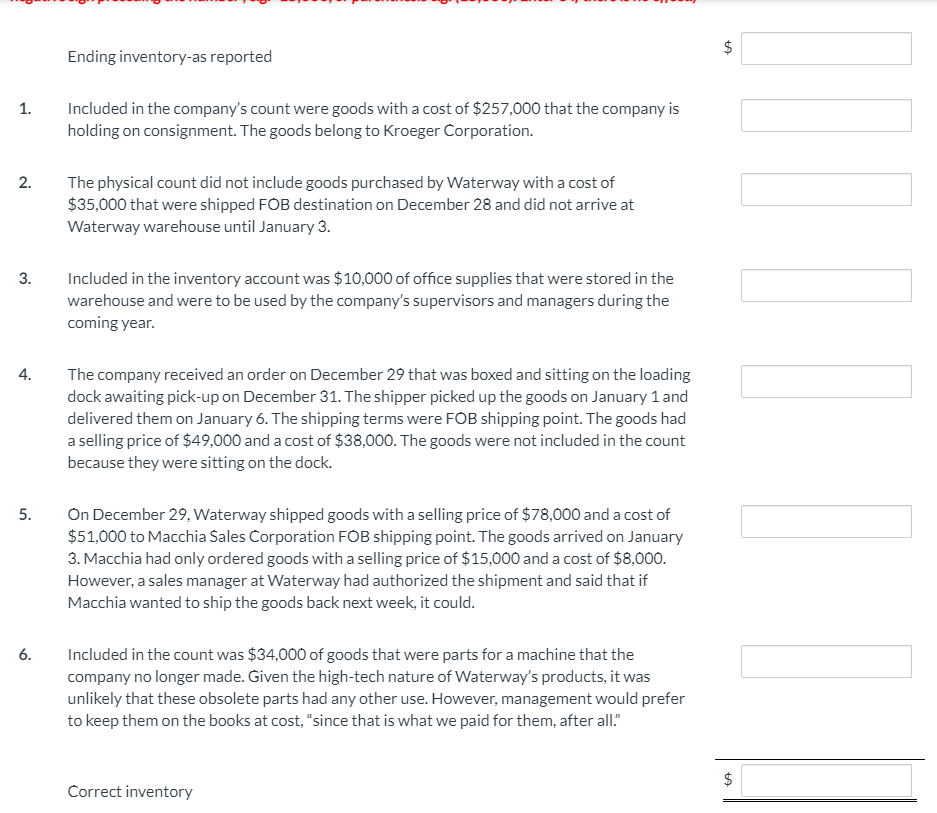

Kari Downs, an auditor with Wheeler CPAs, is performing a review of Waterway Company’s inventory account. Waterway did not have a good year, and top management is under pressure to boost reported income. According to its records, the inventory balance at year-end was $747,000. However, the following information was not considered when determining that amount.

Prepare a schedule to determine the correct inventory amount.

Transcribed Image Text:2$

Ending inventory-as reported

Included in the company's count were goods with a cost of $257,000 that the company is

holding on consignment. The goods belong to Kroeger Corporation.

1.

2.

The physical count did not include goods purchased by Waterway with a cost of

$35,000 that were shipped FOB destination on December 28 and did not arrive at

Waterway warehouse until January 3.

Included in the inventory account was $10,000 of office supplies that were stored in the

warehouse and were to be used by the company's supervisors and managers during the

3.

coming year.

4.

The company received an order on December 29 that was boxed and sitting on the loading

dock awaiting pick-up on December 31. The shipper picked up the goods on January 1 and

delivered them on January 6. The shipping terms were FOB shipping point. The goods had

a selling price of $49,000 and a cost of $38,000. The goods were not included in the count

because they were sitting on the dock.

On December 29, Waterway shipped goods with a selling price of $78,000 and a cost of

$51,000 to Macchia Sales Corporation FOB shipping point. The goods arrived on January

3. Macchia had only ordered goods with a selling price of $15,000 and a cost of $8,000.

However, a sales manager at Waterway had authorized the shipment and said that if

Macchia wanted to ship the goods back next week, it could.

5.

Included in the count was $34,000 of goods that were parts for a machine that the

company no longer made. Given the high-tech nature of Waterway's products, it was

unlikely that these obsolete parts had any other use. However, management would prefer

to keep them on the books at cost, "since that is what we paid for them, after all"

6.

2$

Correct inventory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,