Kellie has $9,000 to invest. A local bank offers a 30-month CD with an APR of 3.8% compounded monthly. What is the APY? (Round your answer to three decimal places.) % Mariah has $12,000 to invest. A local bank offers a 24-month CD with an APR of 3.8% compounded monthly. What is the APY? (Round your answer to three decimal places.) % Compare the APY results. Which of the following statements is true? Kellie's CD has a higher APY because her money is invested for a longer period of time than Mariah's. Mariah's CD has a higher APY because the amount of money she is investing is greater than Kellie's. Their CDs have the same APY because they have the same number of compoundings per year and the same APR. The amount invested and the time period of the investment don't matter because they aren't part of the APY formula.

Kellie has $9,000 to invest. A local bank offers a 30-month CD with an APR of 3.8% compounded monthly. What is the APY? (Round your answer to three decimal places.) % Mariah has $12,000 to invest. A local bank offers a 24-month CD with an APR of 3.8% compounded monthly. What is the APY? (Round your answer to three decimal places.) % Compare the APY results. Which of the following statements is true? Kellie's CD has a higher APY because her money is invested for a longer period of time than Mariah's. Mariah's CD has a higher APY because the amount of money she is investing is greater than Kellie's. Their CDs have the same APY because they have the same number of compoundings per year and the same APR. The amount invested and the time period of the investment don't matter because they aren't part of the APY formula.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 7CE

Related questions

Question

am. 121.

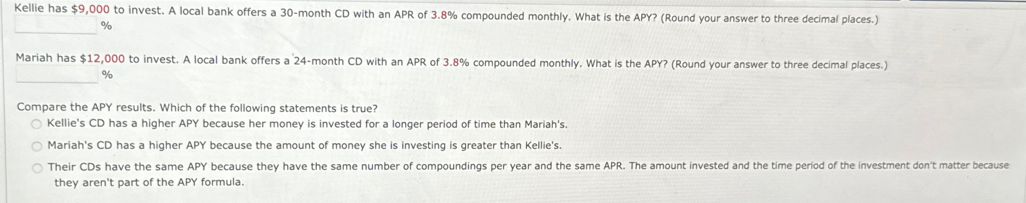

Transcribed Image Text:Kellie has $9,000 to invest. A local bank offers a 30-month CD with an APR of 3.8% compounded monthly. What is the APY? (Round your answer to three decimal places.)

%

Mariah has $12,000 to invest. A local bank offers a 24-month CD with an APR of 3.8% compounded monthly. What is the APY? (Round your answer to three decimal places.)

%

Compare the APY results. Which of the following statements is true?

Kellie's CD has a higher APY because her money is invested for a longer period of time than Mariah's.

Mariah's CD has a higher APY because the amount of money she is investing is greater than Kellie's.

Their CDs have the same APY because they have the same number of compoundings per year and the same APR. The amount invested and the time period of the investment don't matter because

they aren't part of the APY formula.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning