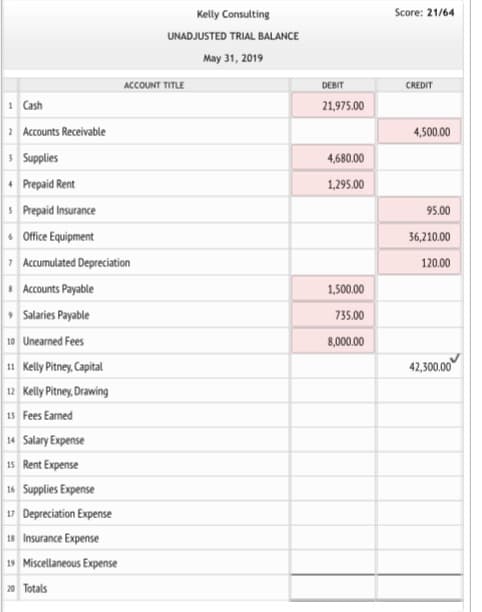

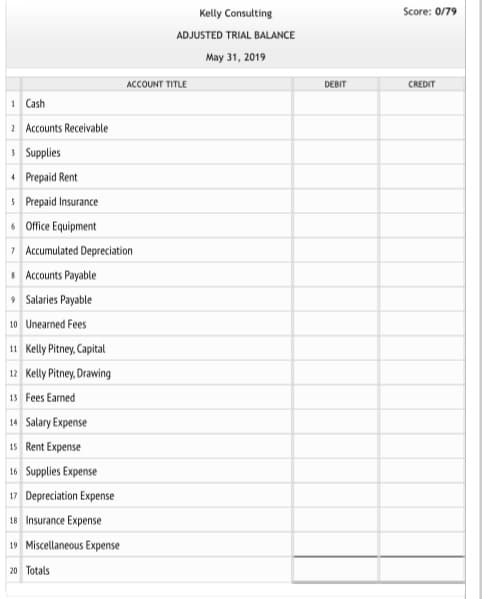

Kelly Consulting Score: 21/64 UNADJUSTED TRIAL BALANCE May 31, 2019 ACCOUNT TITLE DEBIT CREDIT 1 Cash 21,975.00 2Accounts Receivable 4,500.00 3 Supplies • Prepaid Rent 4,680.00 1,295.00 SPrepaid Insurance Office Equipment 7 Accumulated Depreciation • Accounts Payable , Salaries Payable 10 Unearned Fees 11 Kelly Pitney, Capital 12 Kelly Pitney, Drawing 13 Fees Earned 14 Salary Expense 15 Rent Expense 16 Supplies Expense 17 Depreciation Expense 18 Insurance Expense 95.00 36,210.00 120.00 1,500.00 735.00 8,000.00 42,300.00 19 Miscellaneous Expense 20 Totals Kelly Consulting Score: 0/79 ADJUSTED TRIAL BALANCE May 31, 2019 ACCOUNT TITLE DEBIT CREDIT 1 Cash 2 Accounts Receivable 3 Supplies 4 Prepaid Rent 5 Prepaid Insurance 6 Office Equipment 7 Accumulated Depreciation • Accounts Payable 9 Salaries Payable 10 Unearned Fees 11 Kelly Pitney, Capital 12 Kelly Pitney, Drawing 13 Fees Earned 14 Salary Expense 15 Rent Expense 16 Supplies Expense 17 Depreciation Expense 18 Insurance Expense 19 Miscellaneous Expense 20 Totals

Kelly Consulting Score: 21/64 UNADJUSTED TRIAL BALANCE May 31, 2019 ACCOUNT TITLE DEBIT CREDIT 1 Cash 21,975.00 2Accounts Receivable 4,500.00 3 Supplies • Prepaid Rent 4,680.00 1,295.00 SPrepaid Insurance Office Equipment 7 Accumulated Depreciation • Accounts Payable , Salaries Payable 10 Unearned Fees 11 Kelly Pitney, Capital 12 Kelly Pitney, Drawing 13 Fees Earned 14 Salary Expense 15 Rent Expense 16 Supplies Expense 17 Depreciation Expense 18 Insurance Expense 95.00 36,210.00 120.00 1,500.00 735.00 8,000.00 42,300.00 19 Miscellaneous Expense 20 Totals Kelly Consulting Score: 0/79 ADJUSTED TRIAL BALANCE May 31, 2019 ACCOUNT TITLE DEBIT CREDIT 1 Cash 2 Accounts Receivable 3 Supplies 4 Prepaid Rent 5 Prepaid Insurance 6 Office Equipment 7 Accumulated Depreciation • Accounts Payable 9 Salaries Payable 10 Unearned Fees 11 Kelly Pitney, Capital 12 Kelly Pitney, Drawing 13 Fees Earned 14 Salary Expense 15 Rent Expense 16 Supplies Expense 17 Depreciation Expense 18 Insurance Expense 19 Miscellaneous Expense 20 Totals

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 44P

Related questions

Question

100%

I need an unadjustead trial balance and adjusted trial balanced.

Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions:

| May | 3 | Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $4,500. |

| 5 | Received cash from clients on account, $2,450. | |

| 9 | Paid cash for a newspaper advertisement, $225. | |

| 13 | Paid Office Station Co. for part of the debt incurred on April 5, $640. | |

| 15 | Provided services on account for the period May 1–15, $9,180. | |

| 16 | Paid part-time receptionist for two weeks’ salary including the amount owed on April 30, $750. | |

| 17 | Received cash from cash clients for fees earned during the period May 1–16, $8,360. |

Record the following transactions on Page 6 of the journal:

| May | 20 | Purchased supplies on account, $735. |

| 21 | Provided services on account for the period May 16–20, $4,820. | |

| 25 | Received cash from cash clients for fees earned for the period May 17–23, $7,900. | |

| 27 | Received cash from clients on account, $9,520. | |

| 28 | Paid part-time receptionist for two weeks’ salary, $750. | |

| 30 | Paid telephone bill for May, $260. | |

| 31 | Paid electricity bill for May, $810. | |

| 31 | Received cash from cash clients for fees earned for the period May 26–31, $3,300. | |

| 31 | Provided services on account for the remainder of May, $2,650. | |

| 31 | Kelly withdrew $10,500 for personal use. |

| Required: | |||||||||||||

| 1. | The chart of accounts is shown in a separate panel and the post-closing trial balance as of April 30, 2019, is shown below.

|

||||||||||||

| 2. | |||||||||||||

| 3. | Prepare an unadjusted trial balance. Accounts with zero balances can be left blank. | ||||||||||||

| 4. | At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6).

|

Transcribed Image Text:Kelly Consulting

Score: 21/64

UNADJUSTED TRIAL BALANCE

May 31, 2019

ACCOUNT TITLE

DEBIT

CREDIT

1 Cash

21,975.00

2Accounts Receivable

4,500.00

3 Supplies

• Prepaid Rent

4,680.00

1,295.00

SPrepaid Insurance

Office Equipment

7 Accumulated Depreciation

• Accounts Payable

, Salaries Payable

10 Unearned Fees

11 Kelly Pitney, Capital

12 Kelly Pitney, Drawing

13 Fees Earned

14 Salary Expense

15 Rent Expense

16 Supplies Expense

17 Depreciation Expense

18 Insurance Expense

95.00

36,210.00

120.00

1,500.00

735.00

8,000.00

42,300.00

19 Miscellaneous Expense

20 Totals

Transcribed Image Text:Kelly Consulting

Score: 0/79

ADJUSTED TRIAL BALANCE

May 31, 2019

ACCOUNT TITLE

DEBIT

CREDIT

1 Cash

2 Accounts Receivable

3 Supplies

4 Prepaid Rent

5 Prepaid Insurance

6 Office Equipment

7 Accumulated Depreciation

• Accounts Payable

9 Salaries Payable

10 Unearned Fees

11 Kelly Pitney, Capital

12 Kelly Pitney, Drawing

13 Fees Earned

14 Salary Expense

15 Rent Expense

16 Supplies Expense

17 Depreciation Expense

18 Insurance Expense

19 Miscellaneous Expense

20 Totals

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning