Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 21, Problem 21E

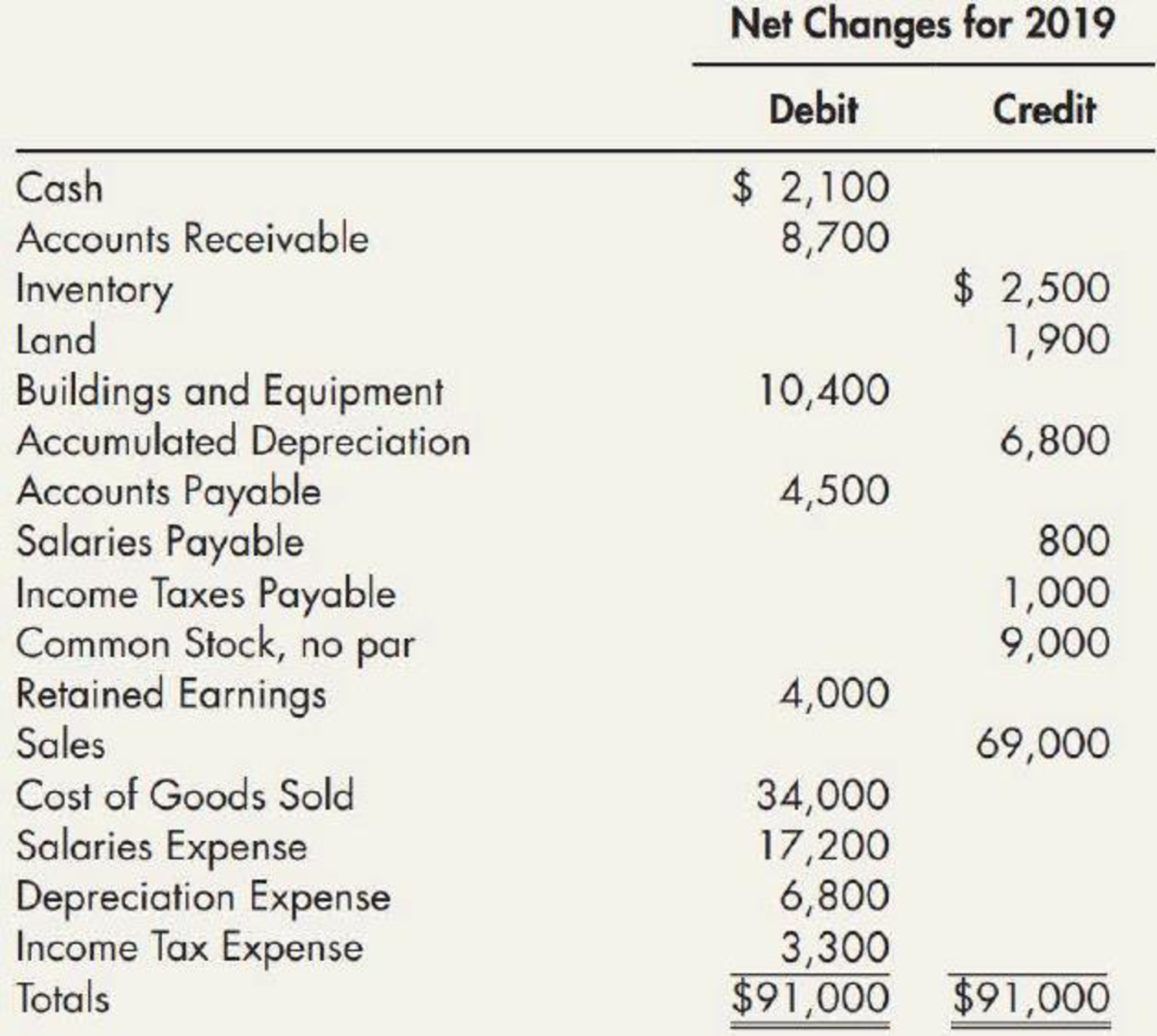

(Appendix 21.1) Visual Inspection The following changes in account balances were taken from Walson Company’s adjusted

In addition, the following information was obtained from the company’s records:

- Land was sold, at cost, for $1,900.

- Dividends of $4,000 were declared and paid.

- Equipment was purchased for $10,400.

- Common stock was issued for $9,000.

- Beginning cash balance was $17,000.

Required:

Using visual inspection and the direct method, prepare Walson’s 2019 statement of

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 21 - What information does the statement of cash flows...Ch. 21 - Briefly describe the three types of activities a...Ch. 21 - Thompson Company sold a piece of equipment that...Ch. 21 - Give two examples of a companys (a) cash inflows...Ch. 21 - Prob. 5GICh. 21 - Prob. 6GICh. 21 - Prob. 7GICh. 21 - Prob. 8GICh. 21 - Prob. 9GICh. 21 - List the three operating cash inflows that a...

Ch. 21 - Prob. 11GICh. 21 - Prob. 12GICh. 21 - Prob. 13GICh. 21 - Dunn Company recognized a 5,000 unrealized holding...Ch. 21 - Jordan Company recognized a 5,000 unrealized...Ch. 21 - Indicate how a company computes the amount of...Ch. 21 - Prob. 17GICh. 21 - Prob. 18GICh. 21 - Prob. 19GICh. 21 - Which of the following would be considered a cash...Ch. 21 - In a statement of cash flows (indirect method),...Ch. 21 - The net cash provided by operating activities in...Ch. 21 - The retirement of long-term debt by the issuance...Ch. 21 - Prob. 5MCCh. 21 - Selected information from Brook Corporations...Ch. 21 - Prob. 7MCCh. 21 - Prob. 8MCCh. 21 - Which of the following need not be disclosed in a...Ch. 21 - The following information was taken from Oregon...Ch. 21 - Prob. 1RECh. 21 - Prob. 2RECh. 21 - Given the following information, convert Cardinal...Ch. 21 - Given the following information, convert Robin...Ch. 21 - In the current year, Harrisburg Corporation had...Ch. 21 - Tifton Co. had the following cash transactions...Ch. 21 - Tifton Co. had the following cash transactions...Ch. 21 - Trenton Corporation has the following items....Ch. 21 - Prob. 9RECh. 21 - In the current year, Harrisburg Corporation...Ch. 21 - Providence Company sold equipment for 25,000 cash....Ch. 21 - Annapolis Corporation paid 270,000 to retire bonds...Ch. 21 - Given the following information, compute Lemon...Ch. 21 - Prob. 14RECh. 21 - Prob. 1ECh. 21 - Prob. 2ECh. 21 - Visual Inspection Noble Companys accounting...Ch. 21 - Prob. 4ECh. 21 - Prob. 5ECh. 21 - Prob. 6ECh. 21 - Prob. 7ECh. 21 - Prob. 8ECh. 21 - Partially Completed Spreadsheet Hanks Company has...Ch. 21 - Spreadsheet The following 2019 information is...Ch. 21 - Spreadsheet and Statement The following 2019...Ch. 21 - Fixed Asset Transactions The following is an...Ch. 21 - Retirement of Debt Moore Company is preparing its...Ch. 21 - Interest and Income Taxes Staggs Company has...Ch. 21 - Investments On October 4, 2019, Collins Company...Ch. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Investing Activities and Depreciable Assets...Ch. 21 - Spreadsheet and Statement The following 2019...Ch. 21 - (Appendix 21.1) Operating Cash Flows The following...Ch. 21 - (Appendix 21.1) Statement of Cash Flows The...Ch. 21 - (Appendix 21.1) Visual Inspection The following...Ch. 21 - Prob. 22ECh. 21 - Classification of Cash Flows A company's statement...Ch. 21 - Prob. 2PCh. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Partially Completed Spreadsheet The following...Ch. 21 - Spreadsheet and Statement of Cash Flows The...Ch. 21 - Prob. 7PCh. 21 - Spreadsheet from Trial Balance Heinz Companys post...Ch. 21 - Prepare Ending Balance Sheet On December 31, 2019,...Ch. 21 - Infrequent Transactions The following transactions...Ch. 21 - Prob. 11PCh. 21 - Comprehensive Angel Company has prepared its...Ch. 21 - Comprehensive The following are Farrell...Ch. 21 - (Appendix 21.1) Operating Cash Flows Refer to the...Ch. 21 - (Appendix 21.1) Statement of Cash Flows The...Ch. 21 - Comprehensive The following are Farrell...Ch. 21 - (Appendix 21.1) Comprehensive The following are...Ch. 21 - Prob. 18PCh. 21 - Financial Statement Interrelationships Prepare an...Ch. 21 - Statement of Cash Flows A friend of yours is...Ch. 21 - Prob. 3CCh. 21 - Operating, Investing, and Financing Activities The...Ch. 21 - Prob. 5CCh. 21 - Spreadsheet Method The spreadsheet method is...Ch. 21 - Prob. 7CCh. 21 - Inflows and Outflows Alfred Engineering Company is...Ch. 21 - Ethics and Cash Flows You are the accountant for...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Spreadsheet The following 2019 information is available for Payne Company: Partial additional information: The net income for 2019 totaled 1,600. During 2019, the company sold, for 390, equipment that cost 390 and had a book value of 300. The company sold land for 200, resulting in a loss of 40. The remaining change in the Land account resulted from the purchase of land through the issuance of common stock. Required: Making whatever additional assumptions that are necessary, prepare a spreadsheet to support the 2019 statement of cash flows for Payne.arrow_forwardThe following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain how multiple-step and single-step income statements differ.arrow_forwardWorksheet Victoria Company has the following account balances on December 31, 2019, prior to any adjustments: Additional adjustment information: (a) depreciation on buildings, 1,100; on equipment, 600; (b) bad debts expense, 240; (c) interest accumulated but not paid: on note payable, 50; on mortgage payable, 530 (this interest is due during the next accounting period); (d) insurance expired, 175; (e) salaries accrued but not paid 370; (f) rent was collected in advance and the performance obligation is now satisfied, 800; (g) office supplies cm hand at year-end, 230 (expensed when originally purchased earlier in the year); and (h) the income tax rate is 30% on current income and is payable in the first quarter of 2020. Required: 1. Transfer the account balances to a 10-column worksheet and prepare a trial balance. 2. Prepare the adjusting entries in the general journal and complete the worksheet. 3. Prepare the companys income statement, retained earnings statement, and balance sheet. 4. Prepare closing entries in the general journal.arrow_forward

- Soon after December 31, 2019, the auditor requested a depreciation schedule for trucks of Jarrett Trucking Company, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2016 to 2019, inclusive. The following data were in the Trucks account as of January 1, 2016: The Accumulated DepreciationTrucks account, previously adjusted to January 1,2016, and duly entered in the ledger, had a balance on that date of 16,460. This amount represented the straight-line depreciation on the four trucks from the respective dates of purchase, based on a 5-year life and no residual value. No debits had been made to this account prior to January 1, 2016. Transactions between January 1,2017, and December 31, 2019, and their record in the ledger were as follows: 1. July 1, 2016: Truck no. 1 was sold for 1,000 cash. The entry was a debit to Cash and a credit to Trucks, 1,000. 2. January 1, 2017: Truck no. 3 was traded for a larger one (no. 5) with a 5-year life. The agreed purchase price was 12,000. Jarrett paid the other company 1,780 cash on the transaction. The entry was a debit to Trucks, 1,780, and a credit to Cash, 1,780. 3. July 1, 2018: Truck no. 4 was damaged in a wreck to such an extent that it was sold as junk for 50 cash. Jarrett received 950 from the insurance company. The entry made by the bookkeeper was a debit to Cash, 1,000, and credits to Miscellaneous Revenue, 50, and Trucks, 950, 4. July 1, 2018: A new truck (no. 6) was acquired for 20,000 cash and debited at that amount to the Trucks account. The truck has a 5-year life. Entries for depreciation had been made at the close of each year as follows: 2016, 8,840; 2017, 5,436; 2018, 4,896; 2019, 4,356. Required: 1. Next Level For each of the 4 years, calculate separately the increase or decrease in earnings arising from the companys errors in determining or entering depreciation or in recording transactions affecting trucks. 2. Prove your work by one compound journal entry as of December 31, 2019; the adjustment of the Trucks account is to reflect the correct balances, assuming that the books have not been closed for 2019.arrow_forwardA review of Anderson Corporations books indicates that the errors and omissions pertaining to the balance sheet accounts shown as follows had not been corrected during the applicable years. The net income per the books is: 2017, 10,000; 2018, 12,000; 2019, 15,000; and 2020, 20,000. No dividends were declared during these years and no adjustments were made to retained earnings. The Retained Earnings balance on December 31, 2020, is 50,000. Omissions Required: Determine the correct net income for the years 2017, 2018, 2019, and 2020, and the adjusted balance sheet accounts as of December 31, 2020. Ignore possible income tax effects.arrow_forwardShannon Corporation began operations on January 1, 2019. Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Shannon Corporation above. Ignoring income taxes, what is the total effect of the errors on the amount of working capital (current assets minus current liabilities) at December 31, 2020? a. working capital overstated by 4,200 b. working capital understated by 5,800 c. working capital understated by 6,000 d. working capital understated by 9,800arrow_forward

- Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services accounting clerk prepared the following unadjusted trial balance at July 31, 2019: The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, 6,400. Depreciation of equipment for the year, 2,800. Accrued salaries and wages at July 31, 900. Unexpired insurance at July 31, 1,500. Fees earned but unbilled on July 31, 10,200. Supplies on hand at July 31, 615. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation ExpenseBuilding, Depreciation ExpenseEquipment, and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance.arrow_forwardFor each of the following accounts, identify in which section of the classified balance sheet it would be presented: current assets, property, intangibles, other assets, current liabilities, long-term liabilities, or stockholders equity. A. Building B. Cash C. Common Stock D. Copyright E. Prepaid Advertising F. Notes Payable (due six months later) G. Taxes Payable H. Unearned Rent Revenuearrow_forwardPrince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000arrow_forward

- The balances of the ledger accounts of Pelango Furniture as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows: ab. Merchandise Inventory at December 31, 104,565. c. Wages accrued at December 31, 934. d. Supplies inventory (on hand) at December 31, 755. e. Depreciation of store equipment, 4,982. f. Depreciation of office equipment, 1,531. g. Insurance expired during the year, 935. h. Rent earned, 2,450. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 16.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. supplies actual count at year end, $6,500 B. remaining unexpired insurance, $6,000 C. remaining unearned service revenue, $1,200 D. salaries owed to employees, $2,400 E. depreciation on property plant and equipment, $18,000arrow_forwardYou are the accountant for Trumpet and Trombone Manufacturing, Inc. and you oversee the preparation of financial statements for the year just ended 6/30/2020. You have the following information from the companys general ledger and other financial reports (all balances are end-of-year except for those noted otherwise): Prepare the companys Statement of Retained Earningsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License