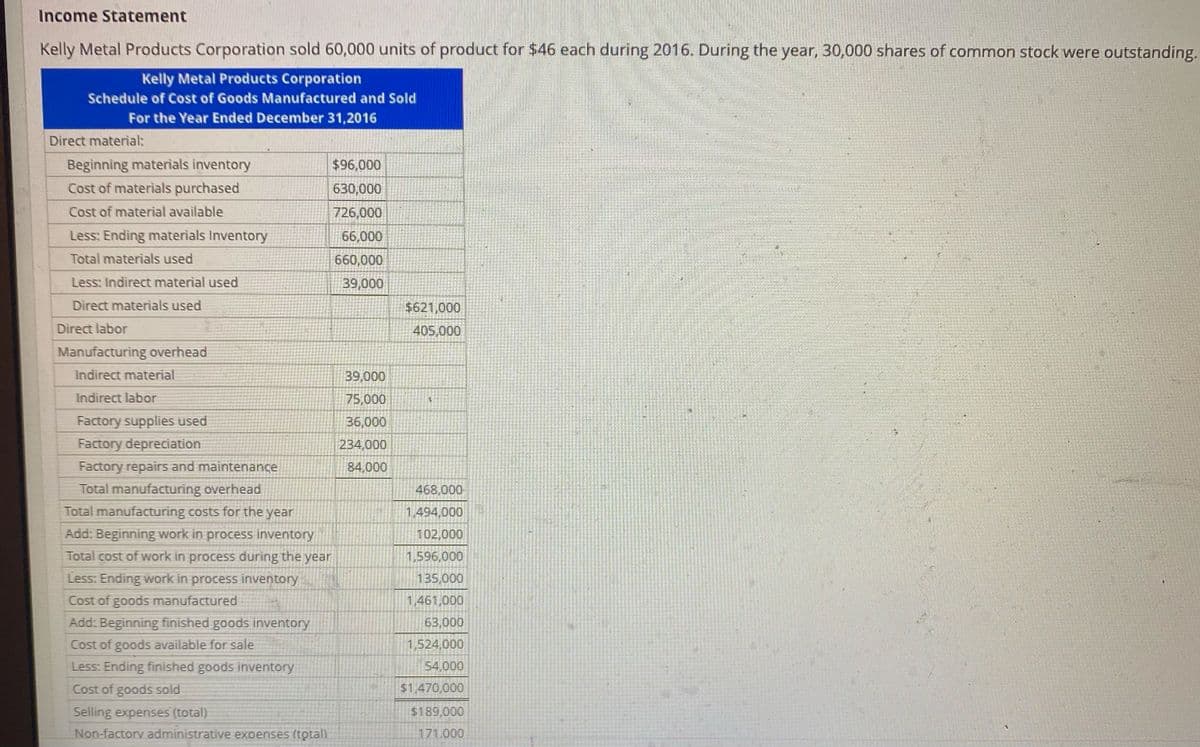

Kelly Metal Products Corporation sold 60,000 units of product for $46 each during 2016. During the year, 30,000 shares of common stock were outsta Kelly Metal Products Corporation Schedule of Cost of Goods Manufactured and Sold For the Year Ended December 31,2016 Direct material: Beginning materials inventory $96,000 Cost of materials purchased 630,000 Cost of material available 726,000 Less: Ending materials Inventory 66,000 Total materials used 660,000 Less: Indirect material used 39,000 Direct materials used $621,000 Direct labor 405,000 Manufacturing overhead Indirect material 39,000 Indirect labor 75,000 Factory supplies used 36,000 Factory depreciation 234,000

Kelly Metal Products Corporation sold 60,000 units of product for $46 each during 2016. During the year, 30,000 shares of common stock were outsta Kelly Metal Products Corporation Schedule of Cost of Goods Manufactured and Sold For the Year Ended December 31,2016 Direct material: Beginning materials inventory $96,000 Cost of materials purchased 630,000 Cost of material available 726,000 Less: Ending materials Inventory 66,000 Total materials used 660,000 Less: Indirect material used 39,000 Direct materials used $621,000 Direct labor 405,000 Manufacturing overhead Indirect material 39,000 Indirect labor 75,000 Factory supplies used 36,000 Factory depreciation 234,000

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 22E

Related questions

Question

Transcribed Image Text:Income Statement

Kelly Metal Products Corporation sold 60,000 units of product for $46 each during 2016. During the year, 30,000 shares of common stock were outstanding.

Kelly Metal Products Corporation

Schedule of Cost of Goods Manufactured and Sold

For the Year Ended December 31,2016

Direct material:

Beginning materials inventory

$96,000

Cost of materials purchased

630,000

Cost of material available

726,000

Less: Ending materials Inventory

66,000

Total materials used

660,000

Less: Indirect material used

39,000

Direct materials used

$621,000

Direct labor

405,000

Manufacturing overhead

Indirect material

39,000

Indirect labor

75,000

Factory supplies used

36,000

Factory depreciation

234,000

Factory repairs and maintenance

84,000

Total manufacturing overhead

468,000

Total manufacturing costs for the year

1,494,000

Add: Beginning work in process inventory

Total cost of work in process during the year

102,000

1,596,000

Less: Ending work in process inventory

Cost of goods manufactured

Add: Beginning finished goods inventory

135,000

1,461,000

63,000

Cost of goods available for sale

1,524,000

Less: Ending finished goods inventory

54,000

Cost of goods sold

$1,470,000

Selling expenses (total)

$189,000

Non-factory administrative expenses (totall

171.000

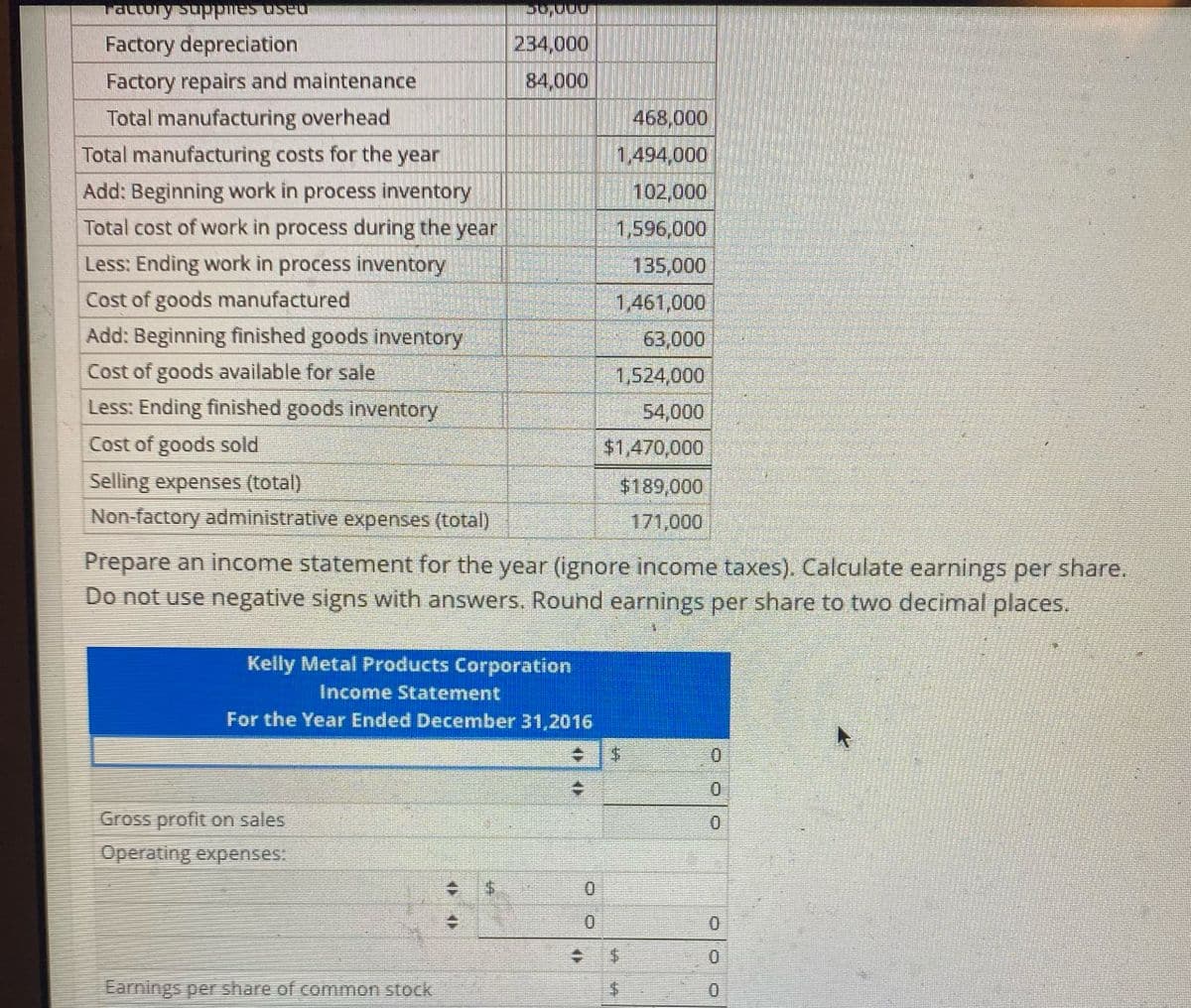

Transcribed Image Text:nasn sauddos

Factory depreciation

234,000

Factory repairs and maintenance

84,000

Total manufacturing overhead

Total manufacturing costs for the year

468,000

1,494,000

Add: Beginning work in process inventory

102,000

Total cost of work in process during the year

1,596,000

Less: Ending work in process inventory

135,000

Cost of goods manufactured

1,461,000

Add: Beginning finished goods inventory

63,000

Cost of goods available for sale

1,524,000

Less: Ending finished goods inventory

54,000

Cost of goods sold

$1,470,000

Selling expenses (total)

Non-factory administrative expenses (total)

$189,000

171,000

Prepare an income statement for the year (ignore income taxes). Calculate earnings per share.

Do not use negative signs with answers. Rouhd earnings per share to two decimal places.

Kelly Metal Products Corporation

Income Statement

For the Year Ended December 31,2016

0.

Gross profit on sales

Operating expenses:

4.

0.

0.

Earnings per share of common stock

0.

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning