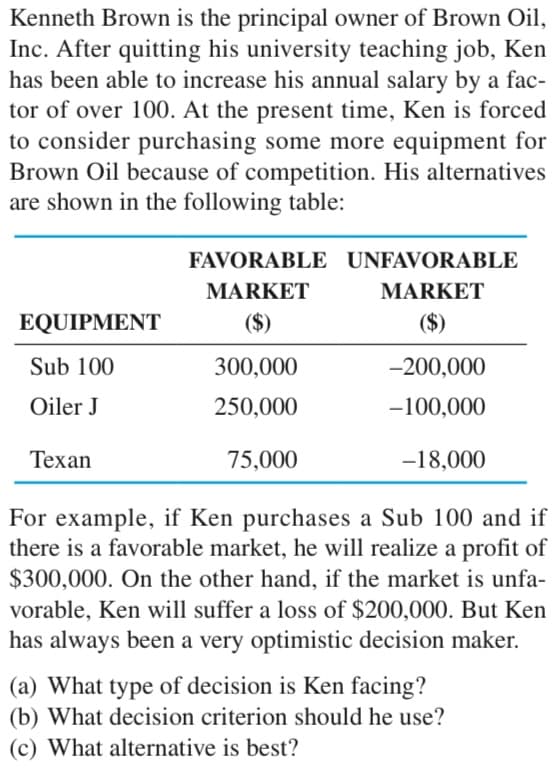

Kenneth Brown is the principal owner of Brown Oil, Inc. After quitting his university teaching job, Ken has been able to increase his annual salary by a fac- tor of over 100. At the present time, Ken is forced to consider purchasing some more equipment for Brown Oil because of competition. His alternatives

Kenneth Brown is the principal owner of Brown Oil, Inc. After quitting his university teaching job, Ken has been able to increase his annual salary by a fac- tor of over 100. At the present time, Ken is forced to consider purchasing some more equipment for Brown Oil because of competition. His alternatives

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter2: Systems Of Linear Equations

Section2.4: Applications

Problem 28EQ

Related questions

Question

help please

Transcribed Image Text:Kenneth Brown is the principal owner of Brown Oil,

Inc. After quitting his university teaching job, Ken

has been able to increase his annual salary by a fac-

tor of over 100. At the present time, Ken is forced

to consider purchasing some more equipment for

Brown Oil because of competition. His alternatives

are shown in the following table:

FAVORABLE UNFAVORABLE

MARKET

MARKET

EQUIPMENT

($)

($)

Sub 100

300,000

-200,000

Oiler J

250,000

-100,000

Техan

75,000

-18,000

For example, if Ken purchases a Sub 100 and if

there is a favorable market, he will realize a profit of

$300,000. On the other hand, if the market is unfa-

vorable, Ken will suffer a loss of $200,000. But Ken

has always been a very optimistic decision maker.

(a) What type of decision is Ken facing?

(b) What decision criterion should he use?

(c) What alternative is best?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning