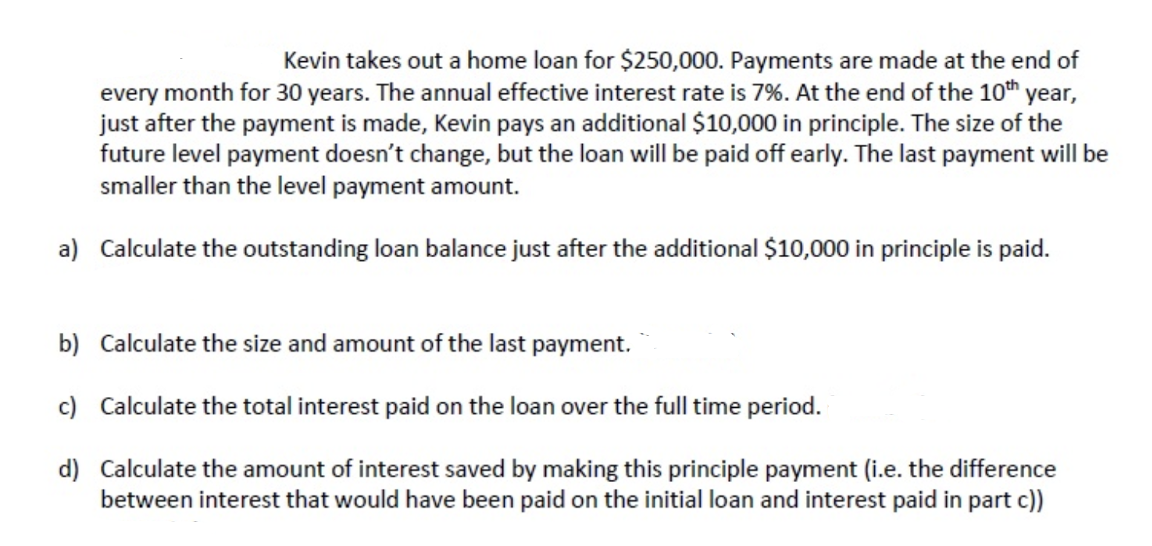

Kevin takes out a home loan for $250,000. Payments are made at the end of every month for 30 years. The annual effective interest rate is 7%. At the end of the 10th year, just after the payment is made, Kevin pays an additional $10,000 in principle. The size of the future level payment doesn't change, but the loan will be paid off early. The last payment will be smaller than the level payment amount. a) Calculate the outstanding loan balance just after the additional $10,000 in principle is paid. b) Calculate the size and amount of the last payment. c) Calculate the total interest paid on the loan over the full time period. d) Calculate the amount of interest saved by making this principle payment (i.e. the difference between interest that would have been paid on the initial loan and interest paid in part c))

Kevin takes out a home loan for $250,000. Payments are made at the end of every month for 30 years. The annual effective interest rate is 7%. At the end of the 10th year, just after the payment is made, Kevin pays an additional $10,000 in principle. The size of the future level payment doesn't change, but the loan will be paid off early. The last payment will be smaller than the level payment amount. a) Calculate the outstanding loan balance just after the additional $10,000 in principle is paid. b) Calculate the size and amount of the last payment. c) Calculate the total interest paid on the loan over the full time period. d) Calculate the amount of interest saved by making this principle payment (i.e. the difference between interest that would have been paid on the initial loan and interest paid in part c))

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter27: Time Value Of Money (compound)

Section: Chapter Questions

Problem 6E

Related questions

Question

All of it please!

Transcribed Image Text:Kevin takes out a home loan for $250,000. Payments are made at the end of

every month for 30 years. The annual effective interest rate is 7%. At the end of the 10th year,

just after the payment is made, Kevin pays an additional $10,000 in principle. The size of the

future level payment doesn't change, but the loan will be paid off early. The last payment will be

smaller than the level payment amount.

a) Calculate the outstanding loan balance just after the additional $10,000 in principle is paid.

b) Calculate the size and amount of the last payment.

c) Calculate the total interest paid on the loan over the full time period.

d) Calculate the amount of interest saved by making this principle payment (i.e. the difference

between interest that would have been paid on the initial loan and interest paid in part c))

Expert Solution

Step by step

Solved in 10 steps with 22 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT