Rey figures för Apple and Google follow. S millions Cash and equivalents Accounts receivable, net Inventories Retained carnings Cost of sales Revenues Total assets Apple $ 48,844 22,926 4,106 45,898 161,782 260, 174 338,516 Google $ 18,498 25,326 999 152,122 71,896 161,857 275,909 Required: 1. Compute common-size percents for each company using the data given. 2. If Google paid a dividend, would retained earnings as a percent of total assets increase or decrease? 3. Which company has the better gross margin ratio on sales?

Rey figures för Apple and Google follow. S millions Cash and equivalents Accounts receivable, net Inventories Retained carnings Cost of sales Revenues Total assets Apple $ 48,844 22,926 4,106 45,898 161,782 260, 174 338,516 Google $ 18,498 25,326 999 152,122 71,896 161,857 275,909 Required: 1. Compute common-size percents for each company using the data given. 2. If Google paid a dividend, would retained earnings as a percent of total assets increase or decrease? 3. Which company has the better gross margin ratio on sales?

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 17.3CP: Vertical analysis The condensed income statements through income from operations for Dell Inc. and...

Related questions

Question

Please help me

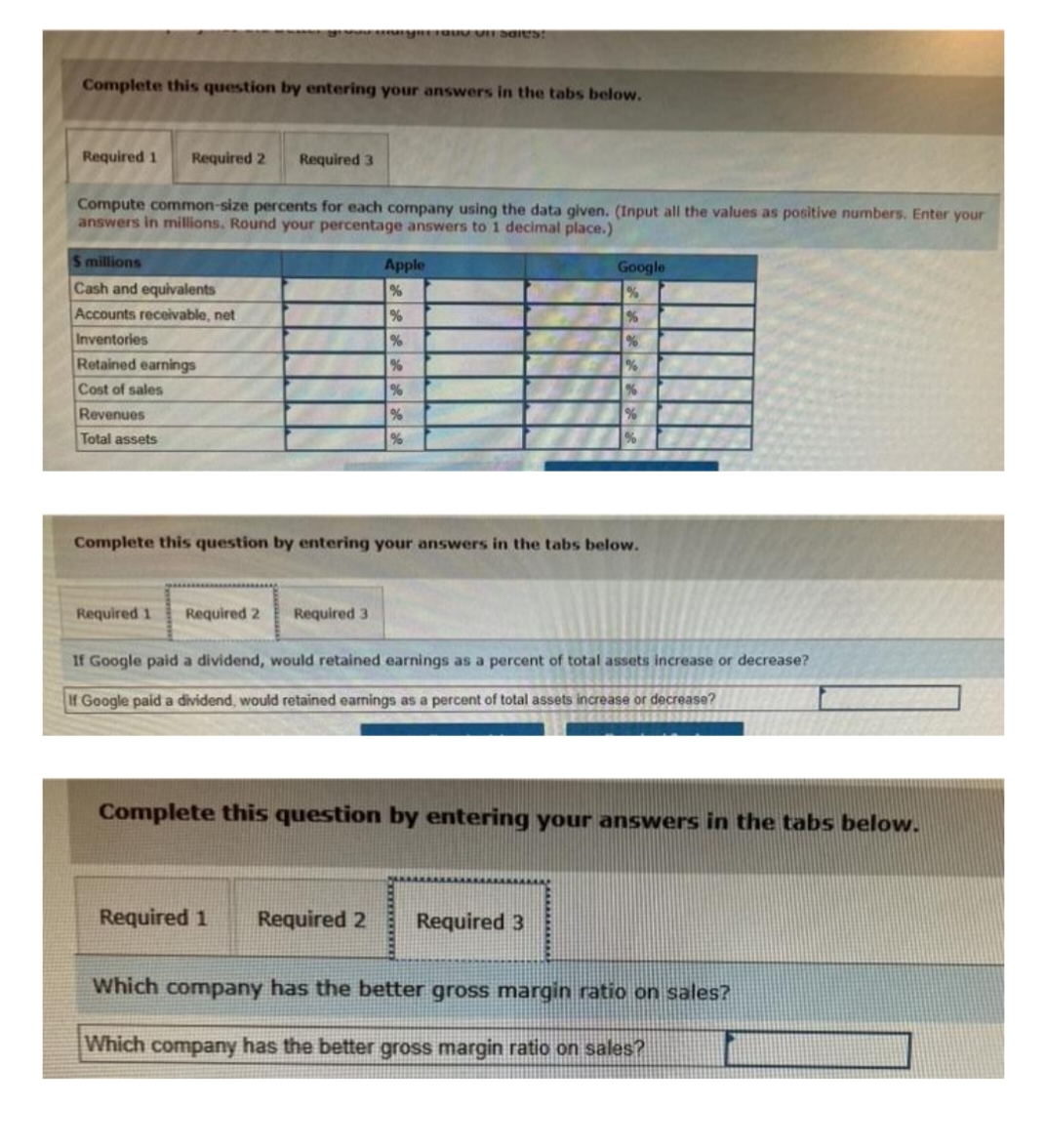

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Compute common-size percents for each company using the data given. (Input all the values as positive numbers. Enter your

answers in millions. Round your percentage answers to 1 decimal place.)

S millions

Apple

%

Google

Cash and equivalents

Accounts receivable, net

Inventories

Retained earnings

%

%

Cost of sales

Revenues

%

Total assets

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

If Google paid a dividend, would retained earnings as a percent of total assets increase or decrease?

If Google paid a dividend, would retained earnings as a percent of total assets increase or decrease?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Which company has the better gross margin ratio on sales?

Which company has the better gross margin ratio on sales?

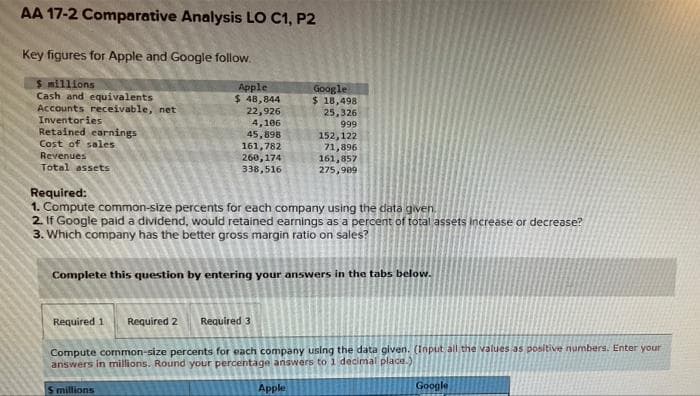

Transcribed Image Text:AA 17-2 Comparative Analysis LO C1, P2

Key figures for Apple and Google follow.

$ millions

Cash and equivalents

Accounts receivable, net

Inventories

Retained carnings

Cost of sales

Apple

$ 48,844

22,926

4,106

45,898

161,782

260,174

338,516

Google

$ 18,498

25,326

999

152,122

71,896

161,857

275,909

Revenues

Total assets

Required:

1. Compute common-size percents for each company using the data given.

2. If Google paid a dividend, would retained earnings as a percent of total assets increase or decrease?

3. Which company has the better gross margin ratio on sales?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Compute cormmon-size percents for each company using the data given. (Input all the values as positive numbers. Enter your

answers in millions. Round your percentage answers to 1 decimal place.)

S millions

Apple

Google

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning