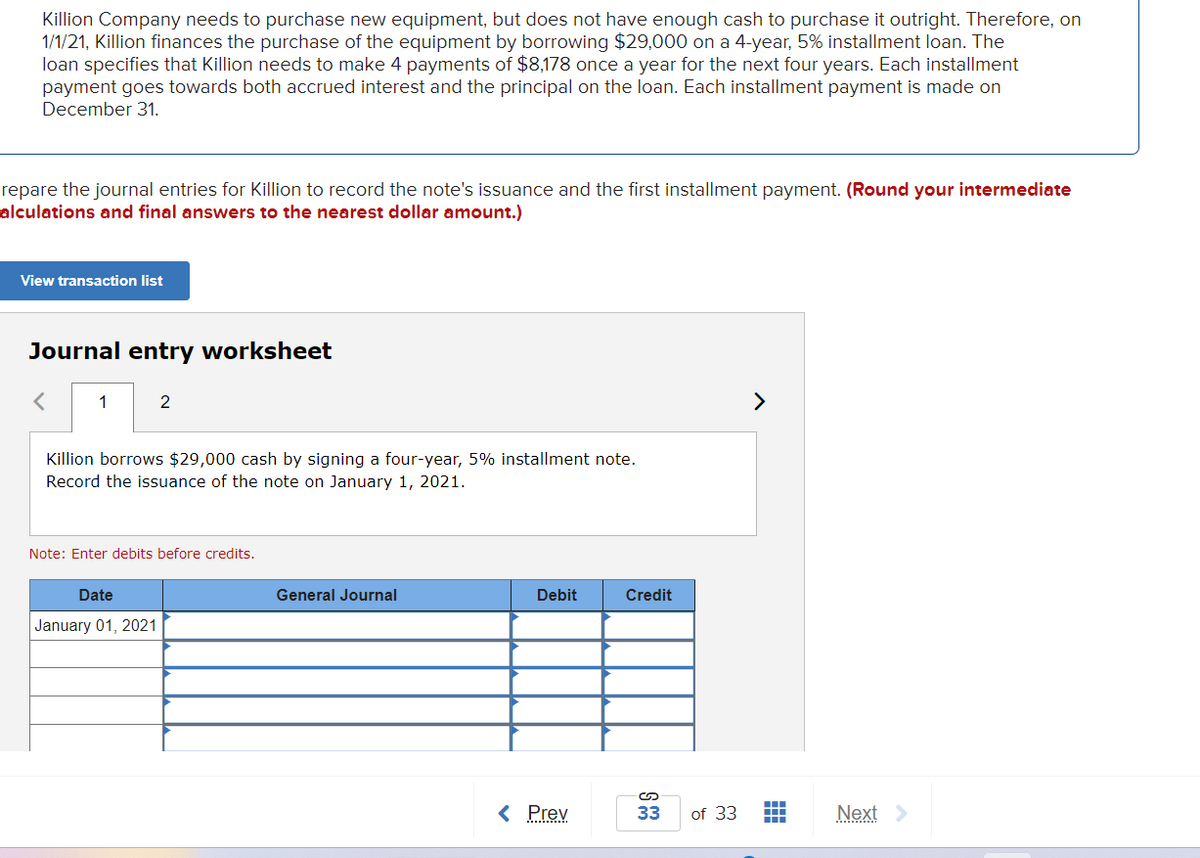

Killion Company needs to purchase new equipment, but does not have enough cash to purchase it outright. Therefore, on 1/1/21, Killion finances the purchase of the equipment by borrowing $29,000 on a 4-year, 5% installment loan. The loan specifies that Killion needs to make 4 payments of $8,178 once a year for the next four years. Each installment payment goes towards both accrued interest and the principal on the loan. Each installment payment is made on December 31.

Killion Company needs to purchase new equipment, but does not have enough cash to purchase it outright. Therefore, on 1/1/21, Killion finances the purchase of the equipment by borrowing $29,000 on a 4-year, 5% installment loan. The loan specifies that Killion needs to make 4 payments of $8,178 once a year for the next four years. Each installment payment goes towards both accrued interest and the principal on the loan. Each installment payment is made on December 31.

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:Killion Company needs to purchase new equipment, but does not have enough cash to purchase it outright. Therefore, on

1/1/21, Killion finances the purchase of the equipment by borrowing $29,000 on a 4-year, 5% installment loan. The

loan specifies that Killion needs to make 4 payments of $8,178 once a year for the next four years. Each installment

payment goes towards both accrued interest and the principal on the loan. Each installment payment is made on

December 31.

repare the journal entries for Killion to record the note's issuance and the first installment payment. (Round your intermediate

alculations and final answers to the nearest dollar amount.)

View transaction list

Journal entry worksheet

<

1

2

Killion borrows $29,000 cash by signing a four-year, 5% installment note.

Record the issuance of the note on January 1, 2021.

Note: Enter debits before credits.

Date

January 01, 2021

General Journal

Debit

< Prev

Credit

33

>

of 33 ―

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College