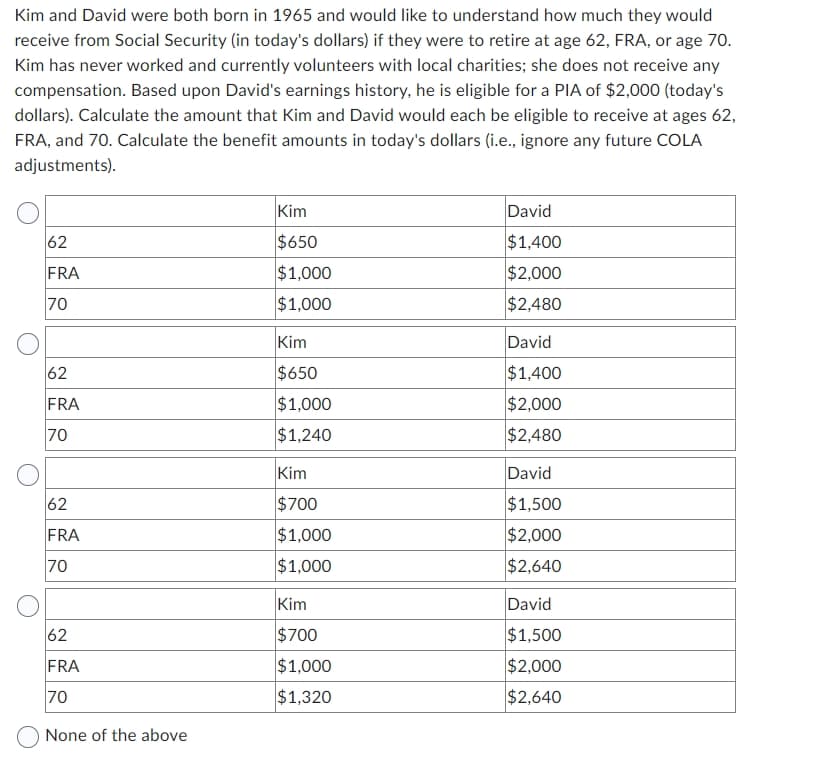

Kim and David were bot

Q: Required 1. Calculate the sales-volume variance and flexible-budget variance for operating income.…

A: Working related to the flexible budget variance Actual Revenue 4800 x 7203456000Budgeted Revenue4800…

Q: Sanders Tax Services prepares tax returns for senior citizens. The standard in terms of (direct…

A: Lets understand the basics.Direct labor rate variance is a variance between the rate at which labor…

Q: Aresco Corporation manufactures two products: Product G51B and Product E48X. The company uses a…

A: Overhead means all type of indirect costs and expenses being incurred in business. These costs can…

Q: Quantum Technology had $646,000 of retained earings on December 31, 20X2. The company paid common…

A: Earnings per share is calculated by dividing earnings available to common stockholders' by average…

Q: Aida Hassen is single and earns $40,000 in taxable income. She uses the following tax rate schedule…

A: A marginal tax rate is the difference in taxes imposed for each dollar of additional income over the…

Q: The accounting records of Sheridan Company show the following data. Beginning inventory 2,710…

A: Weighted Average Method is one of the methods of inventory valuation in which it is assumed that…

Q: Larcker Manufacturing's cost accountant has provided you with the following inform Direct materials…

A: When both gross margin and contribution margin give information about a company's financial success,…

Q: Which of the following transactions is represented by the diagram below? Sale Inventory A junkyard…

A: Following is the correct answer

Q: Jackson has the choice to invest in city of Mitchell bonds or Sundial, Incorporated corporate bonds…

A: Income tax is based on income. Suppose a person has salary income, capital gain income, house rent…

Q: The company paid November's rent of $2,500 on October 30. On October 30, the company recorded a…

A: Adjusting entries are accounting entries made at the end of an accounting period to ensure that…

Q: The NBV of B's property, plant and equipment is $51,000 at 1 January 20X5 and $100,000 at 31…

A: Lets understand the basics.Depreciation is a reduction in value of asset due to wear and tear,…

Q: Garden Sales, Incorporated, usually has to borrow money during the second quarter to support peak…

A: Sales are made on cash and credit basis. The amount to be collected from sales made on credit basis…

Q: 1. Jacobson's original single plantwide overhead allocation rate costing system allocated indirect…

A: Hi studentSince there are multiple subparts, we will answer only first three subparts. If you want…

Q: Please prepare tha income statement thanku

A: The cost of the products manufactured seems to be significant since it provides management with a…

Q: During June, Briganti Corporation purchased $83,000 of raw materials on credit to add to its raw…

A: The journal entries are prepared to record the transactions on regular basis. The direct Costs are…

Q: During 2024, R2D2 Company purchased 10,000 shares of Goliath, Inc. for $30 per share and classified…

A: Unrealized profit and loss means The value of an investment that has not yet been sold or realized…

Q: A computer costs $500,000 and is depreciated for tax purposes straight-line over years 1 through 5.…

A: An agreement of contract that is prepared to transfer the right to use the resources for a…

Q: As of January 1, 2023, the equity section of TS Sport Co.'s balance sheet contained the following:…

A: Journal entry records the accounting transactions of a business in a journal book. All the business…

Q: Caramel Company at the end of 2022, its first year of operations, prepared a reconciliation between…

A: Deferred tax liability refers to underpaid taxes which means the entity has to pay these underpaid…

Q: nged equipmen

A: Interest revenue is the money produced by an organization, usually a corporation or financial…

Q: Marian Company reported the following items for the month of July: Cost of goods sold Sales revenue…

A: Inventory turnover is the efficiency ratio that measures the entity's efficiency in converting…

Q: Nov. Prepare journal entries to record each of the following transactions of a merchandising…

A: Perpetual inventory system is that system under which all purchases and sales related to inventory…

Q: At one time, Del Monte Foods Company reported three separate operating segments: consumer products…

A: BREAKEVEN POINTBreak Even means the volume of production or sales where there is no profit or…

Q: Caramel Compnay's 2023 Income Statement shpwed pretax accounting income of $2,500,000. To compute…

A: The corporation has to pay income taxes. Income tax is paid on the taxable income using the…

Q: On January 1, Year 1, Brown Company borrowed cash from First Bank by issuing a $44,500 face value,…

A: Financial statements are essential documents that give a thorough summary of a company's financial…

Q: Red, Inc provides group term life insurance to all of its employees Susan, a vice-president,…

A: A life insurance premium is like a regular payment you make to an insurance company to keep your…

Q: Mosbius Designs, an architectural firm based in the Upper West Side of New York. Currently, Mosbius…

A: Break even point means a situation where the is neither profit nor loss. Sales revenue is sufficient…

Q: The 2008 balance sheet of Saddle Creek, Inc., showed current assets of $2,100 and current…

A: Net working capital is the difference between the current assets of a company and its current…

Q: The following information applies to the questions displayed below.] George bought the following…

A: When shares are sold, the initial ones that were acquired first must be sold in accordance with the…

Q: Logan Products has two production departments-assembly and finishing. These are supported by two…

A: The various methods for cost allocation are direct, step and reciprocal method. The direct method is…

Q: Required information [The following information applies to the questions displayed below.] Oslo…

A: The break even sales are calculated as fixed costs divided by contribution Margin Ratio. The…

Q: The management of Wengel Corporation is considering dropping product B900. Data from the company's…

A: The dropping of order leads to a decrease in income due to contribution margin loss. In case,…

Q: costs for June 2020. Item Wood Nails, glue, stain Indirect manufacturing labor Depreciation on skill…

A: The journal entries are prepared to record the transactions on regular basis. The indirect Costs…

Q: Rocky Pines golf course is planning for the coming season investors would like to earn a 12% return…

A: Target sale price policy entails assessment of full cost and then adding the estimated profits to…

Q: ROBERTS COMPANY Cost of Goods Manufactured Schedule (b) Show the presentation of the ending…

A: Cost of goods manufactured means the cost incurred on the manufacturing of finished goods.Formula…

Q: Punk Corporation purchased 90 percent of Soul Company's voting common shares on January 1, 20X2, at…

A: Consolidation is an activity in which financial statements of a parent and its subsidiary should be…

Q: What is Jane's taxable incor

A: Under the cash method, you generally report income in the tax year you receive it, and deduct…

Q: 382,000 (57,000) (111,200) (26,000) (9,000) $ 178,800 291,600 (46,000) (80,600) (26,000) (9,000) $…

A: Sales $ 1,80,000 Cost of Goods Sold $ 99,375 Department Manager Salary $…

Q: Morganton Company makes one product and it provided the following information to help prepare the…

A: Product cost is the amount of money incurred on the making of the goods. It includes the cost of…

Q: Whitman Company has just completed its first year of operations. The company’s absorption costing…

A: Variable costing is that costing system under which all variable manufacturing costs will be part of…

Q: Pronghorn Company lost most of its inventory in a fire in December just before the year-end physical…

A: Net Purchases = Purchases for the year - Purchase returns= $295,600 - $27,900= $267,700Net sales =…

Q: Allied Merchandisers was organized on May 1. Macy Company is a major customer (buyer) of Allied…

A: A journal entry is a basic accounting record that records a single financial transaction within a…

Q: Required Information [The following information applies to the questions displayed below.] The City…

A: The statement of net position includes financial data on all of the capital and current assets,…

Q: Raud Company recte of $24.500 and a total contribution margin of $61.159 for July In August, the…

A: The degree of operating leverage (DOL) measures how sensitive a company's operating income is to…

Q: Caramel Co. at the end of 2022, its first year of operations, prepared a reconciliation between…

A: Costs related to litigation include those incurred during court appearances and when disputes or…

Q: Product ) is one of the many products manufactured and sold by Oceanside Company. An income…

A: Variable costs are costs that vary with the change in the level of output whereas fixed costs are…

Q: Rooney Company produces commercial gardening equipment. Since production is highly automated, the…

A: ACTIVITY BASED COSTINGUsing activity-based costing to measure performance is quite effective.Agency…

Q: Liz Raiborn Incorporated has the following financial results for the years 2022 through 2024 for its…

A: Return on sales takes into consideration net operating income and revenue whereas return on…

Q: What were gross profit rate (aka gross profit margin for 2023 and 2022? Based on this metric only,…

A: Cost of goods sold is actual cost of goods that are being sold to customers. Net sales is the excess…

Q: Additional short-term borrowings Purchase of short-term stock investments Cash dividends paid…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Step by step

Solved in 3 steps

- Charles E. Bennett, age 64, will retire next year and is trying to decide whether to begin collecting his Social Security benefits at that time. His monthly benefits will increase if he defers his starting date for the benefits. He has asked you to estimate how much his income tax will increase as a result of collecting Social Security. Charles and his wife Bernice B., file a joint return, have no other dependents, and claim the standard deduction. Their only income other than the Social Security benefits are: The Social Security benefits for the year would be 12,000. a. Complete Worksheet 1, Figuring Your Taxable Benefits, included in IRS Publication 915 to determine the taxable portion of this couples taxable Social Security benefits (the publication includes a blank worksheet). b. What is the taxable portion of the 12,000 in Social Security benefits?Margaret, age 65, and John, age 62, are married with a 23 -year-old daughter who lives in their home. They provide over half of their daughter's support, and their daughter earned $4,100 this year from a part-time job. Their daughter is not a full-time student. The daughter can/cannot be claimed as a dependent because: She cannot be claimed because she is over 19 and not a full-time student. She can be claimed because she is a qualifying child. She can be claimed because she is a qualifying relative. She cannot be claimed because she fails the gross income test.Ellie purchases an insurance policy on her life and names her brother, Jason, as the beneficiary. Ellie pays 32,000 in premiums for the policy during her life. When she dies, Jason collects the insurance proceeds of 500,000. As a result, how much gross income does Jason report?

- Malin is a married taxpayer and has three dependent children. Malin's employer offers health insurance for employees and Malin takes advantage of the benefit for her entire family (her spouse's employer also offers health insurance but they opt out). During the year, Malin paid $ 1,200 toward her family's health insurance premiums through payroll deductions while the employer paid the remaining $ 9,200. Malin's family visited health care professionals numerous times during the year and made total copayments toward medical services of $280. Malin's daughter had knee surgery due to a soccer injury and the insurance company paid the hospital $ 6,700$ directly and reimbursed Malin $400 for her out-of-pocket health care expenses related to the surgery. How much gross income should Malin recognize related to her health insurance? $0 $ 9,200 14,020(9,200+6,7001,200280400) 8,000(9,2001,200) None of the abovePaul Barrone is a graduate student at State University. His 10-year-old son, Jamie, lives with him, and Paul is Jamies sole support. Pauls wife died in 2018, and Paul has not remarried. Paul received 320,000 of life insurance proceeds (related to his wifes death) in early 2019 and immediately invested the entire amount as shown below. Paul had 42,000 of taxable graduate assistant earnings from State University and received a 10,000 scholarship. He used 8,000 of the scholarship to pay his tuition and fees for the year and 2,000 for Jamies day care. Jamie attended Little Kids Daycare Center, a state-certified child care facility. Paul received a statement related to the Green bonds saying that there was 45 of original issue discount amortization during 2019. Paul maintains the receipts for the sales taxes he paid of 735. Paul lives at 1610 Cherry Lane, Bradenton, FL 34212, and his Social Security number is 111-11-1111. Jamies Social Security number is 123-45-6789. The university withheld 2,000 of Federal income tax from Pauls salary. Paul is not itemizing his deductions. Part 1Tax Computation Compute Pauls lowest tax liability for 2019. Part 2Tax Planning Paul is concerned because the Green bonds were worth only 18,000 at the end of 2019, 5,000 less than he paid for them. He is an inexperienced investor and wants to know if this 5,000 is deductible. The bonds had original issue discount of 2,000 when he purchased them, and he is curious about how that affects his investment in the bonds. The bonds had 20 years left to maturity when he purchased them. Draft a brief letter to Paul explaining how to handle these items. Also prepare a memo for Pauls tax file.John Benson, age 40, is single. His Social Security number is 111-11-1111, and he resides at 150 Highway 51, Tangipahoa, LA 70465. John has a 5-year-old child, Kendra, who lives with her mother, Katy. As a result of his divorce in 2016, John pays alimony of 6,000 per year to Katy and child support of 12,000. The 12,000 of child support covers 65% of Katys costs of rearing Kendra. Kendras Social Security number is 123-45-6789, and Katys is 123-45-6788. Johns mother, Sally, lived with him until her death in early September 2019. He incurred and paid medical expenses for her of 15,588 and other support payments of 11,000. Sallys only sources of income were 5,500 of interest income on certificates of deposit and 5,600 of Social Security benefits, which she spent on her medical expenses and on maintenance of Johns household. Sallys Social Security number was 123-45-6787. John is employed by the Highway Department of the State of Louisiana in an executive position. His salary is 95,000. The appropriate amounts of Social Security tax and Medicare tax were withheld. In addition, 9,500 was withheld for Federal income taxes and 4,000 was withheld for state income taxes. In addition to his salary, Johns employer provides him with the following fringe benefits. Group term life insurance with a maturity value of 95,000; the cost of the premiums for the employer was 295. Group health insurance plan; Johns employer paid premiums of 5,800 for his coverage. The plan paid 2,600 for Johns medical expenses during the year. Upon the death of his aunt Josie in December 2018, John, her only recognized heir, inherited the following assets. Three months prior to her death, Josie gave John a mountain cabin. Her adjusted basis for the mountain cabin was 120,000, and the fair market value was 195,000. No gift taxes were paid. During the year, John reported the following transactions. On February 1, 2019, he sold for 45,000 Microsoft stock that he inherited from his father four years ago. His fathers adjusted basis was 49,000, and the fair market value at the date of the fathers death was 41,000. The car John inherited from Josie was destroyed in a wreck on October 1, 2019. He had loaned the car to Katy to use for a two-week period while the engine in her car was being replaced. Fortunately, neither Katy nor Kendra was injured. John received insurance proceeds of 16,000, the fair market value of the car on October 1, 2019. On December 28, 2019, John sold the 300 acres of land to his brother, James, for its fair market value of 160,000. James planned on using the land for his dairy farm. Other sources of income for John are: Potential itemized deductions for John, in addition to items already mentioned, are: Part 1Tax Computation Compute Johns net tax payable or refund due for 2019. Part 2Tax Planning Assume that rather than selling the land to James, John is considering leasing it to him for 12,000 annually with the lease beginning on October 1, 2019. James would prepay the lease payments through December 31, 2019. Thereafter, he would make monthly lease payments at the beginning of each month. What effect would this have on Johns 2019 tax liability? What potential problem might John encounter? Write a letter to John in which you advise him of the tax consequences of leasing versus selling. Also prepare a memo addressing these issues for the tax files.