Kim recelved a one third profits and capital interest in Bright Line. LLC, n echange for legal services she provided. In addeion to her share of partnership profts or losses, she recelves a $20.000 guaranted payment each year for ongoing services she provides to the LLC. For X4. Bright Line reported the following revenues and expenses sales-$140.000, cost of goods sold-$80,000, depreciation expense-$46,000, kong-term capital gains-$5000, qualitied dividends-$5.000. and municipal Bond interest-$3.000. How much ordinary business income toss) will Bright Line allocate to Kim on her Schedule K.1 for X4? Multiple Choice $7.000 $9.000

Kim recelved a one third profits and capital interest in Bright Line. LLC, n echange for legal services she provided. In addeion to her share of partnership profts or losses, she recelves a $20.000 guaranted payment each year for ongoing services she provides to the LLC. For X4. Bright Line reported the following revenues and expenses sales-$140.000, cost of goods sold-$80,000, depreciation expense-$46,000, kong-term capital gains-$5000, qualitied dividends-$5.000. and municipal Bond interest-$3.000. How much ordinary business income toss) will Bright Line allocate to Kim on her Schedule K.1 for X4? Multiple Choice $7.000 $9.000

Chapter21: Partnerships

Section: Chapter Questions

Problem 3BCRQ

Related questions

Question

Please Solve In 10mins I will Thumbs-up

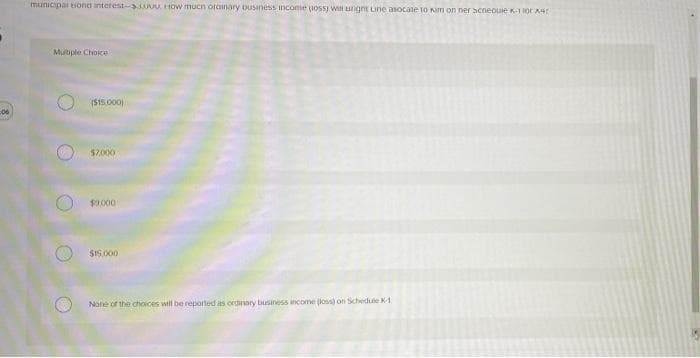

Transcribed Image Text:municipar tiona interest- w.HOw mucn orainary ousiness income uosS) Wil ugnt Line asocate 10 Nm on ner acneouie K-1 Tor KA

Mutiple Choice

(S15.000)

06

$2.000

$9.000

SI5.000

None of the choices will be reported as ordinaty business ncome (loss on Schedue K1

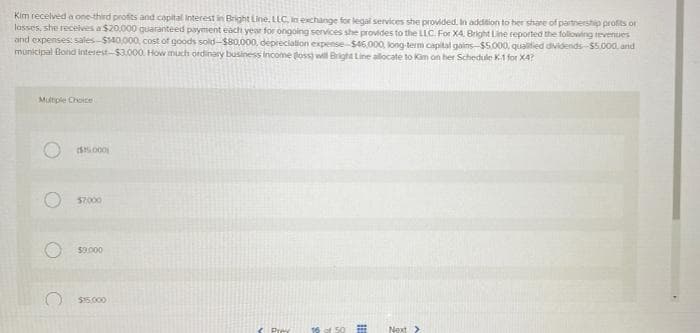

Transcribed Image Text:Kim recelved a one third profes and capital interest in Bright Line. LLC, in exchange for legal services she provided. In addeion to her share of partnershp profits or

losses, she recelves a $20.000 quarantéed payment each year for ongoing services she provides to the LLC. For X4. Bright Line reported the folowing tevenues

and expenses: sales-$140,000, cost of goods sold-$80,000, depreciation expense- $46,000, long-term capital gains-$5.000, qualitied dividends-$5.000. and

municipal Bond interest-$3.000. How much ordinary business income loss) wll Bright Line allocate to Kam on her Schedule K.1 for X4?

Multiple Choice

s.000

57000

$9.000

$15.000

Prey

16 of 50

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you