Kindly answer the 2 questions. Note: Here are the following guidelines for solving an ethical issue. Please use these steps. 1. Identify the facts. 2. Identify the ethical issue. 3. Analyze the alternative courses of action. 4. Make a decision.

Kindly answer the 2 questions. Note: Here are the following guidelines for solving an ethical issue. Please use these steps. 1. Identify the facts. 2. Identify the ethical issue. 3. Analyze the alternative courses of action. 4. Make a decision.

Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment

Section: Chapter Questions

Problem 1CE

Related questions

Question

Kindly answer the 2 questions.

Note: Here are the following guidelines for solving an ethical issue. Please use these steps.

1. Identify the facts.

2. Identify the ethical issue.

3. Analyze the alternative courses of action.

4. Make a decision.

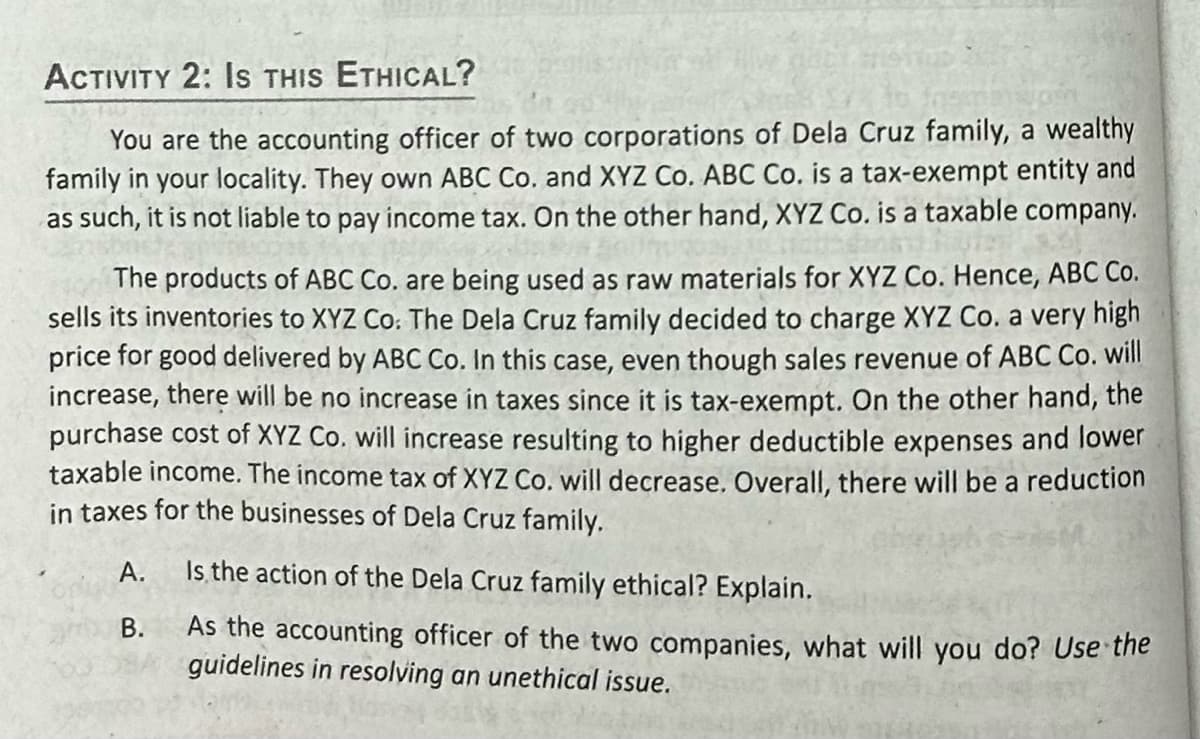

Transcribed Image Text:ACTIVITY 2: IS THIS ETHICAL?

You are the accounting officer of two corporations of Dela Cruz family, a wealthy

family in your locality. They own ABC Co. and XYZ Co. ABC Co. is a tax-exempt entity and

as such, it is not liable to pay income tax. On the other hand, XYZ Co. is a taxable company.

The products of ABC Co. are being used as raw materials for XYZ Co. Hence, ABC Co.

sells its inventories to XYZ Co. The Dela Cruz family decided to charge XYZ Co. a very high

price for good delivered by ABC Co. In this case, even though sales revenue of ABC Co. will

increase, there will be no increase in taxes since it is tax-exempt. On the other hand, the

purchase cost of XYZ Co. will increase resulting to higher deductible expenses and lower

taxable income. The income tax of XYZ Co. will decrease. Overall, there will be a reduction

in taxes for the businesses of Dela Cruz family.

A.

B.

Is the action of the Dela Cruz family ethical? Explain.

As the accounting officer of the two companies, what will you do? Use the

guidelines in resolving an unethical issue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Management Information Systems: Managing The Digi…

Management

ISBN:

9780135191798

Author:

Kenneth C. Laudon, Jane P. Laudon

Publisher:

PEARSON

Business Essentials (12th Edition) (What's New in…

Management

ISBN:

9780134728391

Author:

Ronald J. Ebert, Ricky W. Griffin

Publisher:

PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:

9780134237473

Author:

Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:

PEARSON