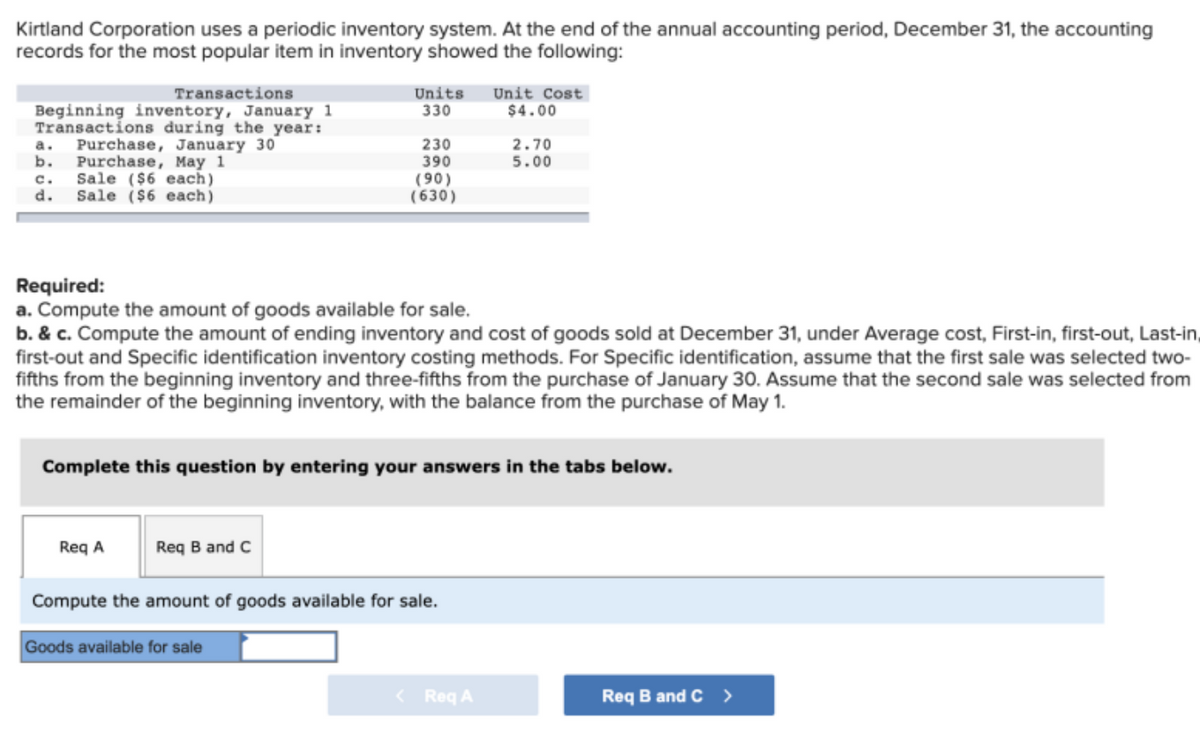

Kirtland Corporation uses a periodic inventory system. At the end of the annual accounting period, December 31, the accounting records for the most popular item in inventory showed the following: Transactions Units 330 Unit Cost $4.00 Beginning inventory, January 1 Transactions during the year: Purchase, January 30 Purchase, May 1 Sale ($6 each) d. 2.70 5.00 a. 230 b. 390 (90) (630) c. Sale ($6 each) Required: a. Compute the amount of goods available for sale. b. & c. Compute the amount of ending inventory and cost of goods sold at December 31, under Average cost, First-in, first-out, Last-in first-out and Specific identification inventory costing methods. For Specific identification, assume that the first sale was selected two- fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the second sale was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1.

Kirtland Corporation uses a periodic inventory system. At the end of the annual accounting period, December 31, the accounting records for the most popular item in inventory showed the following: Transactions Units 330 Unit Cost $4.00 Beginning inventory, January 1 Transactions during the year: Purchase, January 30 Purchase, May 1 Sale ($6 each) d. 2.70 5.00 a. 230 b. 390 (90) (630) c. Sale ($6 each) Required: a. Compute the amount of goods available for sale. b. & c. Compute the amount of ending inventory and cost of goods sold at December 31, under Average cost, First-in, first-out, Last-in first-out and Specific identification inventory costing methods. For Specific identification, assume that the first sale was selected two- fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the second sale was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Related questions

Question

Help

Transcribed Image Text:Kirtland Corporation uses a periodic inventory system. At the end of the annual accounting period, December 31, the accounting

records for the most popular item in inventory showed the following:

Transactions

Units

330

Unit Cost

$4.00

Beginning inventory, January 1

Transactions during the year:

a. Purchase, January 30

b.

230

390

(90)

(630)

2.70

5.00

Purchase, May 1

Sale ($6 each)

Sale ($6 each)

с.

d.

Required:

a. Compute the amount of goods available for sale.

b. & c. Compute the amount of ending inventory and cost of goods sold at December 31, under Average cost, First-in, first-out, Last-in,

first-out and Specific identification inventory costing methods. For Specific identification, assume that the first sale was selected two-

fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the second sale was selected from

the remainder of the beginning inventory, with the balance from the purchase of May 1.

Complete this question by entering your answers in the tabs below.

Req A

Req B and C

Compute the amount of goods available for sale.

Goods available for sale

Req A

Req B and C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub