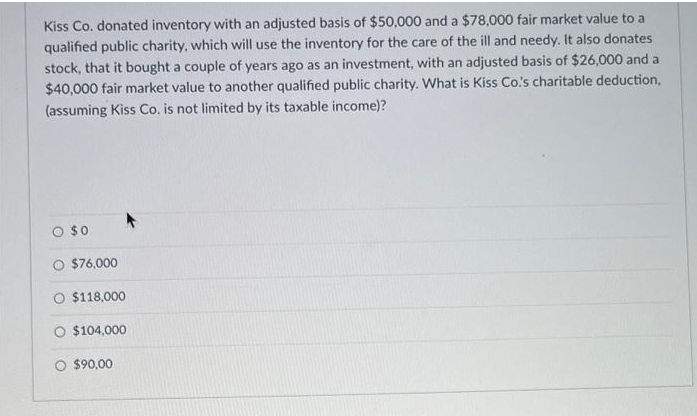

Kiss Co. donated inventory with an adjusted basis of $50,000 and a $78,000 fair market value to a qualified public charity, which will use the inventory for the care of the ill and needy. It also donates stock, that it bought a couple of years ago as an investment, with an adjusted basis of $26,000 and a $40,000 fair market value to another qualified public charity. What is Kiss Co's charitable deduction, (assuming Kiss Co. is not limited by its taxable income)?

Kiss Co. donated inventory with an adjusted basis of $50,000 and a $78,000 fair market value to a qualified public charity, which will use the inventory for the care of the ill and needy. It also donates stock, that it bought a couple of years ago as an investment, with an adjusted basis of $26,000 and a $40,000 fair market value to another qualified public charity. What is Kiss Co's charitable deduction, (assuming Kiss Co. is not limited by its taxable income)?

Chapter14: Property Transact Ions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 83P

Related questions

Question

please help

Transcribed Image Text:Kiss Co. donated inventory with an adjusted basis of $50,000 and a $78,000 fair market value to a

qualified public charity, which will use the inventory for the care of the ill and needy. It also donates

stock, that it bought a couple of years ago as an investment, with an adjusted basis of $26,000 and a

$40,000 fair market value to another qualified public charity. What is Kiss Co.s charitable deduction,

(assuming Kiss Co. is not limited by its taxable income)?

O s0

$76,000

$118,000

O $104,000

O $90,00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT