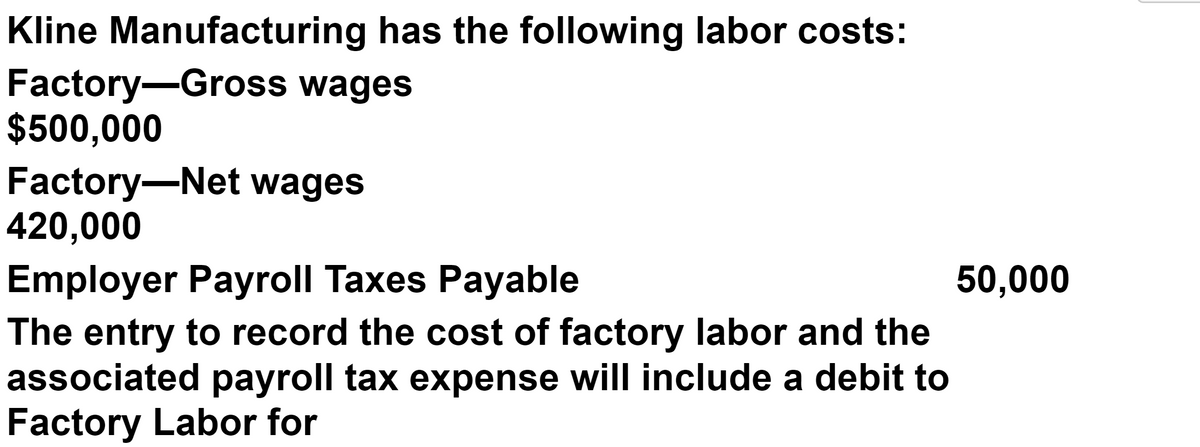

Kline Manufacturing has the following labor costs: Factory-Gross wages $500,000 Factory-Net wages 420,000 50,000 Employer Payroll Taxes Payable The entry to record the cost of factory labor and the associated payroll tax expense will include a debit to Factory Labor for

Q: Dunn Sporting Goods sells athletic clothing and footwear to retail customers. Dunn’s accountantindic...

A: Solution Current assets means an asset which a company can be converted in to cash with in a one yea...

Q: 3. Find the maturity value of the placement after the tax is deducted.

A: Time Deposit = P 1000000 Duration = 90 days Rate of Interest = 0.75%

Q: Required: 1. Determine Shadee's budgeted cost of closures purchased for May and June. 2. Determine S...

A: Please see Step 2 for required information.

Q: Digital cameras and video cameras are two goods that are manufactured by Everlasting Company. Activi...

A: Calculation of activity rates : `Activity (a) Estimated cost (b) Total expected level of activit...

Q: Cost of goods sold equals to a) ® Cost of goods available for sale - ending inventory. b) © Sales +...

A: COST OF GOODS SOLD REFERS TO THE DIRECT COSTS OF PRODUCING THE GOODS SOLD BY A COMPANY .

Q: Sales data for Get Food Now's best-selling menu items Note: Seafood Supreme launched in April Sales ...

A: calculation of item least profitable to produce

Q: In 20X1, Ameer Bhd took a bank loan of RM5M to finance construction of a building. It incurred a yea...

A: Interest cost refers to the borrowing cost that is incurred with respect to a loan. The interest cos...

Q: Required: Compute the materials price and quantity variances for the month. (Indicate the effect of ...

A: Material Price Variance = (Standard Price - Actual Price) x Actual Quantity Material Quantity Varian...

Q: Eren Retail Company was recently created with a beginning cash balance of P12,000. The owner expects...

A: The correct answer for the above mentioned question is given in the following steps for your referen...

Q: Jinchuriki Inc.'s Financial Statement for years 2014-2015. Compute of the Average Sales Period/ Aver...

A: Introduction:- Calculation of the Average Sales Period/ Average Age of Inventory as follows under:- ...

Q: Tenet Engineering, Inc. operates two user divisions as separate cost objects. To determine the costs...

A: Computere service costs allocated to the Division B = Computer time in hours od Division B x Compute...

Q: Record the following transactions on the books of Cullumber Co. (Omit cost of goods sold entries.) (...

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal....

Q: leaving a hologram will. In the last will, he identified his wife, all his 3 children, his brother, ...

A: Hologram will refer to the traditional way of creating a will where the owner writes down the entire...

Q: Operating Cash 435,000 40,000 50,000 Accounts Receivable 100

A: The cash flow from operations is to be computed by adjusting non-cash expenses to the net income and...

Q: Apr. Purchased for cash $388,000 of Vasquez City 4% bonds at 100 plus accrued interest of $3,880. Ju...

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal....

Q: Journalize the corrections for the following transactions: 1. A cash sale of $1,000,000 has been re...

A:

Q: Required: Use the variance formulas to compute the following variances. (Indicate the effect of each...

A: Variable-overhead spending variance $54,000 U Variable-overhead efficiency variance $42,000 U ...

Q: E. The following accounts appear in the general ledger of Rey's Internet Café on December 31, 20OD: ...

A: Journal entry - It refers to the process where the business transactions are recorded in the books o...

Q: Childers Company, which uses a perpetual inventory system, has an established petty cash fund in the...

A: Petty cash: Petty cash fund is established to pay small expenses like office supplies, postage etc. ...

Q: Question Content Area a. Prepare an amortization table for this installment note, similar to the...

A: The question is based on the concept of Financial Accounting.

Q: Prepare the appropriate journal entries to remove the equipment from the books of the Mack Company o...

A: Introduction:- Calculation of Book value as follows under:- Accumulated depreciation as at December ...

Q: Haughton Company uses a job costing system for its production costs and a predetermined factory over...

A: It is already given that the overhead rate is applied on the basis of direct labour. Therefore the p...

Q: Carreras Café is a Spanish restaurant in a college town. The owner expects that the number of meals ...

A: A budgeted income statement depicts the revenue generated and various costs incurred for the forecas...

Q: Calculate wages due under Rowan plan and find out factory cost also with the following details: STD ...

A: The amount earned depends on the employment status and wage rate set by the employer. If you are a s...

Q: On May 1, 2021, P Corp. purchased 75% of S Co.’s P10 par ordinary shares for P990,000. On this date,...

A: Solution Non controlling interest is the interest in which shareholder owns less than 50% of outsta...

Q: Greek Manufacturing Company produces and sells a line of product that are sold usually all year roun...

A: Here in this question, we are required to new selling price to maintain same level of profit. For ca...

Q: JJ Contractors entered into a contract on October 2017 to build a warehouse for Francis Corporation....

A: Solution Vat is the form of tax which is levied on a price of product or service at each stage of pr...

Q: Starbucks is today the world’s leading roaster and retailer of specialty coffee. The company purchas...

A: Analysts and investors use profitability ratios in order to measure and evaluate the company's abili...

Q: Required: For each situation: 1. Identify whether it represents an accounting change or an error. If...

A: Solution:- Given, Williams-Santana Inc., is a manufacturer of high-tech industrial parts that was st...

Q: Poppy Corporation owns 60 percent of Seed Company’s common shares. Balance sheet data for the compan...

A: Earnings per share are the earnings available for common shareholders as per-share value. It can be ...

Q: The following accounts and account balances are available for Badger Auto Parts at December31, 2019:...

A: A trial balance is a statement that shows either the balance or the total amount of debit items and ...

Q: On January 1, 20X1, Pepper purchased 70% interest in Salt for $420K. At the time of the purchase, ...

A: We know that in consolidation or business combination acquisition method is used for all accounting ...

Q: A check written by the company for $272 is incorrectly recorded by a company as $227. On the bank re...

A: The check amount was $272 but deducted from Book Balance $227. Hence, the rest amount of $45 should ...

Q: Lopez Corporation sells a product for $18 per unit, and the standard cost card for the product shows...

A: While making the decision for the special orders, we need to find out the relevant cost for the spec...

Q: Developing). Management has decided to allocate maintenance costs on the basis of machine-hours in e...

A: Under direct method, service department costs are allocated to operating departments (but not to oth...

Q: Sipan Retail Company was recently created with a beginning cash balance of $12,000. The owner expect...

A: Solution Concept In preparation of the cash budget the cash inflow and outflow are to be considered ...

Q: Required information [The following information applies to the questions displayed below.] Shadee Co...

A: Budgeted Cost- A budgeted cost is a forecasted future expense that the corporation is expected to br...

Q: On January 1, 2021, Patter Corp. purchased 80% of the outstanding shares of Saturn Co. at a cost of ...

A: Solution Working- 1- Amortization excess = 50000/4 =12500. 2-Inter company dividend = 80000*80%=6400...

Q: Rick established an irrevocable trust and funded it with $1 million. A corporate trustee is authoriz...

A: Answer: According to the question Rick set up an irreversible trust and put $1 million into it . A ...

Q: The following adjusted trial balance contains the accounts and year-end balances of Cruz Company as ...

A: Closing Entries - Closing entries are required to close the temporary accounts after making financi...

Q: Mack Company purchased equipment in 2018 for S122,000 and estimated an S12,000 salvage value at the ...

A: Solution: Annual depreciation on equipment = (Cost - Salvage value) / useful life = ($122,000 - $12,...

Q: Distinguished between reorganization and reduction of share capital.

A: Reorganization of Capital: The act of changing the capital structure of a company by combining or di...

Q: Vaughn Manufacturing reported sales of $2400000 last year (120000 units at $20 each), when the break...

A: Margin of safety units = Total units sold - Break even units sold = 120000-72000 = 48000 units

Q: Mercury Company has only one inventory pool. On December 31, 2021, Mercury adopted the dollar-value ...

A: Solution: To compute dollar value LIFO inventory, first we compute price index for every year by di...

Q: Indicate whether the following statements are true or false:a. Managerial accounting information is ...

A: Controlling (also known as cost accounting or management accounting) is the accounting department th...

Q: Which one of the following will result from the spouse of a decedent making a qualified disclaimer o...

A: The correct answer for the above mentioned question is given in the following steps for your referen...

Q: During March, Anderson Company engaged in the following transactions involving its pettycash fund:a....

A: To keep track of financial transactions, journal entries are utilised. Your journal entries are rec...

Q: On January 2, 2018, Indian River Groves began construction of a new citrus processing plant. The aut...

A: One of three methods for analysing your company's inventory stock is to use the weighted average cos...

Q: Compute Swiftys accounts receivable turnover for the year, assuming the receivables are sold. (Rou

A: Accounts receivable is the amount that shows that the income has been earned by the company but the ...

Q: Appleton Company uses activity-based costing to apply overhead to and Apple glen. Appleton identifie...

A:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- How would each of the following costs be classified if units produced is the activity base? a. Salary of factory supervisor ($120,000 per year) b. Straight-line depreciation of plant and equipment c. Property rent of $11,500 per month on plant and equipmentPrepare the journal entry to record the factory wages of $28,000 incurred for a single production department assuming payment will be made in the next pay period.Kline Manufacturing has the following labor costs. Factory - Gross wages = $195,000 Factory - Net wages = $160,000 Employer Payroll Taxes Payable = $25,000 The entry to record the cost of factory labor and the associated payroll tax expense will include a debit to Factory Labor for what amount?

- unland Company has the following labor costs: Factory—Gross wages $540000 Factory—Net wages 440000 Employer Payroll Taxes Payable 54000 The amount recorded as an increase to Factory Labor will be $540000. $594000. $486000. $494000.Sundland Company has the following labor costs: Factory-Gross wages 540000, Factory-Net wages 440000, Employer Payrol Taxes Payable 54000. The entry to record the cost of factory labor and the associated payroll tax expense will include a debit to Factory Labor for?Mine Company produced 1,000 units of a product at a selling price of P95.00 each. Direct materials P30, Direct Labor P15, Factory overhead P 20,000.00. Selling and administrative incurred P10,000.00. How much is the net income before tax

- Data relating to labor costs is given below. Manufacturing labor is paid 30 TL per hour and supporting labor is paid 20 TL per hour. For overwork, 50% additional payment is made. Manufacturing Labor Normal working -3000 hours In week overworking -200 hours Weekend holiday- 500 hours Supporting Labor Normal working-600 hours Weekend holiday-100 hours Employer’s Social Security Premium and Unemployment Premium rates are 20% and 2% respectively. Employees’ Social Security Premium and Unemployment Premium rates are 14% and 1% respectively. Income Tax rate is 20% (Stamp Duty is neglected). Company classifies manufacturing labor hours’ cost and employer’s contribution relating to this cost as direct labor cost. Other labor costs are classified as indirect labor cost. Required: a) Gross wage b) Total labor costs c) Direct Labor Costs d) Indirect Labor Costs e) Net wage (Due to Personnel) f) Social Securities and Unemployment Premiums Payable (Employer + Employee)Data relating to labor costs is given below. Manufacturing labor is paid 30 TL per hour and supporting labor is paid 20 TL per hour. For overwork, 50% additional payment is made. Manufacturing Labor 3.000 hours Normal working. 200 hoursIn week overworking Weekend holiday 200 hours Supporting Labor Normal working 600 hours Weekend holiday 100 hours Employer’s Social Security Premium and Unemployment Premium rates are 20% and 2% respectively. Employees’ Social Security Premium and Unemployment Premium rates are 14% and 1% respectively. Income Tax rate is 20% (Stamp Duty is neglected). Company classifies manufacturing labor hours’ cost and employer’s contribution relating to this cost as direct labor cost. Other labor costs are classified as indirect labor cost.Required: a) Gross wage b) Total labor costs c) Direct Labor Costs d) Indirect Labor Costs e) Net wage (Due to Personnel) f) Social Securities and Unemployment Premiums Payable (Employer + Employee)Mine Company produced 1,000 units of a product at a selling price of P95.00 each. Direct materials P30, Direct Labor P15, Factory overhead P 20,000.00. Selling and administrative incurred P10,000.00. How much is the net income before tax P 30.00 P 20.00 P 20,000.00 P 30,000.00

- Income tax was $200,000 for the year. Income tax payable was $20,000 at the beginning of the year and $30,000 at end of the year. Cash payments for income tax reported on the cash flow statement using the direct method is: A.$200,000 B.$220,000 C.$230,000 D.$190,000 Conversion costs are a.direct materials and factory overhead b.direct materials and indirect labor c.factory overhead and direct labor d.direct materials and direct laborABC Company has the following costs and expenses for the year December 31, 2020. Raw Materials, 1/1/2020 P40,000 Insurance, Factory P14,000 Raw Materials, 12/1/2020 P25,000 Property Taxes, Factory Building P6,000 Raw Materials Purchases P305,000 Sales Revenue P2,000,000 Work-in-Process, 1/1/2020 P60,000 Delivery Expenses P50,000 Work-in-Process, 12/1/2020 P40,000 Sales Commissions P100,000 Finished Goods, 1/1/2020 P120,000 Indirect Labor P55,000 Finished Goods, 12/31/2020 P110,000 Indirect Material P105,000 Direct Labor P400,000 Factory Machinery, Rent P25,000 Factory Manager’s Salary P25,000 Factory Utilities P55,000 Depreciation, Office Equipment P25,000 Administrative Expense P250,000 Requirement: Prepare a cost of goods manufactured schedule for ABC Company for 2020. Prepare cost of goods sold schedule for ABC Company for 2020. Prepare Income Statement for ABC Company.The following cost incurred by Lucky corporation for October 2019 were as follows: Direct Materials used, P20,000 Indirect materials used, P1,000 Direct labor, P9,000 Indirect labor, P5,000 Other factory cost, P5,000 Selling expenses,P10,000 Administrative expenses, P12,000 Question: How much is the total product cost? a. P62,000 b. P50,000 c. P29,000 d. P40,000 Plz answer fast without plagiarism and don't copy answer plz