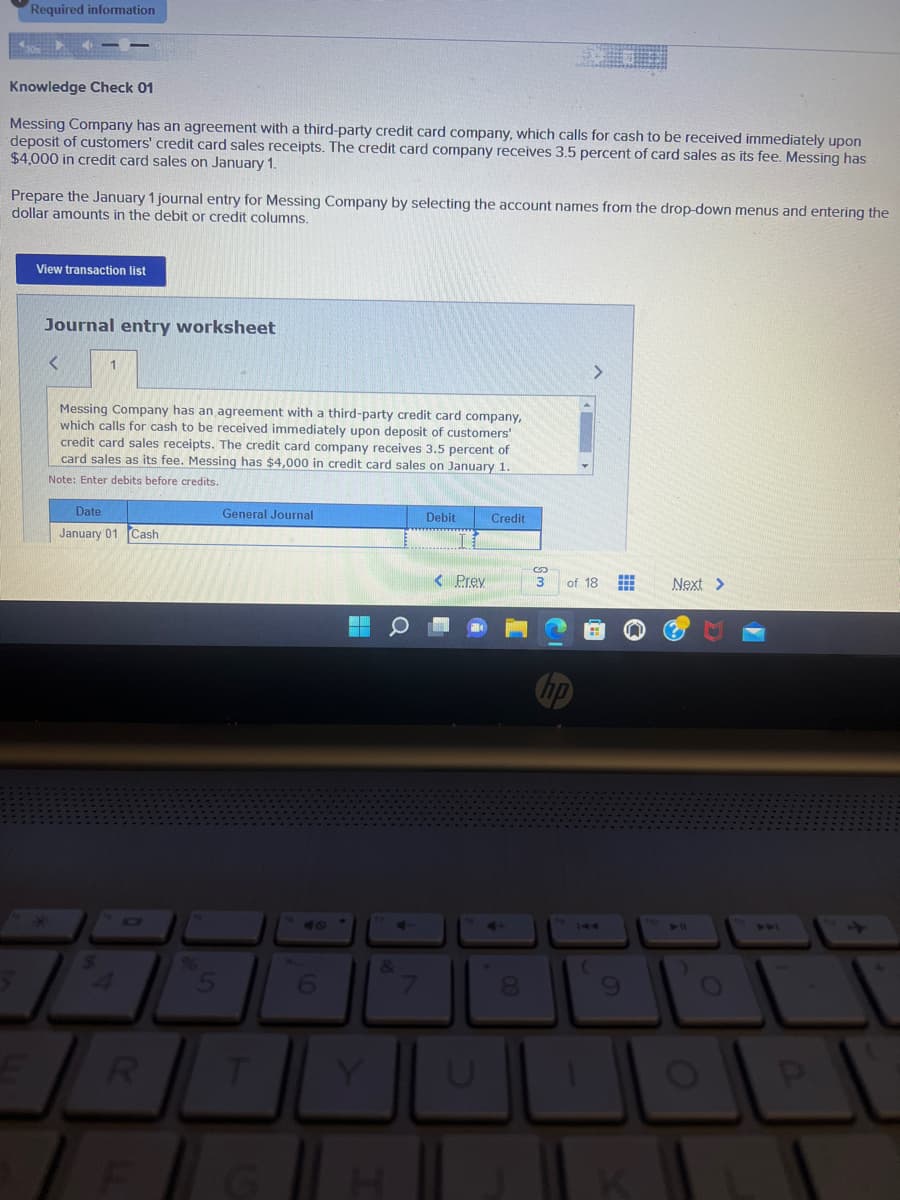

Knowledge Check 01 Messing Company has an agreement with a third-party credit card company, which calls for cash to be received immediately upon deposit of customers' credit card sales receipts. The credit card company receives 3.5 percent of card sales as its fee. Messing has $4,000 in credit card sales on January 1. Prepare the January 1 journal entry for Messing Company by selecting the account names from the drop-down menus and entering t dollar amounts in the debit or credit columns.

Knowledge Check 01 Messing Company has an agreement with a third-party credit card company, which calls for cash to be received immediately upon deposit of customers' credit card sales receipts. The credit card company receives 3.5 percent of card sales as its fee. Messing has $4,000 in credit card sales on January 1. Prepare the January 1 journal entry for Messing Company by selecting the account names from the drop-down menus and entering t dollar amounts in the debit or credit columns.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 18P

Related questions

Question

Transcribed Image Text:Required information

$3054

Knowledge Check 01

Messing Company has an agreement with a third-party credit card company, which calls for cash to be received immediately upon

deposit of customers' credit card sales receipts. The credit card company receives 3.5 percent of card sales as its fee. Messing has

$4,000 in credit card sales on January 1.

Prepare the January 1 journal entry for Messing Company by selecting the account names from the drop-down menus and entering the

dollar amounts in the debit or credit columns.

View transaction list

Journal entry worksheet

<

1

Messing Company has an agreement with a third-party credit card company,

which calls for cash to be received immediately upon deposit of customers'

credit card sales receipts. The credit card company receives 3.5 percent of

card sales as its fee. Messing has $4,000 credit card sales on January 1.

Note: Enter debits before credits.

Date

January 01 Cash

R

General Journal

T

6

--

H

4-

Debit

< Prev

U

Credit

8

S

of 18

(

##

9

Next >

D11

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning