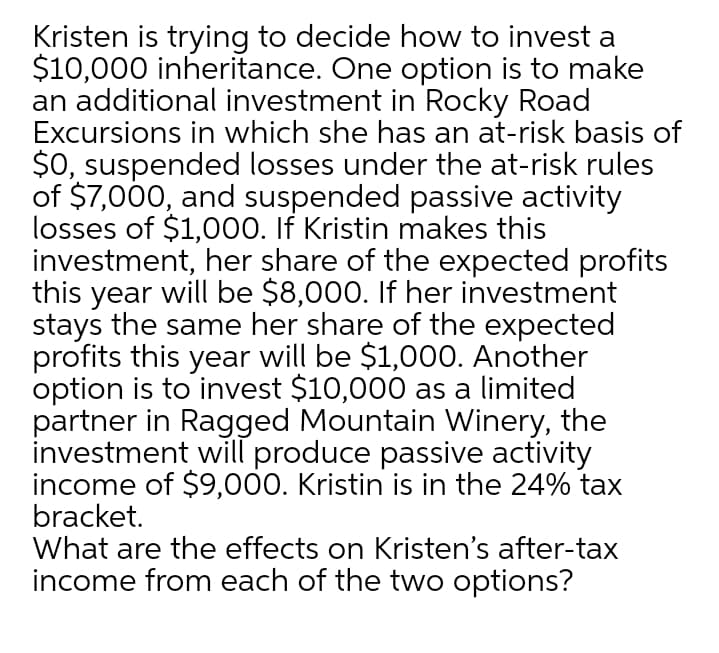

Kristen is trying to decide how to invest a $10,000 inheritance. One option is to make an additional investment in Rocky Road Excursions in which she has an at-risk basis of $0, suspended losses under the at-risk rules of $7,000, and suspended passive activity losses of $1,000. If Kristin makes this investment, her share of the expected profits this year will be $8,000. If her investment stays the same her share of the expected profits this year will be $1,000. Another option is to invest $10,000 as a limited partner in Ragged Mountain Winery, the investment will produce passive activity income of $9,000. Kristin is in the 24% tax bracket. What are the effects on Kristen's after-tax income from each of the two options?

Kristen is trying to decide how to invest a $10,000 inheritance. One option is to make an additional investment in Rocky Road Excursions in which she has an at-risk basis of $0, suspended losses under the at-risk rules of $7,000, and suspended passive activity losses of $1,000. If Kristin makes this investment, her share of the expected profits this year will be $8,000. If her investment stays the same her share of the expected profits this year will be $1,000. Another option is to invest $10,000 as a limited partner in Ragged Mountain Winery, the investment will produce passive activity income of $9,000. Kristin is in the 24% tax bracket. What are the effects on Kristen's after-tax income from each of the two options?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter6: Losses And Loss Limitations

Section: Chapter Questions

Problem 23P

Related questions

Question

Transcribed Image Text:Kristen is trying to decide how to invest a

$10,000 inheritance. One option is to make

an additional investment in Rocky Road

Excursions in which she has an at-risk basis of

$0, suspended losses under the at-risk rules

of $7,000, and suspended passive activity

losses of $1,000. If Kristin makes this

investment, her share of the expected profits

this year will be $8,000. If her investment

stays the same her share of the expected

profits this year will be $1,000. Another

option is to invest $10,000 as a limited

partner in Ragged Mountain Winery, the

investment will produce passive activity

income of $9,000. Kristin is in the 24% tax

bracket.

What are the effects on Kristen's after-tax

income from each of the two options?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning