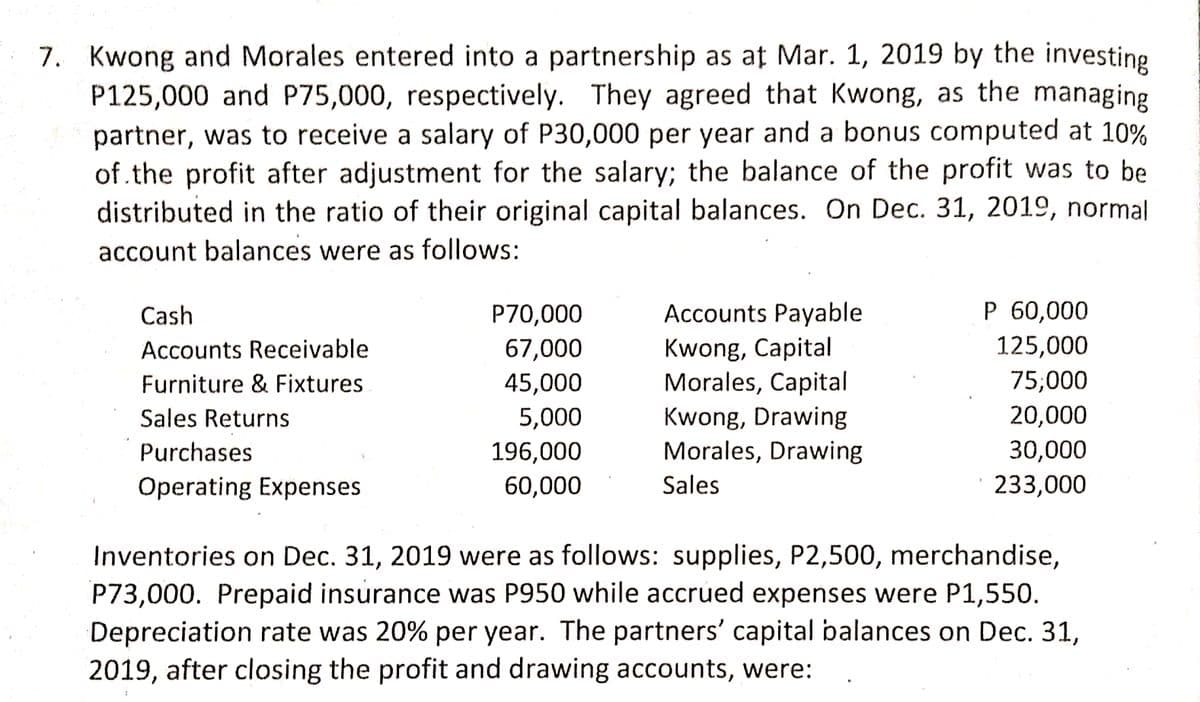

Kwong and Morales entered into a partnership as at Mar. 1, 2019 by the investing P125,000 and P75,000, respectively. They agreed that Kwong, as the managing partner, was to receive a salary of P30,000 per year and a bonus computed at 10% of.the profit after adjustment for the salary; the balance of the profit was to be distributed in the ratio of their original capital balances. On Dec. 31, 2019, normal account balances were as follows: P 60,000 125,000 Cash P70,000 Accounts Payable Kwong, Capital Morales, Capital Kwong, Drawing Morales, Drawing Accounts Receivable 67,000 Furniture & Fixtures 45,000 75,000 Sales Returns 5,000 20,000 Purchases 196,000 30,000 Operating Expenses 60,000 Sales 233,000 Inventories on Dec. 31, 2019 were as follows: supplies, P2,500, merchandise, P73,000. Prepaid insurance was P950 while accrued expenses were P1,550. Depreciation rate was 20% per year. The partners' capital balances on Dec. 31, 2019, after closing the profit and drawing accounts, were:

Kwong and Morales entered into a partnership as at Mar. 1, 2019 by the investing P125,000 and P75,000, respectively. They agreed that Kwong, as the managing partner, was to receive a salary of P30,000 per year and a bonus computed at 10% of.the profit after adjustment for the salary; the balance of the profit was to be distributed in the ratio of their original capital balances. On Dec. 31, 2019, normal account balances were as follows: P 60,000 125,000 Cash P70,000 Accounts Payable Kwong, Capital Morales, Capital Kwong, Drawing Morales, Drawing Accounts Receivable 67,000 Furniture & Fixtures 45,000 75,000 Sales Returns 5,000 20,000 Purchases 196,000 30,000 Operating Expenses 60,000 Sales 233,000 Inventories on Dec. 31, 2019 were as follows: supplies, P2,500, merchandise, P73,000. Prepaid insurance was P950 while accrued expenses were P1,550. Depreciation rate was 20% per year. The partners' capital balances on Dec. 31, 2019, after closing the profit and drawing accounts, were:

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 39P

Related questions

Question

Transcribed Image Text:7. Kwong and Morales entered into a partnership as at Mar. 1, 2019 by the investing

P125,000 and P75,000, respectively. They agreed that Kwong, as the managing

partner, was to receive a salary of P30,000 per year and a bonus computed at 10%

of.the profit after adjustment for the salary; the balance of the profit was to be

distributed in the ratio of their original capital balances. On Dec. 31, 2019, normal

account balances were as follows:

Cash

P70,000

Accounts Payable

P 60,000

125,000

Kwong, Capital

Morales, Capital

Kwong, Drawing

Morales, Drawing

Accounts Receivable

67,000

Furniture & Fixtures

45,000

75,000

Sales Returns

5,000

20,000

Purchases

196,000

30,000

Operating Expenses

60,000

Sales

233,000

Inventories on Dec. 31, 2019 were as follows: supplies, P2,500, merchandise,

P73,000. Prepaid insurance was P950 while accrued expenses were P1,550.

Depreciation rate was 20% per year. The partners' capital balances on Dec. 31,

2019, after closing the profit and drawing accounts, were:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College