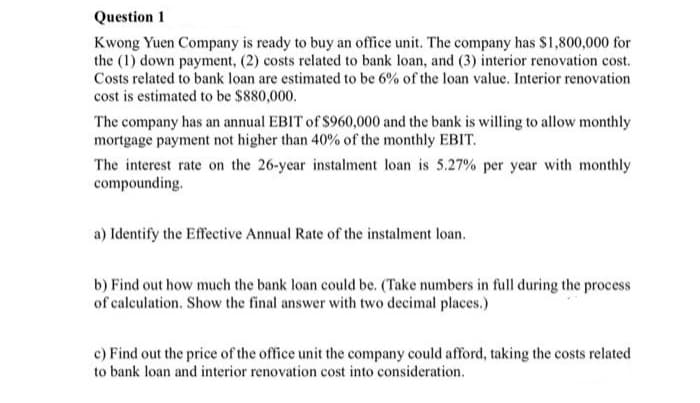

Kwong Yuen Company is ready to buy an office unit. The company has $1,800,000 for the (1) down payment, (2) costs related to bank loan, and (3) interior renovation cost. Costs related to bank loan are estimated to be 6% of the loan value. Interior renovation cost is estimated to be $880,000. The company has an annual EBIT of $960,000 and the bank is willing to allow monthly mortgage payment not higher than 40% of the monthly EBIT. The interest rate on the 26-year instalment loan is 5.27% per year with monthly compounding. a) Identify the Effective Annual Rate of the instalment loan. b) Find out how much the bank loan could be. (Take numbers in full during the process of calculation. Show the final answer with two decimal places.) c) Find out the price of the office unit the company could afford, taking the costs related to bank loan and interior renovation cost into consideration.

Kwong Yuen Company is ready to buy an office unit. The company has $1,800,000 for the (1) down payment, (2) costs related to bank loan, and (3) interior renovation cost. Costs related to bank loan are estimated to be 6% of the loan value. Interior renovation cost is estimated to be $880,000. The company has an annual EBIT of $960,000 and the bank is willing to allow monthly mortgage payment not higher than 40% of the monthly EBIT. The interest rate on the 26-year instalment loan is 5.27% per year with monthly compounding. a) Identify the Effective Annual Rate of the instalment loan. b) Find out how much the bank loan could be. (Take numbers in full during the process of calculation. Show the final answer with two decimal places.) c) Find out the price of the office unit the company could afford, taking the costs related to bank loan and interior renovation cost into consideration.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter1: Introduction And Goals Of The Firm

Section: Chapter Questions

Problem 2.2CE

Related questions

Question

100%

need help ASAP.

Transcribed Image Text:Question 1

Kwong Yuen Company is ready to buy an office unit. The company has $1,800,000 for

the (1) down payment, (2) costs related to bank loan, and (3) interior renovation cost.

Costs related to bank loan are estimated to be 6% of the loan value. Interior renovation

cost is estimated to be $880,000.

The company has an annual EBIT of $960,000 and the bank is willing to allow monthly

mortgage payment not higher than 40% of the monthly EBIT.

The interest rate on the 26-year instalment loan is 5.27% per year with monthly

compounding.

a) Identify the Effective Annual Rate of the instalment loan.

b) Find out how much the bank loan could be. (Take numbers in full during the process

of calculation. Show the final answer with two decimal places.)

c) Find out the price of the office unit the company could afford, taking the costs related

to bank loan and interior renovation cost into consideration.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning