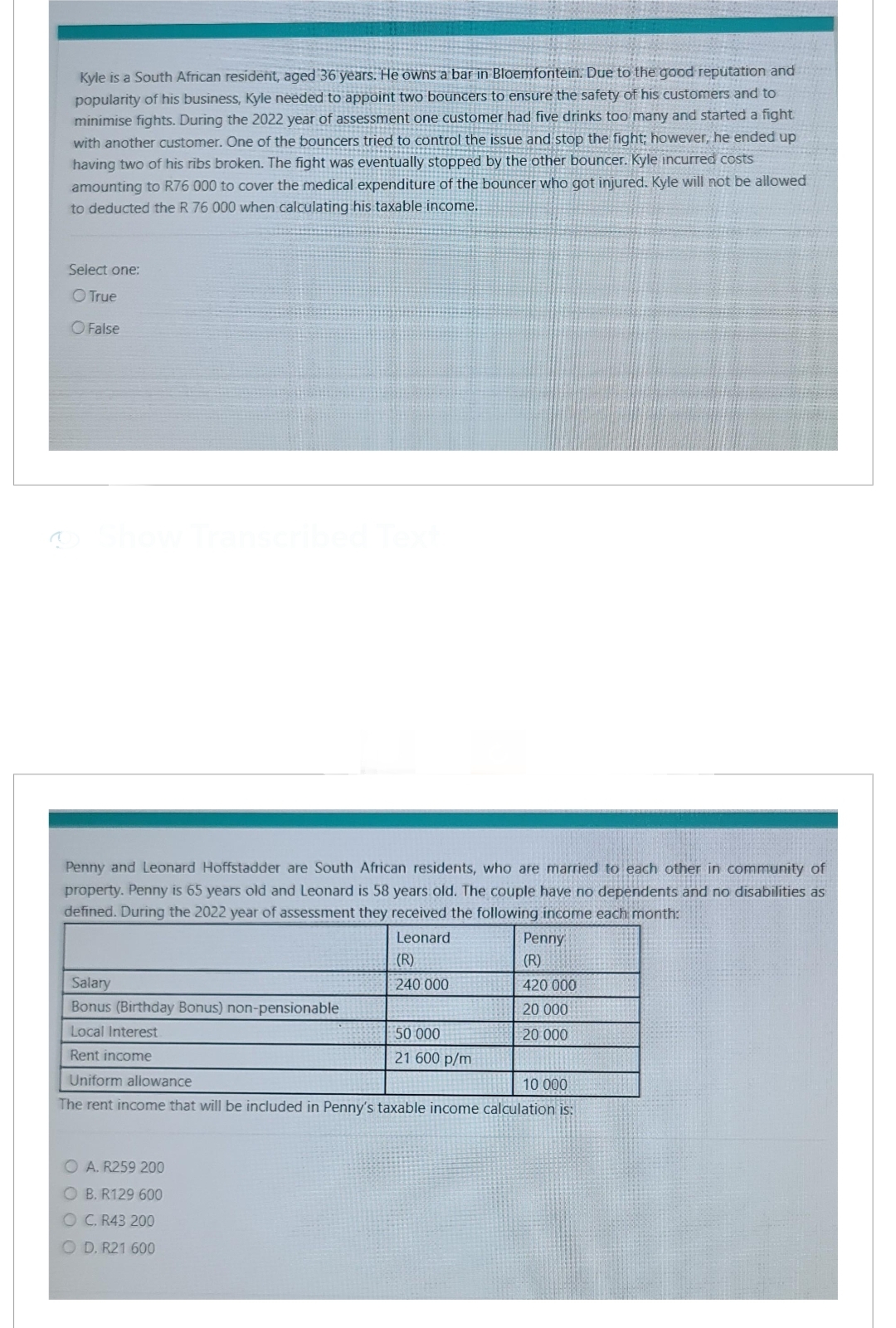

Kyle is a South African resident, aged 36 years. He owns a bar in Bloemfontein. Due to the good reputation and popularity of his business, Kyle needed to appoint two bouncers to ensure the safety of his customers and to minimise fights. During the 2022 year of assessment one customer had five drinks too many and started a fight with another customer. One of the bouncers tried to control the issue and stop the fight; however, he ended up having two of his ribs broken. The fight was eventually stopped by the other bouncer. Kyle incurred costs amounting to R76 000 to cover the medical expenditure of the bouncer who got injured. Kyle will not be allowed to deducted the R 76 000 when calculating his taxable income.

Kyle is a South African resident, aged 36 years. He owns a bar in Bloemfontein. Due to the good reputation and popularity of his business, Kyle needed to appoint two bouncers to ensure the safety of his customers and to minimise fights. During the 2022 year of assessment one customer had five drinks too many and started a fight with another customer. One of the bouncers tried to control the issue and stop the fight; however, he ended up having two of his ribs broken. The fight was eventually stopped by the other bouncer. Kyle incurred costs amounting to R76 000 to cover the medical expenditure of the bouncer who got injured. Kyle will not be allowed to deducted the R 76 000 when calculating his taxable income.

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 96TPC: Allison and Paul are married and have no children. Paul is a lawyer who earns a salary of 80,000. In...

Related questions

Question

Hw.33.

Transcribed Image Text:Kyle is a South African resident, aged 36 years. He owns a bar in Bloemfontein. Due to the good reputation and

popularity of his business, Kyle needed to appoint two bouncers to ensure the safety of his customers and to

minimise fights. During the 2022 year of assessment one customer had five drinks too many and started a fight

with another customer. One of the bouncers tried to control the issue and stop the fight; however, he ended up

having two of his ribs broken. The fight was eventually stopped by the other bouncer. Kyle incurred costs

amounting to R76 000 to cover the medical expenditure of the bouncer who got injured. Kyle will not be allowed

to deducted the R 76 000 when calculating his taxable income.

Select one:

O True

O False

Penny and Leonard Hoffstadder are South African residents, who are married to each other in community of

property. Penny is 65 years old and Leonard is 58 years old. The couple have no dependents and no disabilities as

defined. During the 2022 year of assessment they received the following income each month:

Leonard

(R)

240 000

Salary

Bonus (Birthday Bonus) non-pensionable

Local Interest

Rent income

50 000

21 600 p/m

O A. R259 200

OB. R129 600

OC. R43 200

OD. R21 600

Penny:

(R)

420 000

20 000

20 000

Uniform allowance

10 000

The rent income that will be included in Penny's taxable income calculation is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT