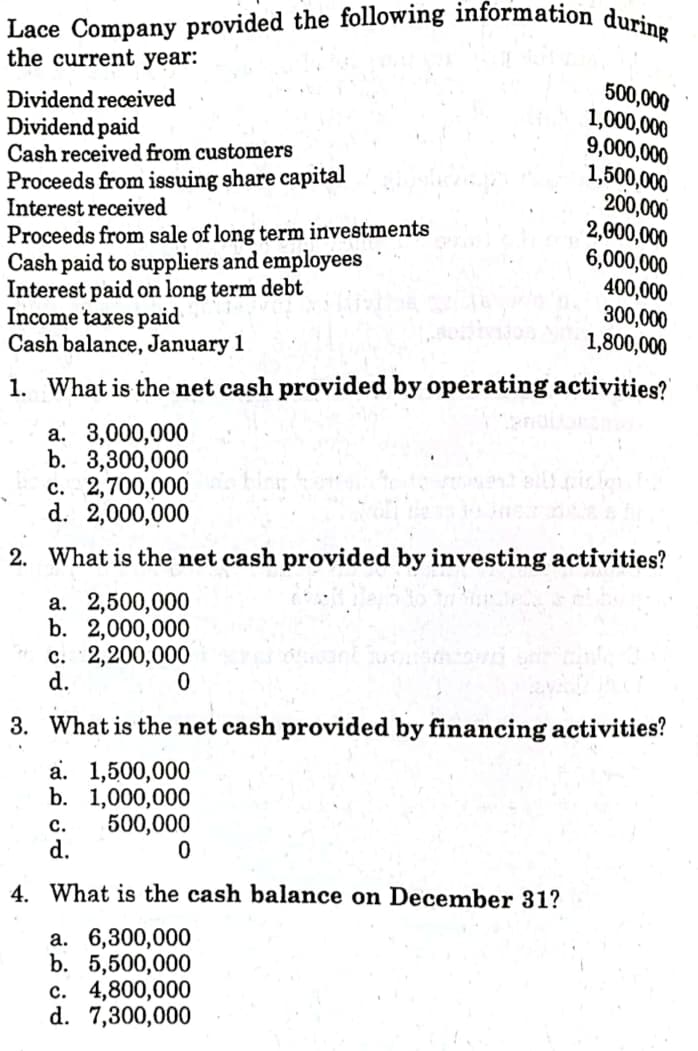

Lace Company provided the following information during the current year: 500,000 Dividend received 1,000,000 Dividend paid 9,000,000 Cash received from customers 1,500,000 200,000 Proceeds from issuing share capital Interest received 2,000,000 6,000,000 Proceeds from sale of long term investments Cash paid to suppliers and employees 400,000 Interest paid on long term debt 300,000 Income taxes paid 1,800,000 Cash balance, January 1 1. What is the net cash provided by operating activities? a. 3,000,000 b. 3,300,000 c. 2,700,000 d. 2,000,000 2. What is the net cash provided by investing activities? a. 2,500,000 b. 2,000,000 c. 2,200,000 d. 0 3. What is the net cash provided by financing activities? a. 1,500,000 b. 1,000,000 500,000 0 d. 4. What is the cash balance on December 31? a. 6,300,000 b. 5,500,000 c. 4,800,000 d. 7,300,000 نن فن C.

Lace Company provided the following information during the current year: 500,000 Dividend received 1,000,000 Dividend paid 9,000,000 Cash received from customers 1,500,000 200,000 Proceeds from issuing share capital Interest received 2,000,000 6,000,000 Proceeds from sale of long term investments Cash paid to suppliers and employees 400,000 Interest paid on long term debt 300,000 Income taxes paid 1,800,000 Cash balance, January 1 1. What is the net cash provided by operating activities? a. 3,000,000 b. 3,300,000 c. 2,700,000 d. 2,000,000 2. What is the net cash provided by investing activities? a. 2,500,000 b. 2,000,000 c. 2,200,000 d. 0 3. What is the net cash provided by financing activities? a. 1,500,000 b. 1,000,000 500,000 0 d. 4. What is the cash balance on December 31? a. 6,300,000 b. 5,500,000 c. 4,800,000 d. 7,300,000 نن فن C.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: During 20X1, Craig Company had the following transactions: a. Purchased 300,000 of 10-year bonds...

Related questions

Question

Asap

Transcribed Image Text:Lace Company provided the following information during

the current year:

500,000

Dividend received

1,000,000

Dividend paid

9,000,000

1,500,000

Cash received from customers

Proceeds from issuing share capital

200,000

Interest received

2,000,000

6,000,000

Proceeds from sale of long term investments

Cash paid to suppliers and employees

400,000

Interest paid on long term debt

300,000

Income taxes paid

1,800,000

Cash balance, January 1

1. What is the net cash provided by operating activities?

a. 3,000,000

b. 3,300,000

c. 2,700,000

d. 2,000,000

2. What is the net cash provided by investing activities?

a. 2,500,000

b. 2,000,000

c. 2,200,000

d.

0

3. What is the net cash provided by financing activities?

a. 1,500,000

b.

1,000,000

C.

500,000

d.

0

4. What is the cash balance on December 31?

a. 6,300,000

b. 5,500,000

c.

4,800,000

d. 7,300,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning