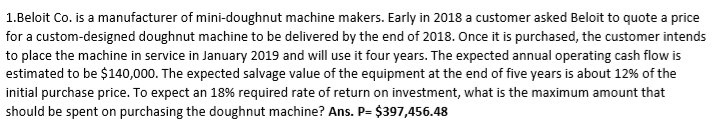

ote a price for a custom-designed doughnut machine to be delivered by the end of 2018. Once it is purchased, the customer intends to place the machine in service in January 2019 and will use it four years. The expected annual operating cash flow is estimated to be $140,000. The expected salvage value of the equipment at the end of five years is about 12% of the initial purchase price. To expect an 18% required rate of return on investment, what is the maximum amount that should be spent on purchasing the doughnut machine? Ans. P- $397,456.48

ote a price for a custom-designed doughnut machine to be delivered by the end of 2018. Once it is purchased, the customer intends to place the machine in service in January 2019 and will use it four years. The expected annual operating cash flow is estimated to be $140,000. The expected salvage value of the equipment at the end of five years is about 12% of the initial purchase price. To expect an 18% required rate of return on investment, what is the maximum amount that should be spent on purchasing the doughnut machine? Ans. P- $397,456.48

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 14P

Related questions

Question

Good day! I need your help tutor please answer the question attached below. The answer is already provided, which means that will be your basis if your answers are correct or not.

Ps. In your solution, you identify the given and the what is being asked in the problem and I want to see the formula that you used and box your final answer. Don't give me a solution that is made in ms excel, I am not econ major so i'm asking for you to do the manual or the traditional computation.Lastly, don't give me a shortcut solution because i want to learn and study your computation :)

Pps. I want you to use the Present Worth Methods (if applicable)

Transcribed Image Text:1.Beloit Co. is a manufacturer of mini-doughnut machine makers. Early in 2018 a customer asked Beloit to quote a price

for a custom-designed doughnut machine to be delivered by the end of 2018. Once it is purchased, the customer intends

to place the machine in service in January 2019 and will use it four years. The expected annual operating cash flow is

estimated to be $140,000. The expected salvage value of the equipment at the end of five years is about 12% of the

initial purchase price. To expect an 18% required rate of return on investment, what is the maximum amount that

should be spent on purchasing the doughnut machine? Ans. P= $397,456.48

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College