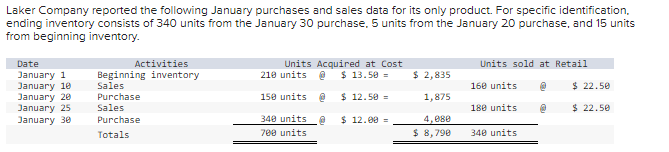

Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 340 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost 210 units @ $13.50 = 150 units @ $ 12.50 = 340 units @ 700 units $ 12.00- $ 2,835 1,875 4,080 $ 8,790 Units sold at Retail @ 160 units 180 units 340 units $ 22.50 $ 22.50

Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 340 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost 210 units @ $13.50 = 150 units @ $ 12.50 = 340 units @ 700 units $ 12.00- $ 2,835 1,875 4,080 $ 8,790 Units sold at Retail @ 160 units 180 units 340 units $ 22.50 $ 22.50

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 3RE: Reid Company uses the periodic inventory system. On January 1, it had an inventory balance of...

Related questions

Topic Video

Question

how do i calculate the weighted average of cost of goods sold

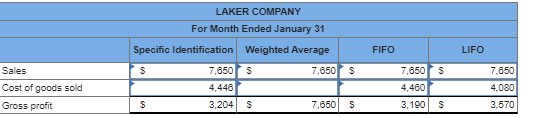

Transcribed Image Text:Sales

Cost of goods sold

Gross profit

LAKER COMPANY

For Month Ended January 31

Weighted Average

Specific Identification

$

$

7,650 $

4,446

3,204 $

7,650 $

7,650

$

FIFO

7,650 $

4,460

3,190

$

LIFO

7,650

4,080

3,570

Transcribed Image Text:Laker Company reported the following January purchases and sales data for its only product. For specific identification.

ending inventory consists of 340 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units

from beginning inventory.

Date

January 1

January 10

January 20

January 25

January 30

Activities

Beginning inventory

Sales

Purchase

Sales

Purchase

Totals

Units Acquired at Cost

$13.50 =

210 units @

150 units @

340 units @

700 units

$ 12.50 =

$ 12.00 =

$ 2,835

1,875

4,080

$8,790

Units sold at Retail

@

160 units

180 units

340 units

$ 22.50

$ 22.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,